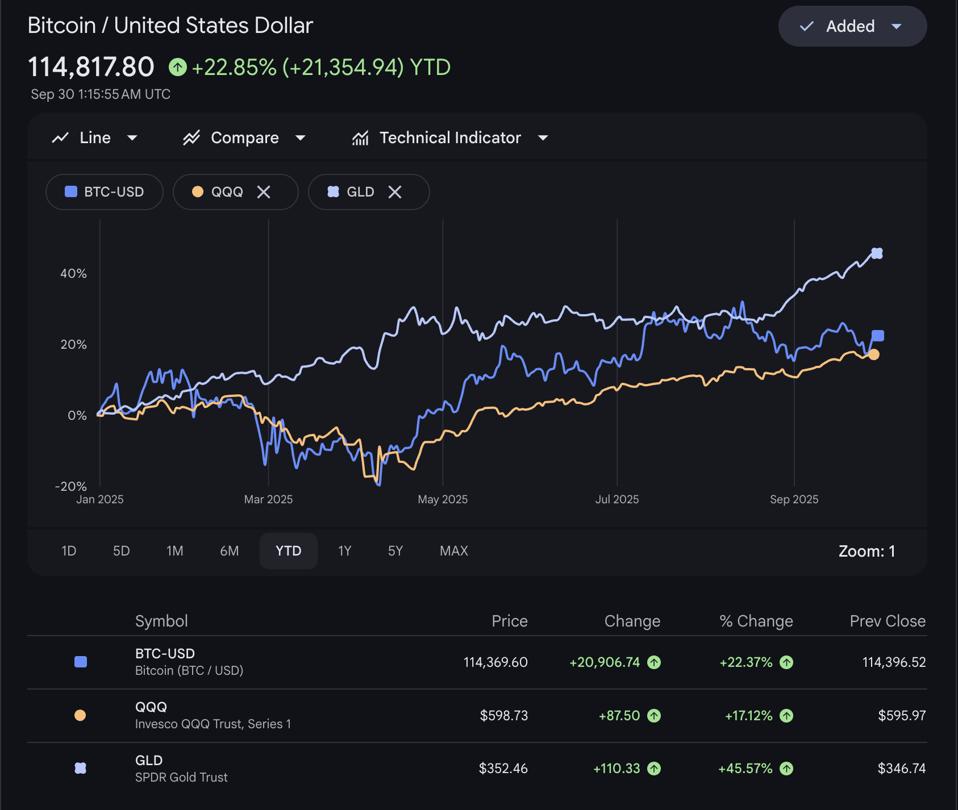

Bitcoin’s performance in 2025 has lagged expectations. Year to date, the asset is up about 22%, compared with a 17% gain in the Nasdaq Composite and a striking 46% surge in gold prices. This raises the question many traders are asking: is bitcoin topped?

Year-to-date performance of bitcoin (BTC), Nasdaq 100 ETF (QQQ), and gold ETF (GLD) in 2025.

google finance

Often described as both “digital gold” and a tech proxy, bitcoin has underperformed gold this year while only slightly outpacing major equity indices. Weakness extends beyond bitcoin: excluding bitcoin and ether, the broader crypto market has risen about 16%, trailing the Nasdaq Composite.

Is Bitcoin Topped: Social Sentiment and Market Reaction

On September 6, a well‑known crypto influencer wrote that their “gut says we’re topped.”

Crypto influencer calls crypto market top.

Blknoiz06 / X

The post sparked debate on crypto social channels and was followed by higher volatility. Bitcoin dipped to roughly $107,000, then recovered to trade near $114,600 by late September.

Meanwhile, U.S. equities advanced on the back of strong technology earnings and steady economic growth, underscoring a divergence between crypto and traditional markets.

However, many market participants disagree that the cycle has topped.

Qiao Wang on market pullback.

Qiao Wang / X

Several analysts suggest that the current pullback indicates temporary market exhaustion rather than the beginning of a prolonged decline. Throughout 2025, the pattern of quick rallies, diminishing momentum, and repeated dip‑buying has defined much of 2025, frustrating traders seeking clearer directional moves.

Is Bitcoin Topped: The Bull Case

Is Bitcoin Topped: Monetary Policy Easing

The Federal Reserve cut rates by 25 basis points in September, bringing the federal funds target to 4.00–4.25%. Futures markets expect two more cuts before year‑end.

Historically, lower rates reduce borrowing costs and improve liquidity, supporting risk assets. For more than a decade, the “four‑year cycle” tied to bitcoin’s halving shaped investor expectations. But as institutional adoption has deepened, that model is breaking down. Bitcoin is increasingly a proxy for global liquidity conditions, and liquidity is on the rise.

Is Bitcoin Topped: Economic growth driven by AI

U.S. GDP is projected to expand at roughly 2.5% annualized in Q3, supported by consumer spending and technology‑sector investment. The “Magnificent 7” stocks continue to deliver strong earnings, much of it powered by artificial intelligence.

In a recent interview, Nvidia CEO Jensen Huang outlined plans to invest $100 billion in AI data centers and said AI infrastructure spending could reach $3–4 trillion by the end of the decade (Reuter). This has bolstered confidence in the economic outlook and reduced recession fears.

Is Bitcoin Topped: Trump’s favorable policies for crypto

Since January 2025, the administration has pursued a pro‑crypto agenda aimed at positioning the U.S. as a global hub for digital assets. Commonly cited steps include:

- A January executive order establishing a President’s Working Group on Digital Asset Markets to provide regulatory clarity and support blockchain development

- A March directive to create a Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile for centralizing and managing government‑held crypto assets

- Passage of the GENIUS Act in July, which created a framework for stablecoins with consumer protections and clarified SEC and CFTC jurisdictions

These initiatives, along with pro‑crypto appointments such as Treasury Secretary Scott Bessent, have coincided with fewer enforcement actions against routine activities, clearer guidelines for practices such as staking and memecoins, and increased institutional inflows, helping support bitcoin’s price even during September’s volatility.

Is Bitcoin Topped: Revenue reality in crypto

Beyond price action, some crypto applications are generating meaningful revenue.

- Hyperliquid, a decentralized perpetual futures exchange, is achieving a record‑high revenue per employee, with an estimated annualized revenue of $1.167 billion and a lean team of 11 core contributors, according to CEO Jeff Yan. This surpasses companies like Nvidia ($3.6 million), Apple ($2.4 million), and Meta ($2.2 million).

- Pump.fun, a Solana-based memecoin launchpad, has surpassed $700 million in cumulative revenue in just over a year, outperforming most public companies in terms of revenue growth rate.

These examples demonstrate how crypto applications are generating real value beyond speculation. The shift toward measurable financial performance and proven product-market fit signals a maturing ecosystem that is becoming more resilient to market volatility.

Is Bitcoin Topped: Looking Ahead

Digital assets have underperformed in 2025, especially relative to historical patterns of strong post‑halving years. Fatigue is evident among traders, both in sentiment and in trading volumes.

Even so, an easier policy stance, resilient growth supported by AI investment, and rising protocol revenues point to a constructive backdrop. What looks like exhaustion today may ultimately prove to be consolidation, suggesting the real top of this cycle could still lie ahead.