BitMEX co-founder Arthur Hayes says a looser US monetary policy could trigger Bitcoin (BTC) to reach a much higher price.

Citing a comparison to the monetary policy that was put in place during the Covid-19 pandemic, Hayes says in a new essay that Bitcoin is “set to go parabolic” over the next three years if the Federal Reserve engages in quantitative easing and the commercial banks boost their lending.

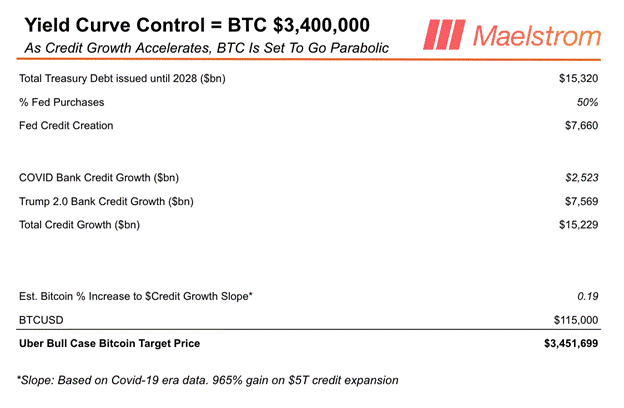

“The slope of the percentage increase in Bitcoin to a dollar of credit growth [during COVID] was approximately 0.19. Ladies and gentlemen, that results in a 2028 Bitcoin price prediction of $3.4 million!

Do I think Bitcoin will rise to $3.4 million by 2028? No, but I believe the number will be markedly higher than the approximately $115,000 that it trades at today.”

According to Hayes, the Federal Reserve could create $7.66 trillion in new credit by 2028, while the commercial banking system could create $7.569 trillion over the same period.

“During COVID the Fed purchased approximately 40% of all treasury debt issued using the [System Open Market Account] SOMA, which increased the size of the balance sheet. I believe the Fed will purchase 50% or more of debt issued, because today even fewer foreign central banks will buy treasury debt because they know Trump will issue a fuck ton of it.

Arriving at an estimation of bank credit growth is difficult. The most defendable estimate is to use the COVID period as guidance. During COVID, Trump ran quantitative easing for Poor People. Bank credit growth increased by $2.523 trillion over that period evidenced by the growth in banking other deposits and liabilities reported each week by the Fed. Trump has approximately three years left to juice the markets, which equates to $7.569 trillion of bank loans issued.

That brings the total Fed plus commercial banking credit growth to $15.229 trillion.”

SOMA, which is under the Federal Reserve Bank of New York’s management, is a securities portfolio tasked with holding the assets purchased by the Federal Reserve banking system for monetary policy purposes.

Bitcoin is trading at $113,113 at time of writing.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney