Bitcoin (BTC) dropped below $110,000 in September. However, the latest data show it has bottomed and will have difficulty returning to this price level in October.

Analysts highlight several signals supporting this outlook. What are they? Let’s look at the details.

Reasons Bitcoin may have found its bottom

In this context, the bottom refers to the $108,900 level reached on September 25. By October, the Bitcoin price had recovered back above $116,00.

For months, Bitcoin has usually moved sideways over weekends. Many linked this to weak buying pressure from traditional financial institutions or ETFs.

However, analyst Maartunn noted that BTC began rising late on the last Sunday of September, just before the weekly close. He viewed this as a strong signal that bulls had regained control.

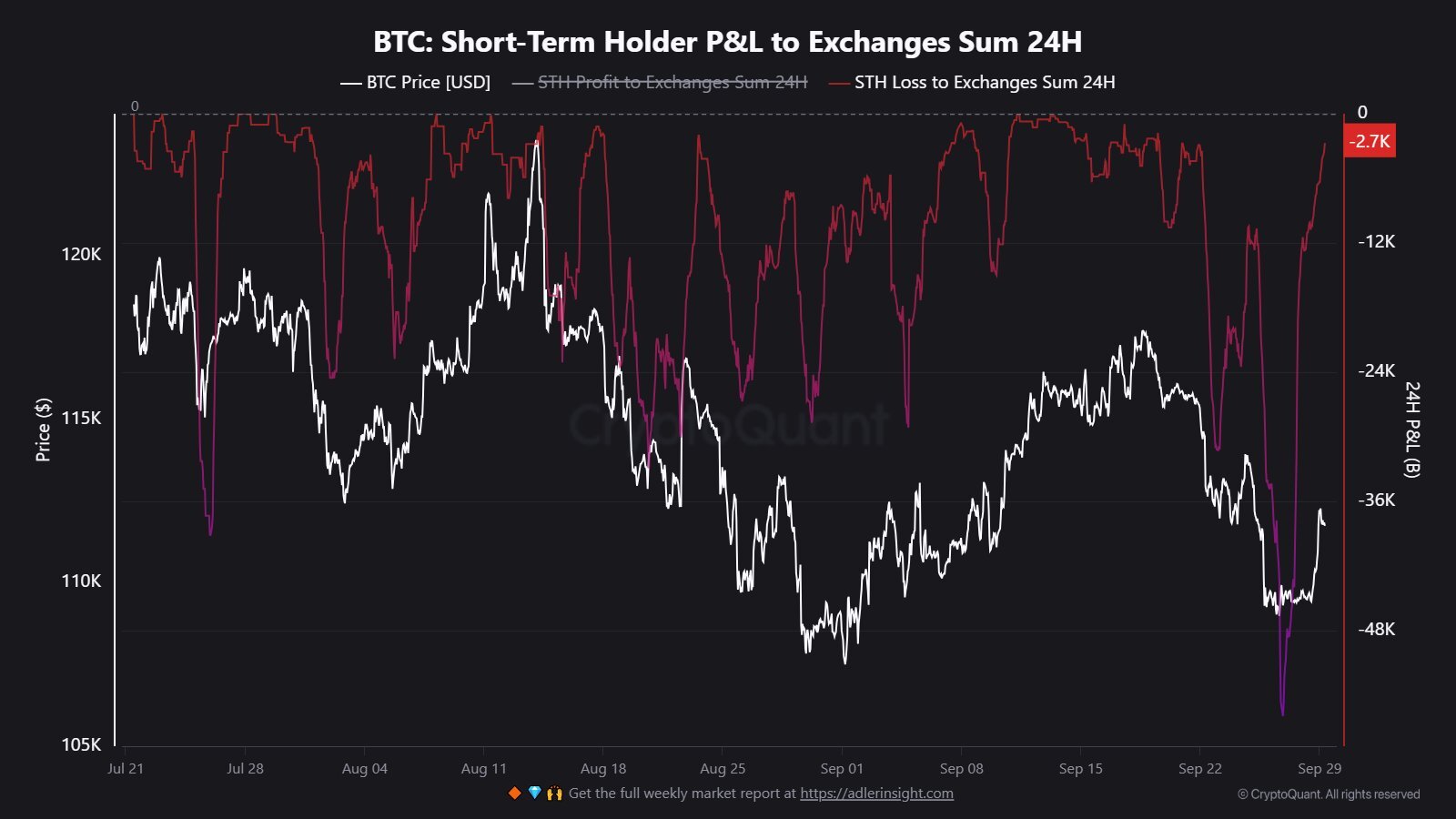

On-chain data also shows that Short-Term Holders sold at heavy losses, signaling the end of a capitulation phase.

