Ethereum is recovering over $4,100 with traders evaluating rising bullish formation throughout the crypto marketplace. Analysts note there would be a huge pool of short positions in case of a sudden upside move in case the price remains higher.

In the meantime, the consistent resurgence of the Bitcoin market since last week following the crash has regained confidence among investors, who are back in the risk assets. With this new optimism, MAGACOIN FINANCE is attracting heavy presale attention therefore inverting the ETH and BTC demand making it the best crypto to buy today.

ETH Price Outlook Turns Bullish as Liquidation Risks Mount

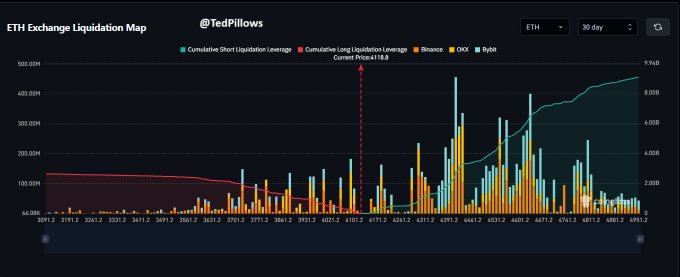

According to new information provided by ETH Exchange Liquidation Map by TedPillows, there is a drastic imbalance between the short and long positions. Short leverage of approximately $9.5 billion is being liquidated in case Ethereum rises as little as 20%, versus long exposure of $2.6 billion in case Ethereum falls. Analysts refer to this construct as “max pain to the upside” which implies that compelled buybacks might speed a shift towards $4,500 and higher.

Source: X

Source: X

The disparity is also obvious in large exchanges including Binance, OKX, and Bybit where the clusters of liquidation are developing between $4,000 and $4,700. With a convergence in the prices at present levels, short sellers become more exposed. Statistics indicate that cumulative short liquidation leverage has been increasing continuously whereas long exposure has leveled off.

In the event that Ethereum surges above $4,500 with high trading volume, analysts predict a domino short squeeze. This may drive the prices to the level of $5,000 since the algorithmic liquidations and market makers will be scrambling to fill the open positions.

Institutional Buying Resurges as ETH Coinbase Premium Hits 2025 High

After falling drastically to $3,686 in the flash crash on Oct. 10, Ethereum rebounded. In just several days, ETH surged to $4,134, a 24-hour gain of 8%. CoinGlass reported that the volume of futures soared 52.9% to 128.1 billion and open interest increased by 9.3% to 48 billion. Such numbers indicate new cash influx back into the market moving forward and not traders settling positions.

