Spot Bitcoin ETFs in the United States saw net outflows of $175 million, extending the outflow streak amid thin liquidity during the holiday season. The outflows come as investors brace for Friday’s $23 billion BTC options expiry and bearish price predictions from experts.

Spot Bitcoin ETFs Outflow Streak Signals Bearish Institutional Interest

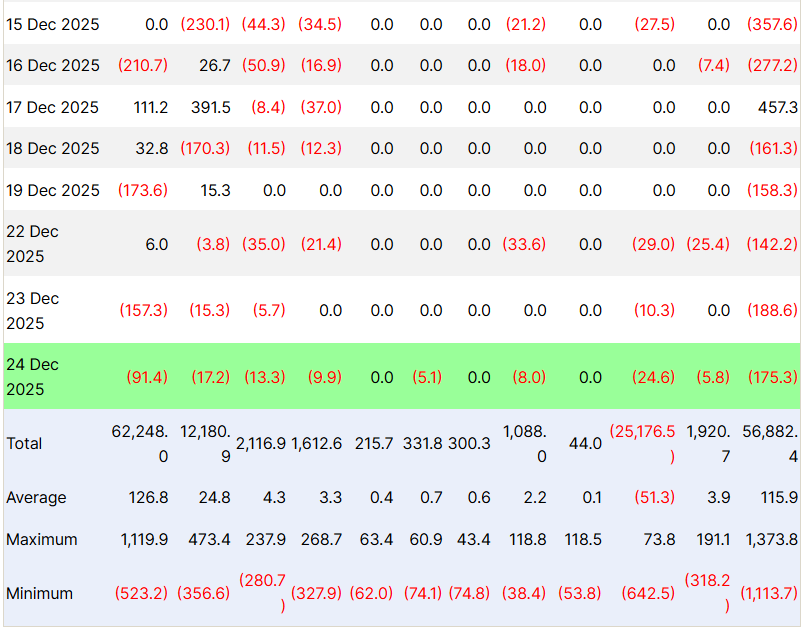

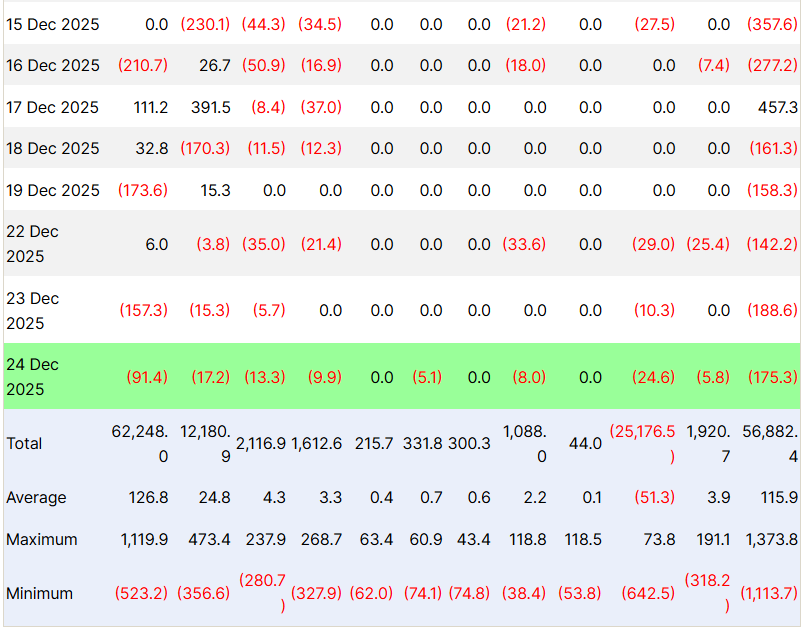

According to Farside Investors, spot Bitcoin ETFs recorded 5th consecutive net outflow of $175.3 million on Wednesday. Continuous outflows indicate negative sentiment among institutional investors on Bitcoin price recovery to $100K.

The withdrawals were again led by BlackRock’s iShares Bitcoin Trust (IBIT). It recorded $91.4 million in outflows, following $157.3 million in institutional redemptions the previous day. It is followed by outflows of $24.6 million from Grayscale’s GBTC and $17.2 million from Fidelity’s FBTC.

Spot Bitcoin ETFs by Bitwise, Ark 21Shares, VanEck, and Franklin Templeton also recorded outflows. This marks continued choppy outflows witnessed throughout December. The cumulative inflow has dropped from $62.7 billion to $56.8 billion.

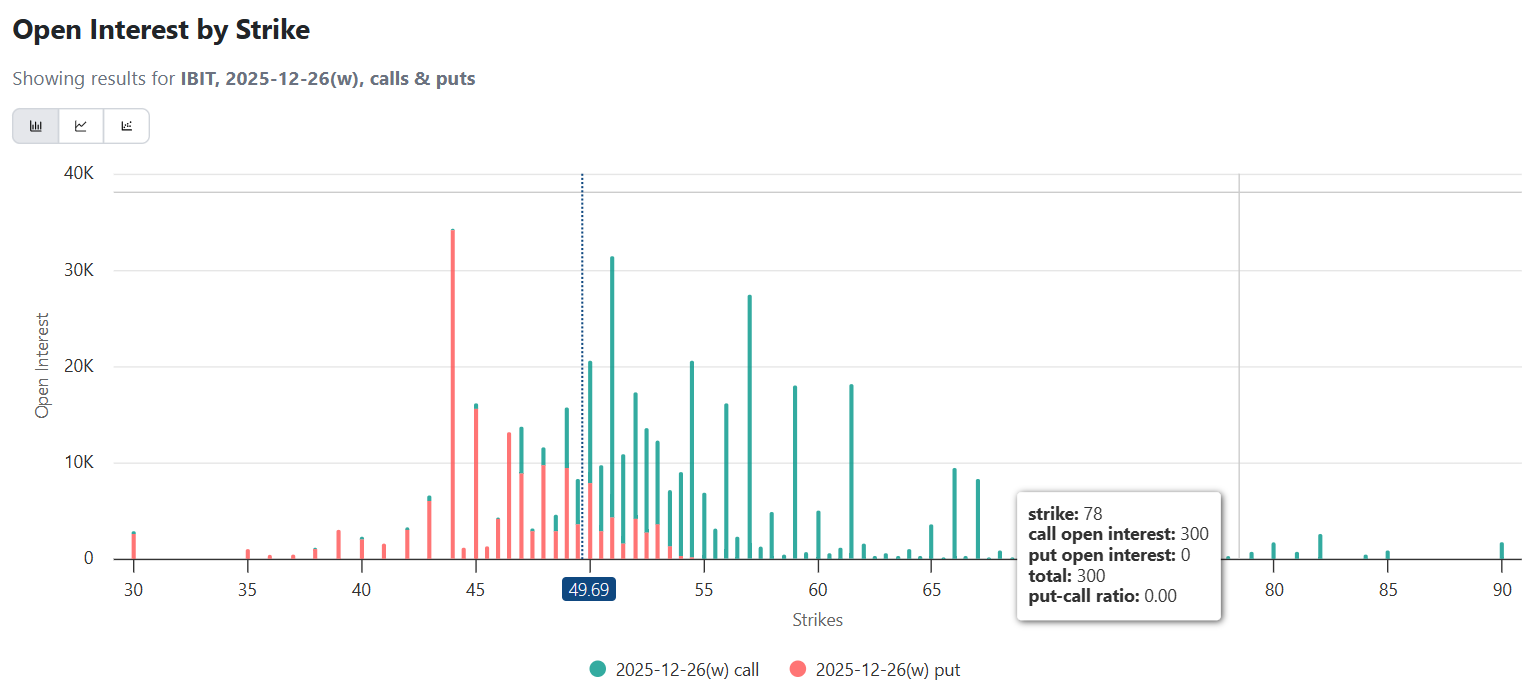

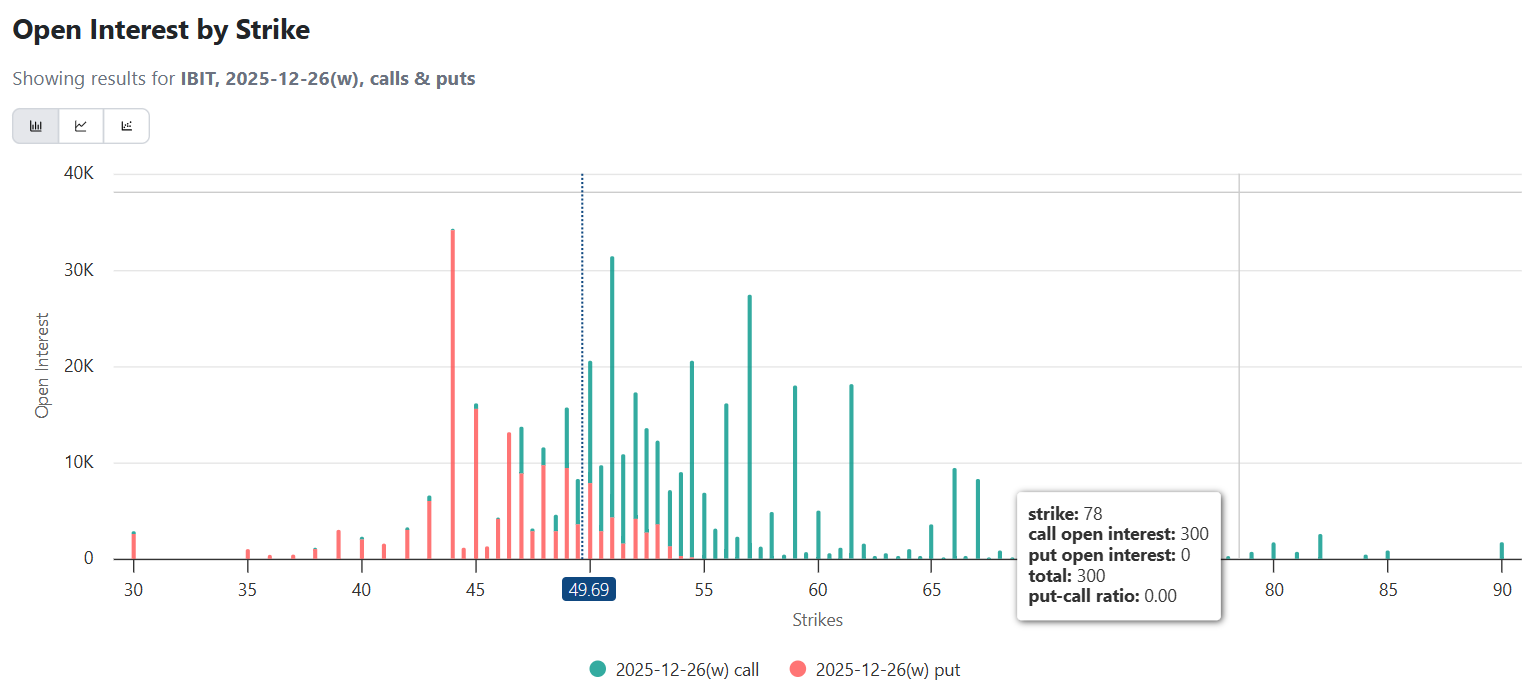

Investors are under pressure ahead of options expiry, with $23 billion in BTC options expiring on Deribit and 457K options open interest expiring on BlackRock Bitcoin ETF (IBIT).

Bitcoin price remains under heavy pressure, with implied volatility (IV) compressing, leverage retreating, and risk-off sentiment rising after the October crypto market crash. Rise in gold price and outflows from spot Bitcoin ETF signal tax-loss harvesting.

Similar patterns were observed last year, including substantial outflows in the days leading up to the 2024 Christmas and New Year.

10x Research said, “With few near-term catalysts and a Federal Reserve expected to be less dovish than markets had hoped, upside momentum appeared limited.”

Analysts Predict Deeper Crash in Bitcoin Price

While crypto participants’ outlook on Bitcoin’s direction in the coming weeks remains uncertain, some believe in a BTC rally in the coming months. However, popular analysts are pointing to a potential deeper correction, targeting Bitcoin price crash to as low as $40K.

