In 2025, financial markets witnessed a surge in traditional assets, especially precious metals. Silver, often seen as gold’s “poor cousin,” unexpectedly became a star performer with remarkable growth.

The question now arises: Should Bitcoin (BTC) investors worry as silver steals the spotlight from the leading cryptocurrency? Recent data offers some insights.

Silver outperforms Bitcoin

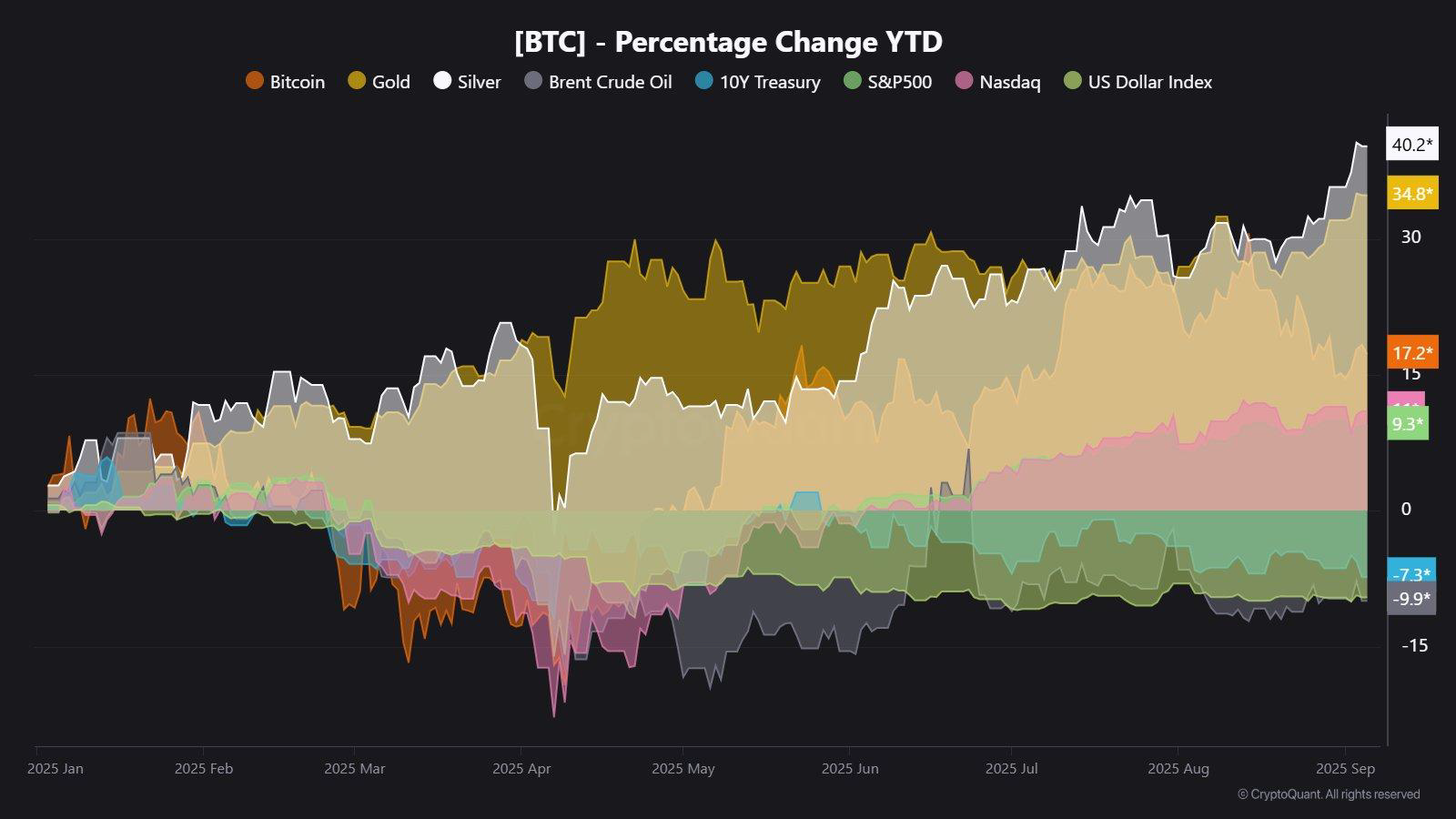

Investment performance this year highlights silver’s strength. Analyst Maartunn observed that silver not only outperformed gold, Bitcoin, and Ethereum (ETH), but also led the list of top-performing assets.

Performance comparison between assets. Source: Maartunn

“Silver – Best performing asset this year (+40.2%) Followed by: Gold: +34.8%.

Ethereum (ETH): +32.6% Bitcoin (BTC): +18.3%” – Maartunn said.

