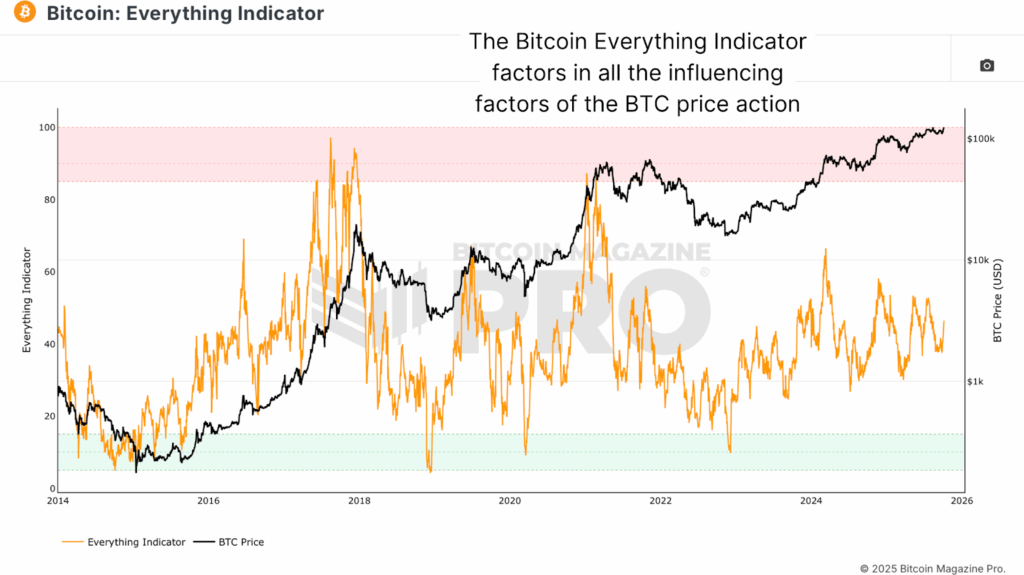

In this week’s analysis, we explore what happens when every significant Bitcoin data point — from on-chain activity to macroeconomic liquidity — is merged into one unified model designed to refine bitcoin price prediction. This is the Bitcoin Everything Indicator, built to capture every key driver of BTC price action in a single, dynamic framework. But as Bitcoin evolves, and as institutions and global markets reshape its behavior, we’ll also look at how adapting this model to changing conditions can make it even more powerful.

A Comprehensive Bitcoin Price Model

Over the years, analysts have created countless “all-in-one” indicators to measure Bitcoin’s valuation across its cycles. However, most of them rely too heavily on a single data type — such as on-chain activity, miner profitability, or technical charting patterns — often ignoring the macroeconomic shifts that now play a critical role in bitcoin price movement.

Our goal was to take a broader approach by combining all major drivers of Bitcoin’s value, including global liquidity, miner expectations, on-chain metrics like the MVRV Z-Score and SOPR, network utilization data, and technical signals such as the Crosby Ratio.

How the Everything Indicator Tracks Bitcoin Price Cycles

This confluence of macro, on-chain, and technical data forms the backbone of the Bitcoin Everything Indicator, giving a multi-dimensional view of when BTC is historically overheated or undervalued. Historically, this model has aligned remarkably well with bitcoin price cycles, highlighting long-term accumulation and distribution phases.

Evolving Models for Accurate Bitcoin Price Analysis

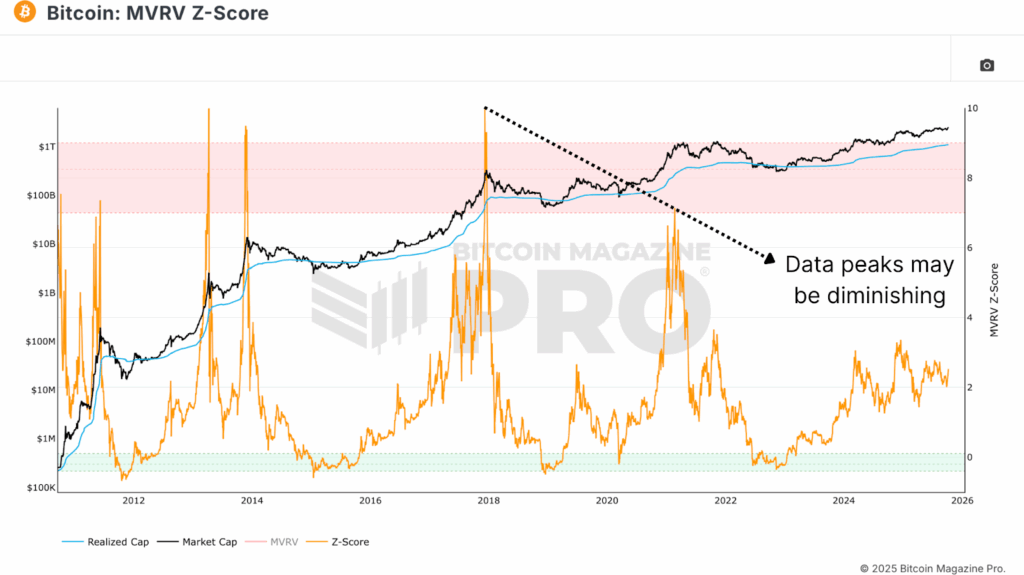

Bitcoin as an asset is constantly evolving, and so must our models for accurate bitcoin price analysis. For instance, while the MVRV Z-Score has historically signaled major tops and bottoms, its peaks have become less extreme over time as volatility declines and institutional participation increases.

