During the second quarter of 2024, 66% of institutional investors either held or increased their Bitcoin holdings through US-based spot exchange-traded funds (ETFs), according to Bitwise. The SEC Form 13F filings show that 44% of asset managers upped their Bitcoin ETF positions, while 22% maintained their holdings.

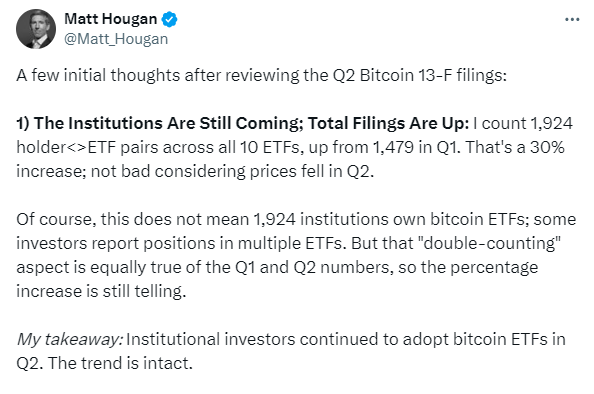

A minority of investors decreased their exposure, with 21% trimming their holdings and 13% selling out. Bitwise’s chief investment officer, Matt Hougan, noted that these numbers are similar to other ETFs, describing it as “a pretty good result.”

Despite a 14. Despite the 5% loss in value of Bitcoin over the three months under review, institutional acceptance of Bitcoin ETFs did not wane. Hougan observed that the number of holder/ETF pairs rose from 1,479 in Q1 to 1,924 in Q2, an increase of 30%, and attributed this to institutional investors who do not panic during volatilities.

Hougan noted that big hedge funds such as Millennium, Schonfeld, Boothbay, and Capula own ETFs, as do a range of advisers, family offices, and other institutions.

On August 14, in a 13F filing, Morgan Stanley disclosed that it held more than 5.5 million shares of BlackRock’s iShares Bitcoin Trust, worth $188m, ranks it as a top-five fundholder. Goldman Sachs also disclosed that it had over $238 million invested in IBIT and other spot Bitcoin ETFs.

This is a positive sign because the market volatility has not deterred institutional investors from investing in Bitcoin ETFs, and other players such as wealth managers and pensions are expected to follow suit.

Also Read: Morgan Stanley Invests $188 Million in Bitcoin ETF