Grayscale has predicted that Bitcoin might reach new highs in the coming year. They also added that the four-year cycle no longer explains how the market behaves.

Grayscale Argues Bitcoin’s Next Peak May Arrive in 2026

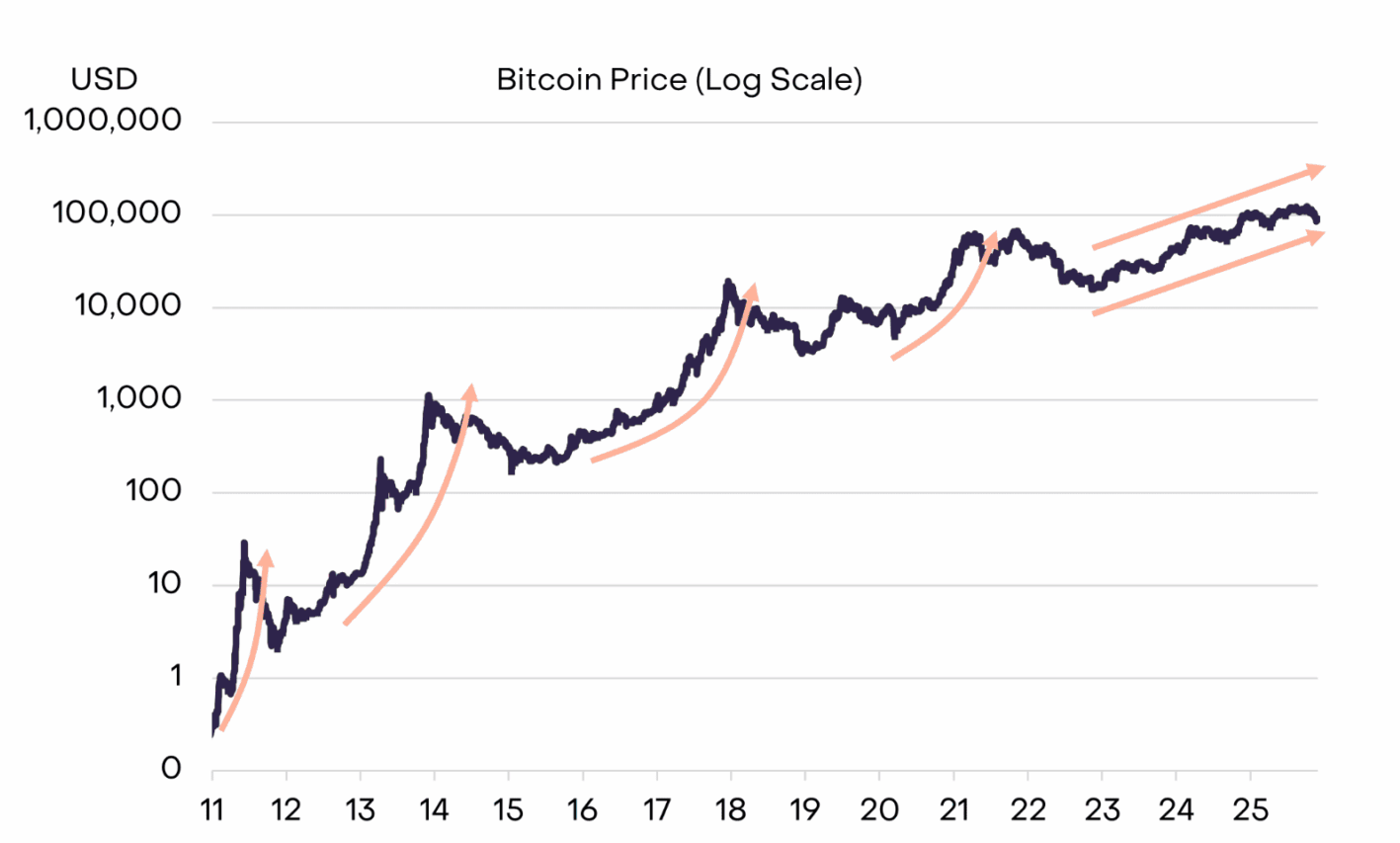

Grayscale Research released a new report stating that BTC might be on track to reach new all-time highs in 2026. This is happening despite concerns about a potential crash that could last for several years. The firm believes that the idea of the coin following a four-year cycle of boom and bust no longer fits the current market situation.

There is a belief that BTC’s price changes followed its supply halving schedule. This means that the price tends to rise over three years then drop significantly in the fourth year. However, the firm now says this way of thinking is outdated.

The report explains why the old model is no longer valid. In contrast to past bull markets, this year, the coin did not have a rally that normally happens before a significant drop.

Also, today capital inflows mainly come through exchange-traded products and corporate digital asset treasuries. Furthermore, conditions still seem favorable for risk assets going into 2025.

“We believe the four-year cycle thesis will prove to be incorrect, and that Bitcoin’s price will potentially make new highs next year,” they shared.

