Over the past few years, Bitcoin has been absorbed into mainstream finance through exchange-traded funds (ETFs), institutional custody platforms and growing acceptance by banks, corporates and asset managers. That shift has changed not just who owns Bitcoin, but also how it behaves and what risks investors need to understand before “buying the dip”.

Market integration

Bitcoin’s early years were shaped by isolation, driven largely by exuberance, technological promise, and scarcity. Today, those stories coexist with a more powerful force: global macroeconomics. As institutional investors entered the market, Bitcoin’s volatility moderated, though it did not vanish.

“Earlier cycles were marked by extreme, speculation-driven swings, but deeper liquidity and institutional participation have softened these spikes,” says Sumit Gupta, Co-founder of CoinDCX. This moderation has also tethered Bitcoin more closely to macro factors such as interest rates, liquidity and risk sentiment, pulling it closer to equities and other risk assets.

Conventional wisdom holds that institutional participation stabilises markets, but Bitcoin complicates that view. Institutional ownership is relatively small, with US-based Bitcoin exchange River estimating that as of October, under 8% of Bitcoin supply is held by wealth managers and fund houses, with another 9-10% owned by governments and businesses.

“Institutional holdings are still too small to materially influence Bitcoin prices,” says Suresh Sadagopan, Founder, Ladder7 Financial Advisories, adding volatility is intrinsic to the asset. Institutions also invest very differently. Long-only allocators behave unlike hedge funds that trade actively, making their impact either stabilising or disruptive. What institutions do bring, Sadagopan says, is greater resilience: deeper analysis, more data and a higher ability to ride periods of stress.

A mature, but not calm market

Exchange data suggests large players now dominate activity. At CoinDCX, over 45% of trading volume comes from high net worth individuals and institutions, says Gupta, indicating price discovery driven more by deep capital pools than retail emotion.

One visible result has been lower dayto-day volatility. Siddharth Sogani Jain, Founder of investment firm Blue Astra Capital, says that Bitcoin’s average daily movement has narrowed. “Now the average movement of Bitcoin is not more than 2-3% per day; 2-3 years ago it was 5-6% per day.”

Yet, it doesn’t mean drawdowns are gone. A risk associated with Bitcoin is leverage. “Recent drawdowns have been driven by forced liquidations, particularly in futures markets,” says Gupta. Once key levels break, “automated liquidations accelerate declines, creating sharp, mechanical sell-offs”.

In recent years, some companies have used debt and equity issuances to build large Bitcoin positions, effectively turning their balance sheets into leveraged bets on the cryptocurrency. The most prominent example is MicroStrategy, a US-listed software firm that has amassed one of the world’s largest corporate Bitcoin treasuries. As of 19 December, it held 6,71,268 Bitcoins, making it among the largest non-government holders.

While such strategies amplify gains during bull markets, they can become a source of pressure during prolonged downturns. If prices remain weak for extended periods, these players may be forced to prioritise balance-sheet stability over long-term conviction, potentially adding to selling pressure at precisely the wrong time.

This concentration risk is emerging just as the US moves to establish clearer crypto rules. The GENIUS Act, passed in July, marks a shift from years of uncertainty to formal oversight, as digital assets become more entwined with the traditional financial system. Yet long-term investors have not rushed for the exits. “We saw limited feardriven selling; many investors chose to hold or even buy the dip,” says Gupta, suggesting recent declines reflect leverage clean-ups rather than collapsing conviction.

For investors contemplating a dip-buy, understanding future triggers matters more than past returns. Gupta highlights three drivers: “Global monetary policy, institutional flows through ETFs, and broader risk sentiment.” In India’s case, domestic policy also plays a role. “If the Indian government introduces clear regulations, removes TDS, and aligns crypto taxation with other asset classes, it would significantly boost domestic participation,” he says.

Jain adds that Bitcoin now moves alongside traditional markets. “We have observed that there is a higher correlation between Bitcoin and S&P 500 and NASDAQs and dollar volatility index,” he notes. That makes macro indicators essential reading for investors. That, however, seems unlikely.

High taxes in India

Even if Bitcoin delivers strong returns, India’s tax regime complicates the picture. Gains are taxed at 30%, with no set-off or carry forward of losses. A 1% TDS on each transaction further ties up capital, especially for high-volume investors, as the tax is deducted upfront on every trade and can only be adjusted later while filing returns.

Sadagopan argues that taxation alone does not deter investors chasing asymmetric returns. “Even with a 30% tax, the payoff can still be attractive,” he says. Access, however, remains a challenge. Unlike global investors who use ETFs and regulated funds, Indian investors lack domestic options and are forced onto exchanges or overseas routes. A key risk is custody: crypto is not held in demat-style accounts. When WazirX was hacked last year, losses affected even those whose assets were not directly compromised.

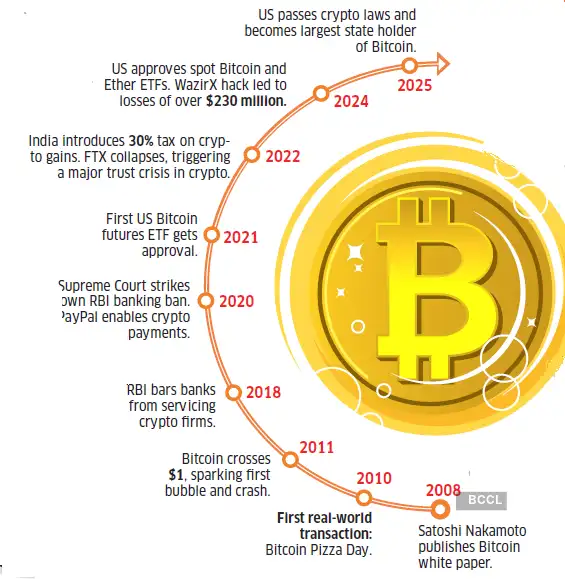

Crypto’s defining moments

Is buying the dip a good idea?

Bitcoin today is less chaotic but more entangled with global markets. For long-term believers, dips may still represent accumulation opportunities. But for those expecting quick rebounds, the risks are higher than they appear. If you wish to invest, Sadagopan of Ladder7 advises investing through ETFs. He prefers overseas-listed spot Bitcoin ETFs accessed through the Liberalised Remittance Scheme (LRS), rather than holding tokens directly. “We suggest maybe maximum 3% of the portfolio,” he says, stressing that crypto should remain a small, satellite allocation rather than a core holding.

Another benefit of investing through international ETFs is that they are tax efficient. “A lot of people are using this loophole. If international Bitcoin ETFs are held for over two years, the tax rate becomes 12.5%, making it more tax friendly,” says Nishant Khemani, Partner, Saturn Consulting Group. “However, keep in mind that under LRS, 20% TCS is charged on these transaction above the threshold of Rs.7 lakh.”

Jain, meanwhile, argues that Bitcoin now deserves a defined place in diversified portfolios. He recommends allocating around 4-5% to Bitcoin alone, calling it the only decentralised asset to have achieved broad institutional adoption, while cautioning investors to avoid smaller, speculative tokens.

Investors should remember that crypto assets are not regulated by the Securities and Exchange Board of India. The RBI has cautioned against their risks, and recent breaches underscore that avenues for grievance redressal are largely non-existent.