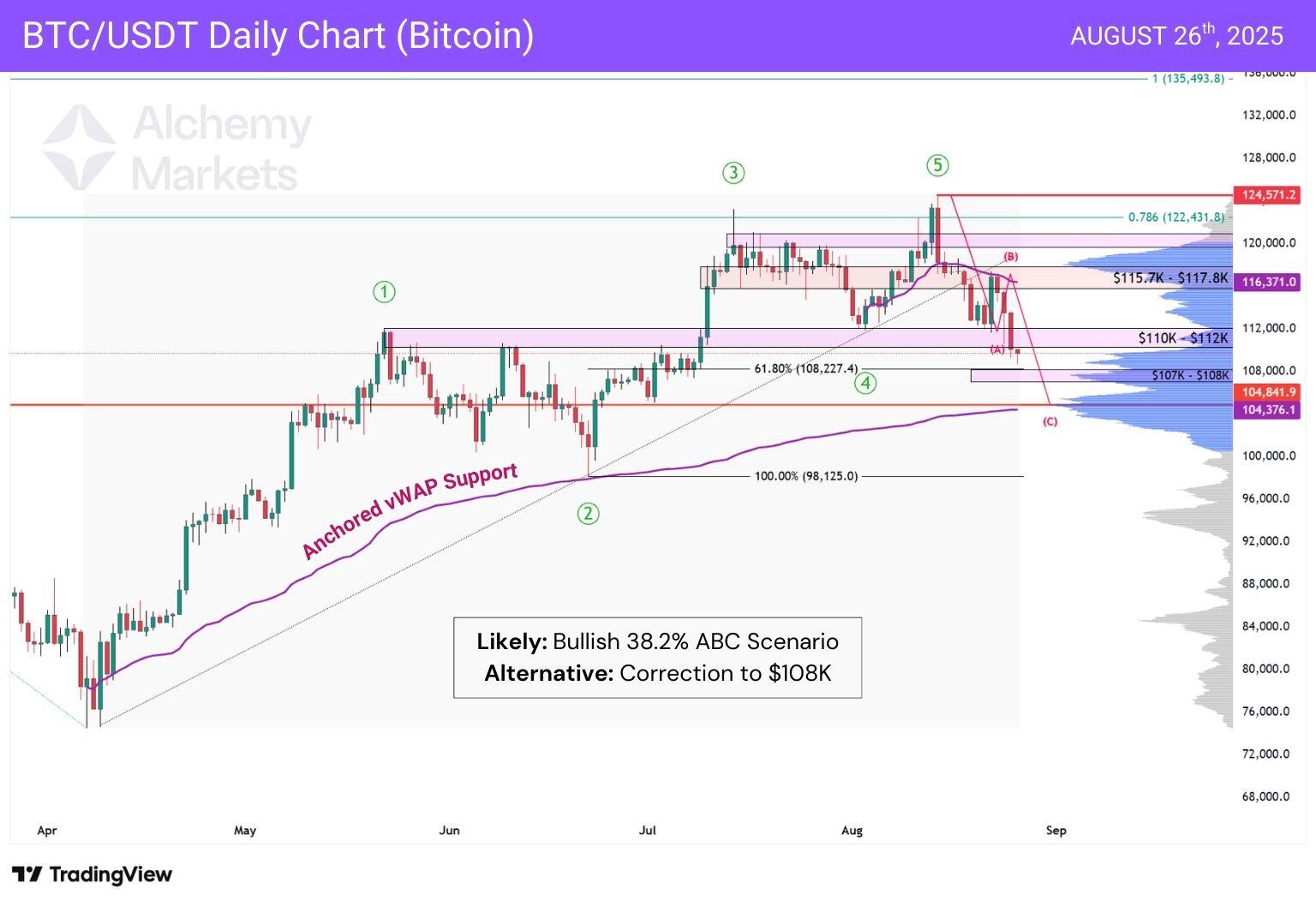

Previously, I theorised that Bitcoin was in a ABC correction with two main possibilities:

- BTC/USDT bounces at $110K and ultimately corrects to $105K (Bullish scenario).

- BTC/USDT bounces at $105K and corrects even lower to $99K (Typical 5-wave correction).

This week, we are given some more clarity — Bitcoin has indeed bounced at $110K, and then rejected at ~$117K over the weekends, and has now dropped to sub $109,000 levels.

A continued cascade is likely to take us to $105,000, which is a 10% drop from the peak of Wave B. This aligns well with the length of Wave A, another ~10% drop. For context — in Elliott Wave Theory, Wave C typically is equal in length to Wave A.

The confluence here is astounding as the $105,000 target fulfills these factors:

- Wave A confluence.

- Point of Control since April 2025 (Start of 5-wave rally).

- Anchored vWAP Support since April 2025.

However, there’s now a new scenario to be aware of: a bounce at the $107,000 to $108,000 zone. This is the 61.8% Fibonacci retracement of June to mid-August’s uptrend, which aligns with a high volume node.

Order flow insight tools such as Bookmap also show a cluster at $108,000 with more volume than at the $105,000 zone, validating this as a potential reversal zone.

Source: Bitcoin (Binance) Bookmap

Invalidation of this idea

We are trading below $110K, but if the daily candle closes back above $110K, it suggests the market only staged a liquidity grab rather than a clean Wave C continuation. In Elliott Wave terms, this would lean toward an ABC flat correction rather than a zigzag.

A further close above $112K would add strong confirmation, signalling that the downside break was corrective and not impulsive.

To strengthen this invalidation, watch for momentum flip (RSI/MACD divergence or strong volume thrust). Without these, a single close above $110K could still be noise, but with them, the case for the flat correction becomes much more convincing.

Closing thoughts

Bitcoin has shown its hand over the weekends, telling traders that we are likely on course to complete Wave C at $105,000. But orders clumped at $108K, which aligns with a Fibonacci Golden Pocket, serve as a reminder that an alternate scenario could happen.

Stay principled in your position sizing, and be aware of invalidation levels. Remember, the market doesn’t move in a straight line.