Bitcoin has struggled since the Federal Reserve cut interest rates last week (even as the market gears up for what could be a Wall Street game-changer).

Sign up now for CryptoCodex—A free crypto newsletter that will get you ahead of the market

The bitcoin price has dropped to near $111,000 per bitcoin, down from almost $118,000 last week as fears of a “death spiral” hit the wider crypto market.

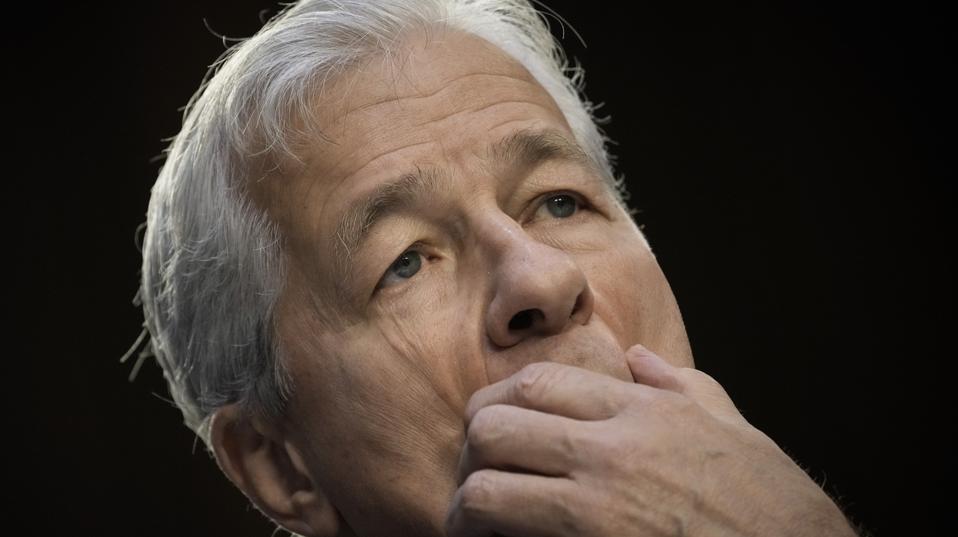

Now, as the bitcoin price looks to be on a collision course with a $9.5 trillion “wall of cash,” JPMorgan chief executive Jamie Dimon has warned the Fed may not be able to cut interest rates further in the months ahead—something that could drive traders out of bitcoin and crypto.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

JPMorgan chief executive Jamie Dimon has warned the Federal Reserve may not be able to cut interest rates further—potentially putting pressure on the bitcoin price.

Getty Images

“If inflation does not go away, it’s going to be hard for the Fed to cut more,” Dimon told CNBC-TV18.

“Inflation seems a little bit stuck at 3%. Again, I can give you some arguments why it’s going to go up, not down,” he said, adding he hopes the U.S. economy will return to “decent growth” that allows the Fed to cut interest rates rather than policy makers being forced to due to a recession.

The Fed cut rates by 25 basis points last week for the first time in 2025, pushing the bitcoin price briefly higher but failing to reignite the bull market that catapulted bitcoin over $100,000 at the end of last year.

Meanwhile, Treasury secretary Scott Bessent has slammed Fed chair Jerome Powell for failing to champion further rate cuts.

“Rates are too restrictive, they need to come down,” Bessent told Fox Business, showing the battle for control between the Trump administration and the Fed isn’t over yet. “I’m a bit surprised that the chair hasn’t signaled that we have a destination before the end of the year of at least 100 to 150 basis points.”

Earlier this week, Powell downplayed the possibility of a rapid series of interest rate cuts, saying the Fed had to balance a weakening labor market and the risk of higher inflation.

“Near-term risks to inflation are tilted to the upside and risks to employment to the downside—a challenging situation,” Powell told the Greater Providence Chamber of Commerce. “Two-sided risks mean that there is no risk-free path.”

Elsewhere, top Fed official Austan Goolsbee, president of the Chicago Fed and Federal Open Market Committee (FOMC) member, told the Financial Times he could be less willing to support further cuts at forthcoming policy votes due to inflation fears.

The market continues to heavily bet on another 25 basis point cut next month.

Sign up now for CryptoCodex—A free crypto newsletter that will get you ahead of the market

The bitcoin price has dipped from its all-time high of $124,000 per bitcoin reached last month, with fears of a bitcoin price crash rattling traders.

Forbes Digital Assets

Amid the uncertainty over the Fed’s interest rate path forward, traders are looking to this week’s economic data for clues.

“Bitcoin retreated under $112,000 on Thursday, with traders turning cautious ahead of key U.S. releases, including today’s GDP figures and Friday’s PCE data,” Christopher Tahir, senior market strategist at Exness, said in emailed comments.

“Softer prints could reinforce expectations of a dovish Federal Reserve stance and support bitcoin, while signs of deeper economic weakness could weigh on broader risk sentiment.”