Bitcoin Short-Term holder P&L. Source: CryptoQuant.

At the same time, the Stablecoin Supply Ratio (SSR)—which measures the ratio of Bitcoin’s market cap relative to the total market cap of all stablecoins—flashed positive signs.

Stablecoin Supply Ratio. Source: CryptoQuant.

When the ratio is low, it means stablecoin supply is high, which points to strong latent buying power. Recently, the SSR bounced from a low level, suggesting investors are now deploying stablecoins to seize buying opportunities during the dip.

These factors and local lows in futures taker sell volume convinced Maartunn that Bitcoin’s bottom is in.

“Multiple confluences marked the local bottom:

-

Short-term holders capitulated with heavy losses.

-

Taker futures sell volume hit local lows.

-

Stablecoin SSR bounced at strong support.

→ Bottom confirmed,” — Maartunn said.

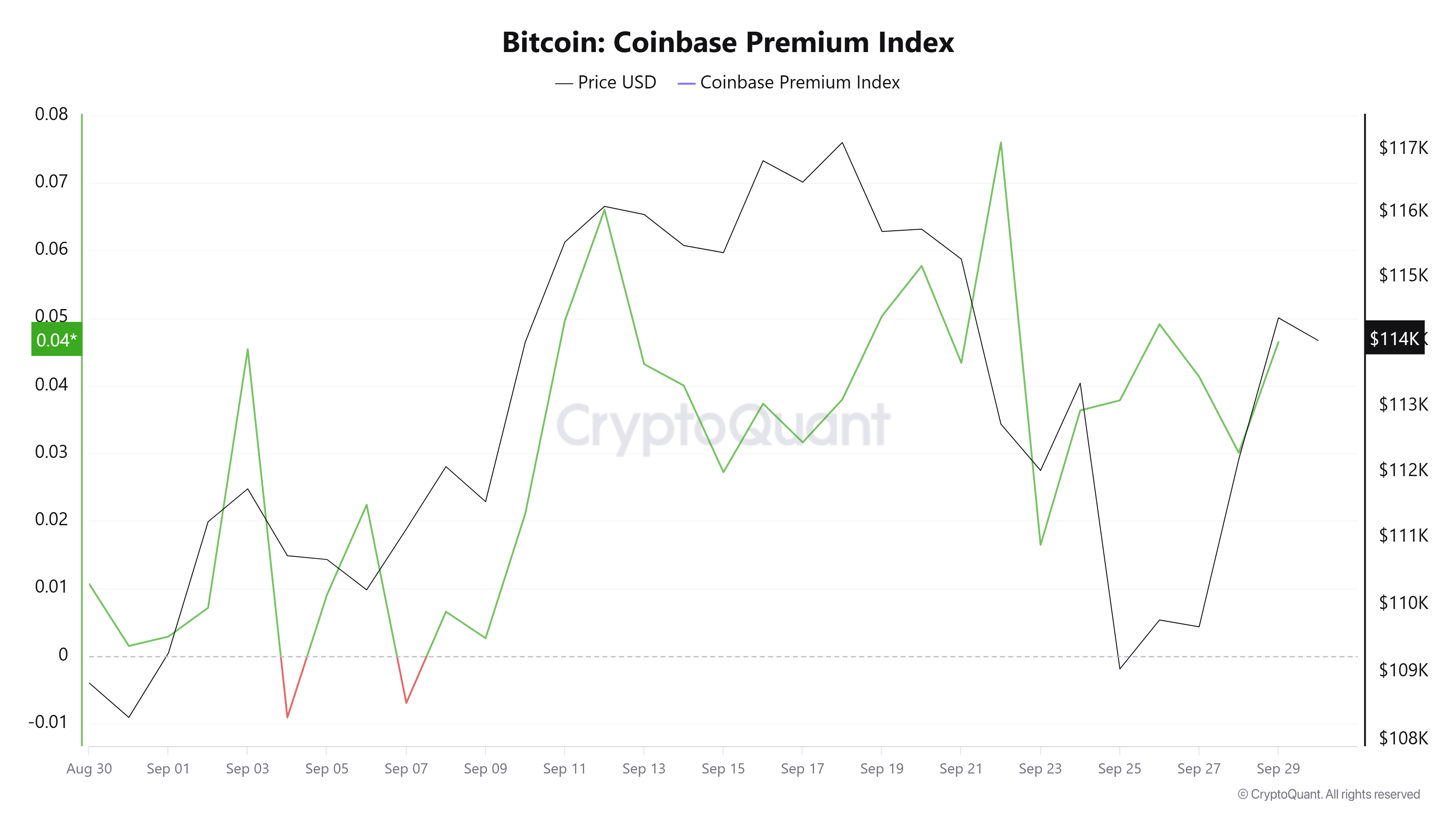

US investors show steadfast demand

Another noteworthy sign came during the late-September correction. The Coinbase Premium Index—which measures the price gap between Bitcoin on Coinbase and Binance—remained positive. This indicates that US investors kept paying higher prices for Bitcoin, showing their confidence even during the downturn.

Coinbase Premium Index. Source: CryptoQuant

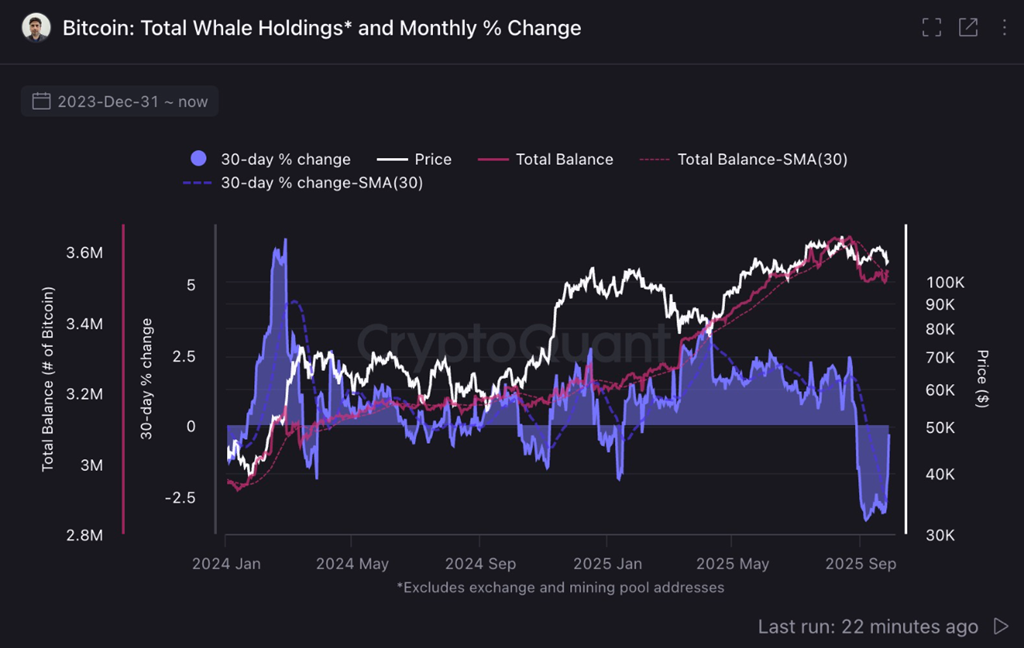

Analyst Crypto_Lion observed that the amount of Bitcoin held by whale wallets increased again in the final week of September. He predicted that US investors would step up their buying even more in October.

Bitcoin Total Whale Holding. Source: CryptoQuant

“It’s [Whale Balance] back. I hope this will attract more American players.” – Crypto_Lion said.

October has historically been one of Bitcoin’s strongest months, giving bulls an encouraging backdrop for the new month.

Still, the market is full of surprises. Macro data and the Federal Reserve’s interest rate decisions in October will carry far more weight than on-chain indicators. Without strict capital management, investors could face unpredictable volatility.