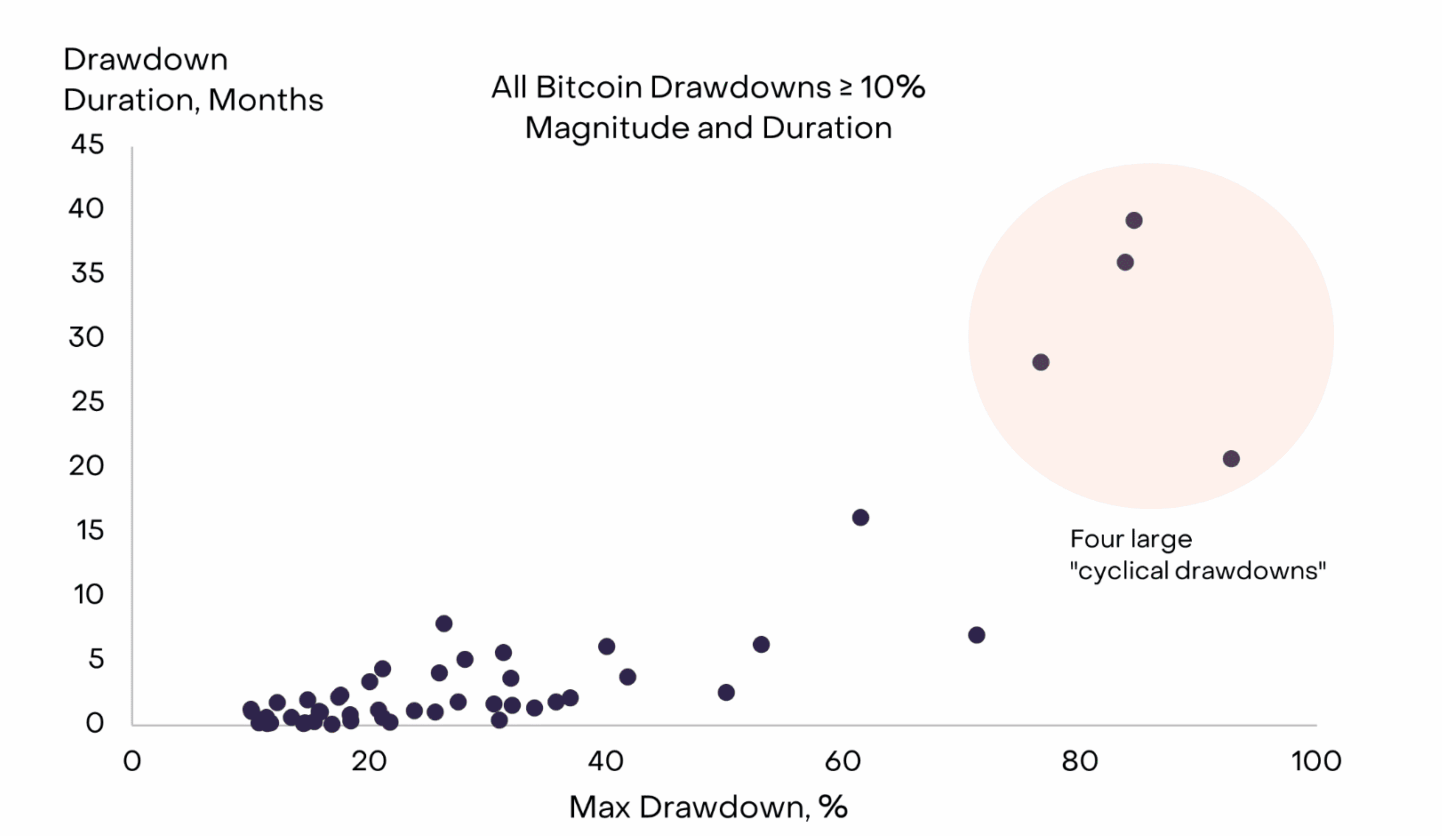

The firm also said that the recent drop in its price is similar to what was seen in the past. Usually, Bitcoin experiences three drops of at least 10% in a year due to normal market fluctuations. The decline from early October to late November saw a 32% decrease. This is very close to the average long-term drop of 30%.

Fundstrat’s Tom Lee also believes the coin could set a new all-time high as early as January 2026. He pointed out similar trends that suggest the market might be getting ready for a major recovery.

Would Regulatory Changes Boost BTC to New Highs?

There are some new developments that could help see the token eventually hit new highs. The closer one is the Federal Reserve’s interest rate decision in December. Bitcoin could see an increase in the short term.

Also, reports suggest that Kevin Hassett is leading the race to replace Jerome Powell. Hassett has been a strong supporter of cryptocurrency and favors lower interest rates.

In addition, the Senate Agriculture Committee released a bipartisan draft on the U.S. crypto market structure last month. Analysts think that progress on this bill in 2025 could encourage more institutional involvement.