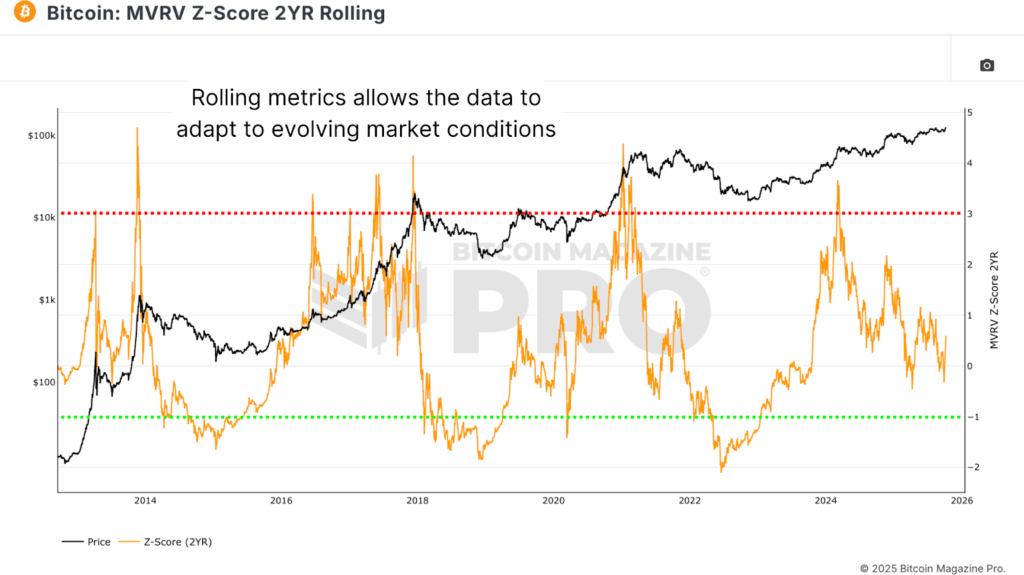

To adapt, we introduced the 2-Year Rolling MVRV Z-Score, which uses a rolling data window to better reflect current market dynamics. This approach reduces lag and normalizes long-term shifts in volatility, helping improve bitcoin price forecasting in a maturing market.

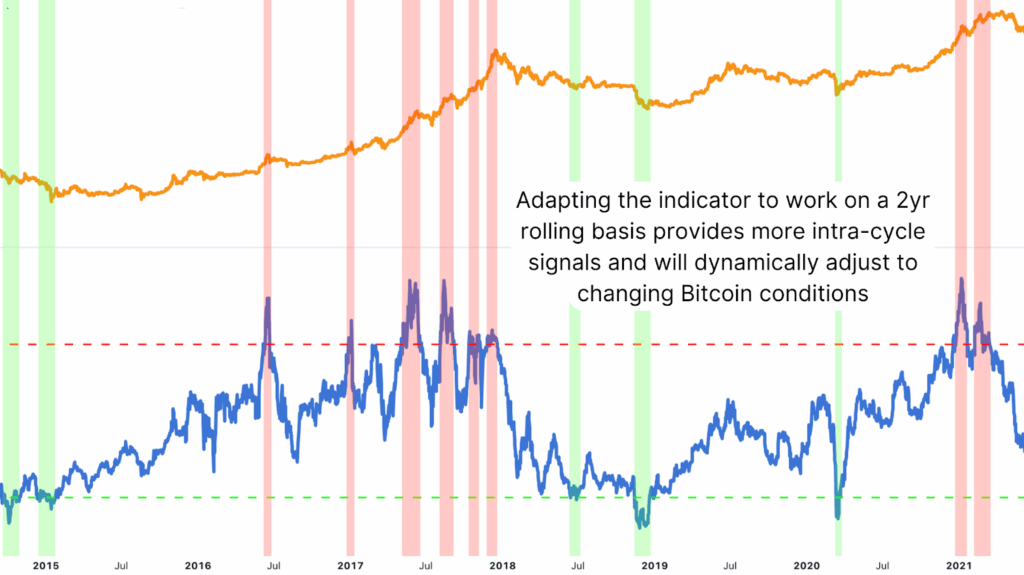

The 2-Year Rolling Bitcoin Price Indicator

By applying a 2-year rolling methodology, the Everything Indicator removes backward bias and captures real-time momentum in liquidity and on-chain data. This adaptive design helps maintain sensitivity to bitcoin price inflection points while filtering out short-term noise.

The bottom 5% zones have historically marked prime accumulation phases, while the top 5% zones identified overheated conditions preceding major retracements. In the current cycle, Bitcoin remains below that overheated threshold — implying bitcoin price upside potential remains strong.

Conclusion: A Dynamic Future for Bitcoin Price Prediction

Bitcoin is no longer the purely retail-driven, high-volatility asset it once was. With institutional accumulation, ETF inflows, and even sovereign-level holdings now shaping supply dynamics, the historical amplitude of Bitcoin’s cycles has compressed. This means traditional models, built for the era of retail dominance, may be becoming less accurate.

The Bitcoin Everything Indicator provides one of the most complete pictures of Bitcoin’s valuation and cyclical positioning by combining macro, on-chain, and technical factors into a single composite model. By dynamically adapting to new data and recalibrating across rolling time frames, this enhanced version of the Everything Indicator remains highly accurate in identifying both cyclical tops and bottoms. At present, the model suggests that Bitcoin still has significant room to the upside before approaching overheated conditions.

For a more in-depth look into this topic, watch our most recent YouTube video here: This Might Be The Only Bitcoin Chart You Ever Need

For deeper data, charts, and professional insights into bitcoin price trends, visit BitcoinMagazinePro.com. Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.