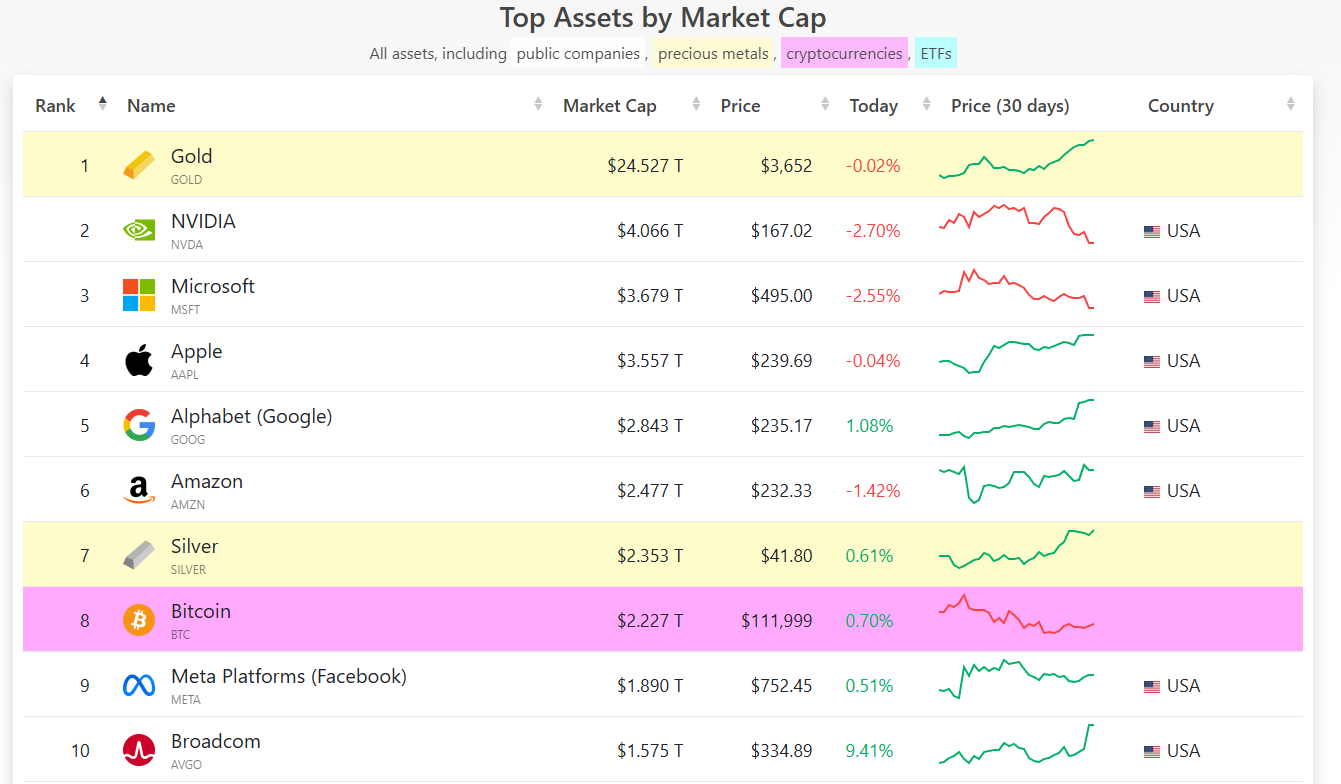

Another striking data point comes from market capitalization. According to Companies Marketcap, by September 2025, silver surpassed Bitcoin in market cap. Silver reached about $2.353 trillion, ranking 7th, while Bitcoin stood at $2.228 trillion, ranking 8th.

Top Assets by Market Cap. Source: Companies Marketcap

Back in July 2025, Bitcoin had briefly overtaken silver. However, silver’s strong rally reversed the situation, signaling a shift in capital flows. Investors appeared to favor the stability of precious metals over the high risks of crypto.

Meanwhile, analysts remain bullish on silver. The Great Martis noted that silver has formed a massive cup-and-handle structure since 1979.

“$48 or 18% higher should see the culminating high. Long-term, much much higher,” The Great Martis predicted.

Other experts pointed to central banks, commercial banks, major corporations, and elites accumulating precious metals. They argued that gold and silver would rise faster than the US dollar loses value.

Why Silver outperforming Bitcoin raises concerns

Silver’s outperformance draws investor attention away from Bitcoin.

Historically, Bitcoin outperformed most traditional assets over the long term. However, investors may diversify or shift funds from BTC to silver when that leadership weakens, reducing Bitcoin’s momentum.

Analyst LBroad shared an important observation when reviewing the BTC-to-silver chart.

Bitcoin vs Silver. Source: LBroad

From 2011 to 2017, the BTC/silver pair showed Bitcoin’s dominance. Yet the growth margin has gradually narrowed. While BTC remained stronger for most of the period, the BTC/silver chart entered an exhaustion pattern.

LBroad suggested Bitcoin’s outperformance against silver may be ending.

“What’s interesting is that the chart comparing Bitcoin to gold looks very similar. It seems like capital is starting to rotate out of assets that had skyrocketed, like Bitcoin, and into traditional safe havens like precious metals,” LBroad said.

Recent price data confirmed a worrying divergence between gold and Bitcoin. Gold kept climbing from August and set new highs in September. Meanwhile, Bitcoin kept falling during September. These signals support the idea that Bitcoin is losing its appeal compared to precious metals.

However, Pierre Rochard, CEO of The Bitcoin Bond Company, argued that silver cannot truly surpass Bitcoin for fundamental reasons.

“The problem with silver is that more of it gets mined when its price goes up, whereas with bitcoin the quantity mined is inelastic and halved every ~four years,” Rochard explained.

Silver’s story grows more complex when factoring in industrial demand. Analysts noted that silver plays a key role in producing solar panels that power data centers and AI training. Bloomberg also reported that tariff concerns have boosted silver demand.

Although it may seem unlikely that silver will surpass Bitcoin in attractiveness, the discussions and data show valid reasons for concern.