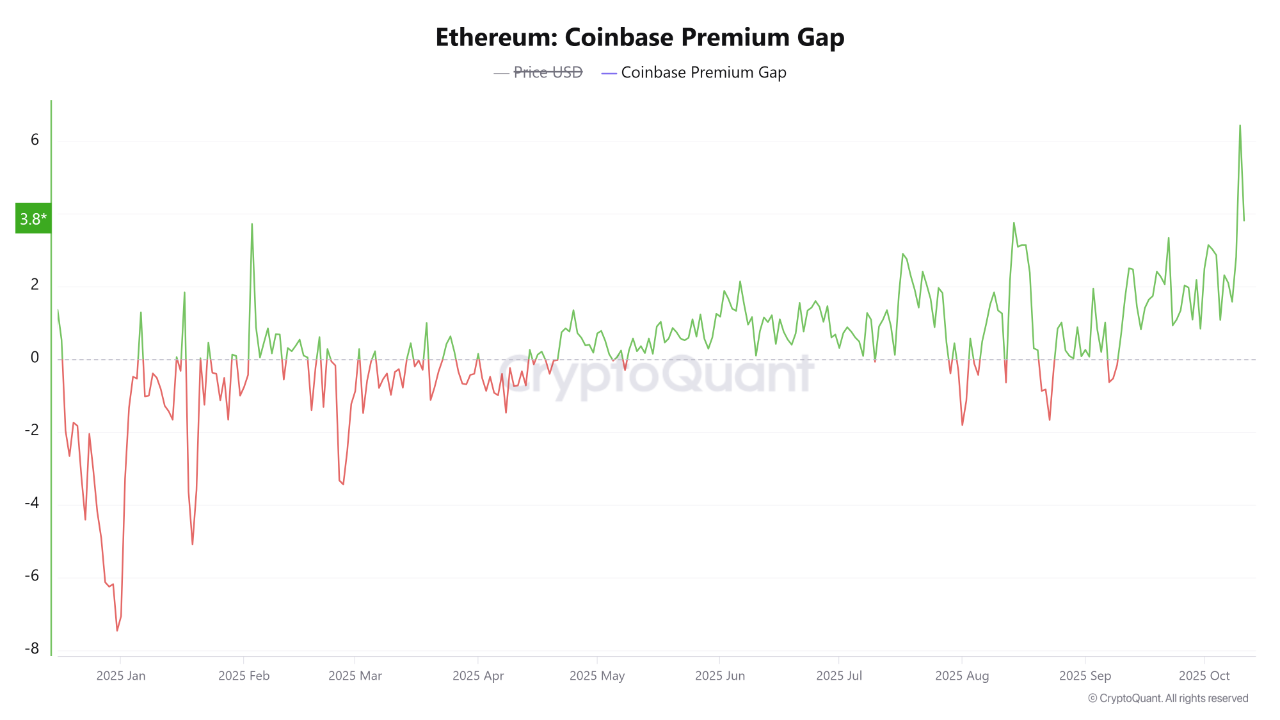

According to CryptoQuant data, the Coinbase Premium Index of Ethereum reached its highest value of 2025 of +6.0, which is the highest since 2025, which is a good indicator of high institutional demand for Ethereum in the United States.

Source: Cryptoquant

Source: Cryptoquant

CryptoOnChain called the pattern institutional dip-buying at scale, with the large numbers of large investors actually seeing the recent pullback as an opportunity to buy ETH at a discount. This is being done alongside the persistent inflows into spot Ethereum ETFs, the majority of which are managed by Coinbase, which is why the domestic purchasing trend is so robust.

Bitcoin Recovery Strengthens Market Sentiment

Bitcoin recovery above $110,000 has been beneficial in stabilizing the wider crypto sentiment following the panic last week. A leveraged liquidation of over 20 billion was occasioned by the recent flash crash which was occasioned by tariff issues between the U.S and China. Nevertheless, the prices have since gone up with the calming of the geopolitical tensions and regained investor confidence.

The Crypto Fear & Greed Index has left extreme fear behind and the technical analysts also reported that Bitcoin has created a golden cross – a trend where the 50-day moving average crosses the 200-day line.

Source: X

Source: X

History of this trend occurred before multi-fold rallies. It is considered that the capacity of Bitcoin to maintain over $110,000, is crucial to the continuance of the existing bullish trend and may open the door to reach $125, 000 provided the trend is maintained.

MAGACOIN FINANCE Gains Investor Attention During Market Rebound

Although the big players are working with Bitcoin and Ethereum, small investors are approaching new projects like MAGACOIN FINANCE. The presale of the project has already exceeded $16 million demonstrating great confidence despite the changing situation. Analysts state that it is among the fastest-growing token launches in 2025 due to its audited smart contracts and open roadmap of development.

MAGACOIN FINANCE is now completely audited by HashEx, and no serious vulnerabilities are detected, and it has sent code to CertiK to further audit.

This is a two-audit strategy that will help the project gain investor confidence since it is ready to be listed in the exchange. As it grows its community and is dedicated to being transparent, MAGACOIN FINANCE keeps attracting both retail and early-stage investors interested in the most promising crypto to invest in before the boom.

Conclusion

The technical structure of Ethereum is improving and institutional purchases create the possibility of an upward trend to $4,500, whereas the recovery of Bitcoin boosts market confidence.

With a fresh inflow of liquidity back into digital assets, traders are looking forward to an expanded rally moving into the next cycle. To investors who want to gain exposure in this climate early MAGACOIN FINANCE is among the best crypto to buy during the current market recovery.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.