The billionaire investor has expressed doubts about Bitcoin’s long-term upside.

Peter Thiel is one of the most intriguing, albeit elusive, characters in Silicon Valley.

Back in 2000, he was busy working as a co-founder of online payments pioneer PayPal. As fate would have it, PayPal acquired a competing platform called X.com, led by aspiring entrepreneur Elon Musk. After PayPal was acquired by eBay in 2002, Thiel took his payout and became a venture capitalist.

One of his notable early investments was Facebook (now Meta Platforms), where he was the first outside investor. He also helped launch data analytics company Palantir Technologies.

I bring these details up to help paint a picture of Thiel as a generational technology-sector savant. His track record for spotting disruptive technologies early is hard to rival. Against that backdrop, Thiel’s contrarian opinion around Bitcoin‘s upside (BTC 0.83%) might surprise you.

Let’s explore what Thiel has to say about Bitcoin and assess if the billionaire investor’s concerns are valid.

Today’s Change

(-0.83%) $-884.80

Current Price

$105169.00

Key Data Points

Market Cap

$2097B

Day’s Range

$104768.00 – $107357.00

52wk Range

$74604.47 – $126079.89

Volume

70B

Avg Vol

0

Gross Margin

0.00%

Dividend Yield

N/A

What is Bitcoin, and why is it important?

Back in 2008, an anonymous figure using the pseudonym Satoshi Nakamoto authored the Bitcoin Whitepaper. In that work, Nakamoto argued that the legacy financial system was archaic and inefficient due to its reliance on intermediaries to verify and process transactions.

These inefficiencies inspired Nakamoto to introduce the idea of Bitcoin as a completely decentralized digital payments network. His premise was that by putting control into the hands of individuals rather than big banks and corporations, Bitcoin could pave the way to a revolutionary peer-to-peer monetary system in a digital era.

Initially, the theoretical idea of Bitcoin and decentralized finance (DeFi) drew significant interest from Thiel. However, during a discussion at the Aspen Ideas Festival last June, Thiel changed his tune.

Image source: Getty Images.

Why is Thiel skeptical of Bitcoin’s upside?

Thiel explained that his connections in law enforcement — namely, at the FBI — told him that they prefer to know whether a suspect is conducting transactions in Bitcoin rather than fiat currencies. Such an admission reveals a startling and sobering reality: Using cryptocurrency as a means of payment may not be as decentralized or untraceable as most enthusiasts believe.

In other words, a combination of blockchain analytics and more stringent regulatory protocols could temper Bitcoin’s capacity to be a truly independent and autonomous force in the financial world.

Later in the discussion, Thiel grew more critical of the cryptocurrency when he spoke about the rise of spot Bitcoin ETFs. He seemed to cast doubt over Bitcoin’s upside, largely due to its rising acceptance among large financial institutions.

This is actually a rather unusual take. Many Bitcoin maximalists see its adoption across corporate treasuries and the exploration of sovereign nations building strategic Bitcoin reserves as pillars supporting the asset’s long-term potential.

Thiel seems to distance himself from this philosophy. The billionaire had some choice words about the rise of Bitcoin ETFs, proclaiming that the cryptocurrency was becoming “co-opted” by BlackRock — which offers one of the most popular spot Bitcoin funds, the iShares Bitcoin Trust.

My interpretation of this sentiment is that Thiel thinks a growing portion of Bitcoin’s ownership is flowing toward large institutions as opposed to individuals. In other words, institutional and regulated products offered by banks may shift power and influence into their hands over time — compressing the upside for direct holders of Bitcoin.

In this way, the entire thesis around the need for Bitcoin and its decentralized structure becomes dampened.

Is Thiel right about Bitcoin?

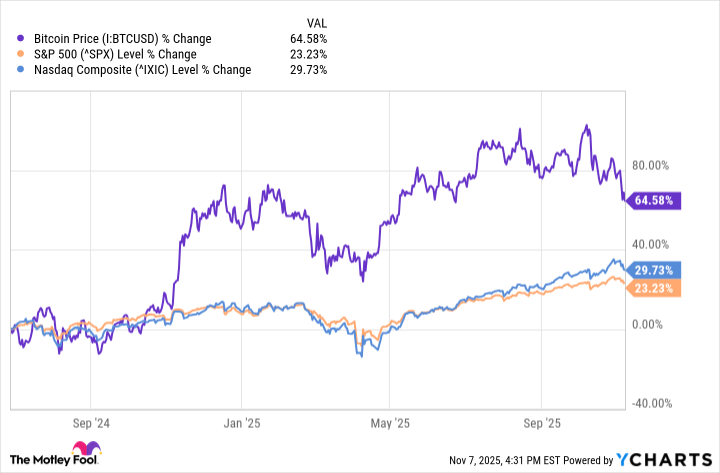

Since Thiel offered that skeptical take on Bitcoin, the cryptocurrency has risen by 64% — handily outperforming both the S&P 500 (^GSPC +1.54%) and Nasdaq Composite (^IXIC +2.27%).

Bitcoin Price data by YCharts.

In my view, Thiel’s commentary is interesting, but I see his concerns as more philosophical than concretely pointing to structural weaknesses in Bitcoin. Given the dynamics illustrated above, it would appear that the markets have largely ignored Thiel’s rhetoric, at least so far.

Despite its unprecedented gains, Bitcoin is still not a mainstream payments solution within the global financial ecosystem — and there is no guarantee that it ever will be. With that in mind, it is entirely possible that Thiel’s assertion that Bitcoin’s long-term upside is limited will eventually prove to be true.

All told, I think that investing in Bitcoin is best reserved for investors who can handle unusually high volatility without flinching. If that description doesn’t fit you, then cryptocurrency stocks such as Coinbase or Robinhood Markets, or an ETF that has a meaningful fraction of its weight in crypto sector players, would probably be more appropriate ways for you to gain some portfolio exposure to Bitcoin.