Veteran trader Peter Brandt and Tom Lee’s Fundstrat warned about Bitcoin’s fall to $60K. The Bank of Japan’s rate hike has spurred fresh fear of a potential drop in early 2026.

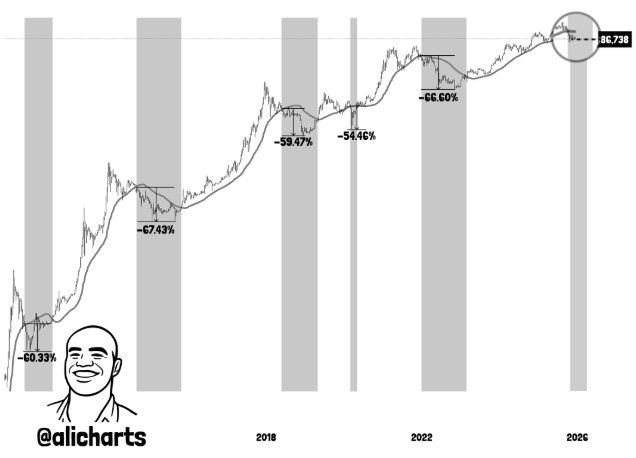

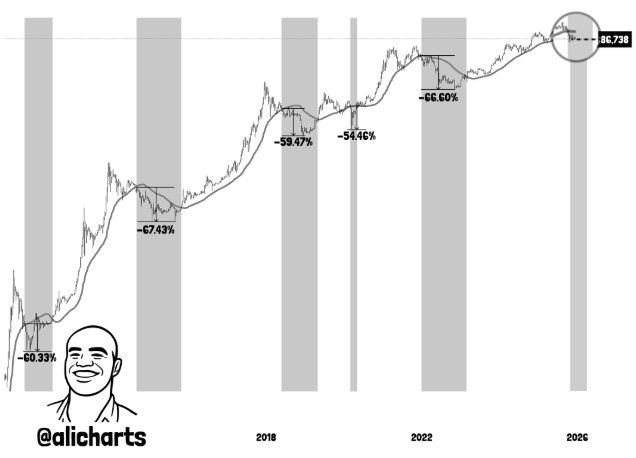

Crypto analyst Ali Martinez pointed out that Bitcoin price has dropped an average of 60% following a break below the 50-week moving average (WMA). He shared a target of $40K if BTC repeats its historical patterns.

Popular analyst Cheds Trading claims Bitcoin could bottom at $35K-$45K. He quoted Bloomberg’s senior commodity strategist Mike McGlone’s $10K price target as a “fundamental misunderstanding.”

The bearish predictions by analysts come on the back of macroeconomic uncertainties, unrealized losses among short-term holders, and the possibility of extended risk-off sentiment in 2026.

At the time of writing, Bitcoin price is trading at $87,730. The intraday low and high are $86,411 and $87,956, respectively. Trading volume further dropped by 48% over the past 24 hours.