Riot Platforms opened a new $500 million at-the-market equity offering this week as the bitcoin miner reported lower November production and continued to sell a large portion of its monthly output to fund operations and expansion.

In a filing with the U.S. Securities and Exchange Commission yesterday, Riot said it entered into a definitive sales agreement allowing it to issue and sell up to $500 million of common stock at prevailing market prices through the Nasdaq Capital Market.

The facility replaces a prior at-the-market program established in August 2024, which Riot terminated effective Tuesday.

Under the new agreement, Riot retains discretion over the timing and volume of any share sales. The company said proceeds will be used to fund capital expenditures, potential strategic acquisitions, investments in existing and future data centers and bitcoin mining projects, as well as general corporate purposes.

The company also noted that stock buybacks could be funded with the proceeds, alongside working capital needs.

Riot’s bitcoin production

Riot sold roughly $600.5 million worth of stock under the 2024 agreement before terminating it, leaving about $149.5 million of unused capacity. The new program resets the company’s fundraising flexibility as it continues to scale infrastructure in Texas. Shares were down nearly 1% in trading Wednesday.

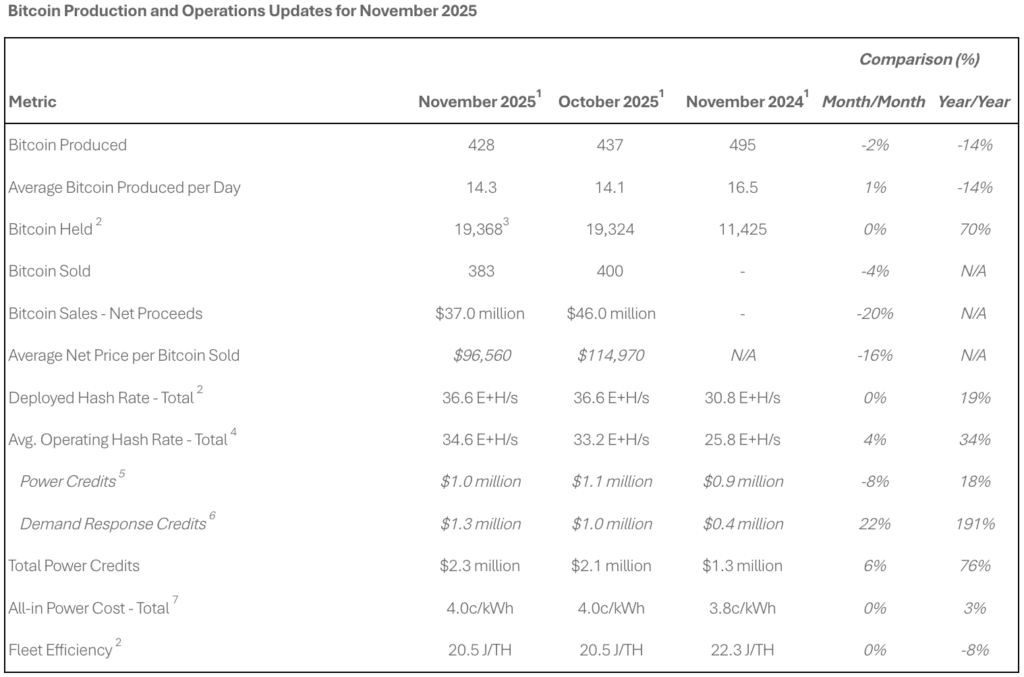

The capital raise comes alongside a mixed monthly operating update. The company said it produced 428 bitcoins in November, a 14% decline from the same month a year earlier.

The company attributed the year-on-year drop to higher network difficulty and planned curtailments tied to power strategy. Total bitcoin holdings stood at 19,368 at the end of November, up 70% from a year earlier, but only four bitcoins higher than in October.

Riot sold 383 bitcoins during the month, generating $37 million in net proceeds. That compares with October, when the company sold 400 bitcoins for $46 million. The average realized sale price fell sharply to $96,560 in November from $114,970 a month earlier, reflecting the pullback in bitcoin prices during late autumn trading.

At the time of writing, bitcoin was trading around $88,000, up just over 1% on the day, with retail sentiment also leaning bearish.

Riot stock remains up 24% year-to-date and 21% over the past 12 months, despite recent volatility.

Institutional analysts continue to see longer-term upside tied to Riot’s infrastructure footprint. J.P. Morgan recently forecast 45% upside for the shares through 2026, citing expectations that the company could secure a 600-megawatt colocation deal at its Corsicana site by the end of next year.

The company currently owns roughly 1.7 gigawatts of power capacity across two large-scale Texas facilities, which analysts describe as rare tier-one assets in the bitcoin mining sector.