Bitcoin (BTC) is trying to hold steady at $76,273 after dropping 3% in the past 24 hours, as the market reacts to a sharp increase in volatility. Even with the recent dip, spot Bitcoin ETFs saw $562 million in new investments as buyers took advantage of lower prices, showing that large institutional investors remain active.

Daily trading volume has reached $67.8 billion, setting up a contest between traders betting against Bitcoin and companies looking to buy more.

LSE’s New King: SWC Becomes Britain’s Largest Bitcoin Holder

This week, The Smarter Web Company (SWC) made its official debut on the Main Market of the London Stock Exchange, marking a significant moment for UK finance. Now the largest publicly listed Bitcoin holder in Britain, the company’s treasury has 2,674 BTC, making it 29th in the world among public companies.

CEO Andrew Webley aims for the company to join the FTSE 250 by 2026, highlighting a major move toward corporate Bitcoin adoption in the UK.

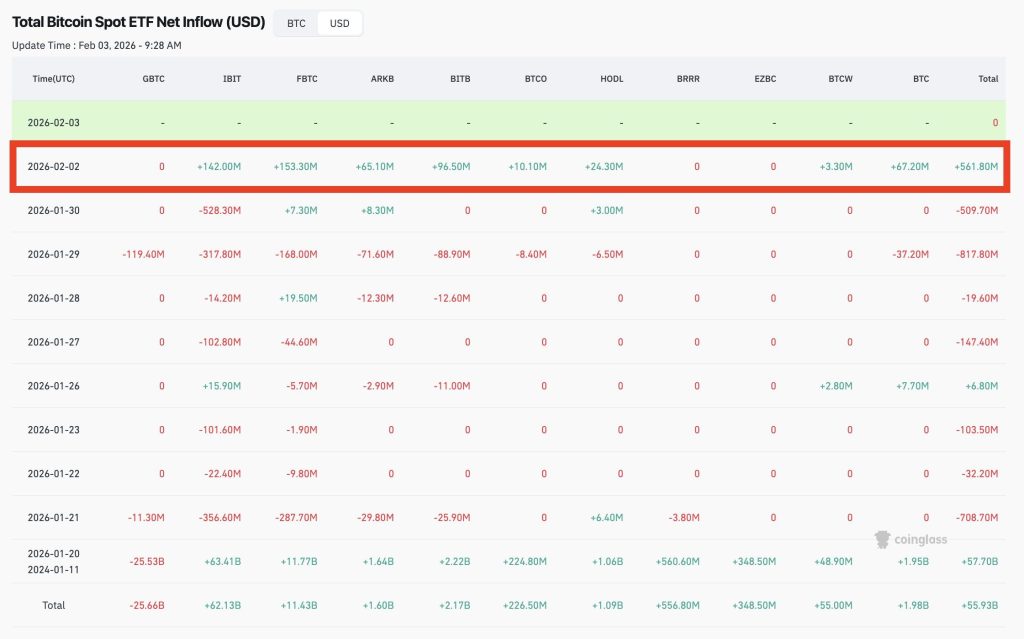

ETF Warriors: The $562 Million “Dip Buy”

After four days in a row of withdrawals spot Bitcoin ETFs had a robust comeback on Monday bringing in $562 million in new investments. This shows that some investors are “buying the dip” as Bitcoin recovers from weekend weakness partially offsetting last week’s massive $1.5 billion sell-off.

Institutional Conviction: Analysts note that Bitcoin is currently trading below the ETF average cost basis of $84,000, which is acting as a magnetic support zone for major funds.

Recovery Rally: The recovery from weekend lows below $75,000 back toward the $79,000 mark helped reignite demand, though macro uncertainty around US monetary policy remains a looming headwind.

The Gold Token Surge: A $6 Billion Market Test

The market for digital gold tokens such as PAX Gold and Tether Gold has grown four times larger since late 2024.

Flight to Safety: As spot gold hit a record $5,594.82, tokenized gold demand surged, though a recent historic one-day decline in precious metals is putting these assets to the test.

Custody Concerns: Experts warn that extreme price swings could trigger a rush for physical gold, raising questions about audits and actual ownership in the digital space.

Bitcoin (BTC/USD) Technical Analysis: Bulls Defend the $74,000 “Line in the Sand”

Bitcoin price prediction is currently navigating a period of stabilization after a “liquidity hunt” pushed prices to a nine-month low of $74,500. Before the correction, BTC was coiled in a massive symmetrical triangle. While the breach below $80,000 weakened the immediate bullish case, the long-term resolution target remains a psychological $100,000.

The Daily RSI has dipped into the 28–30 range, which typically signals an oversold market ripe for a reversal. A bullish Stochastic crossover further suggests that selling exhaustion is setting in.

Immediate structural support is anchored at $74,420–$74,666, while a reclaim of the $78,400 (0.236 Fibo) level is necessary to retest the $84,000 overhead resistance.

Conclusion

The current market setup points to a healthy reset of over-leveraged positions. With the Smarter Web Company leading corporate adoption on the LSE and ETF inflows picking up again, the main reasons for a bullish outlook remain strong. If buyers can keep Bitcoin above $74,000, reaching $100,000 may be more achievable than it appears.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

d for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $31.2 million, with tokens priced at just $0.013675 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale