The digital asset market is currently navigating a period of intense structural realignment. As of February 4, 2026, Bitcoin (BTC) is trading at around $73,350, reflecting a modest 24-hour decline of over 1.50%

Although Bitcoin’s price is moving slowly right now, two main trends are shaping the market. First, there is a cautious mood as AI changes the tech sector. Second, more institutional-level Bitcoin infrastructure is emerging.

The “Morning Bid” Effect: AI Winners and Losers

Reuters’ latest “Morning Bid” notes that the AI boom is becoming more selective. Anthropic’s new AI “agents” have shaken up the software and data services industries, as investors start to see which companies will benefit from AI and which could be replaced.

Software giants like Microsoft and AMD have faced recent ups and downs, even with strong earnings. Meanwhile, Walmart became the first retailer to reach a $1 trillion market value, showing that traditional companies using AI to cut costs are now favored by the market.

This uncertainty has made Bitcoin’s market slow, and the asset is having trouble gaining strength after reaching its lowest point since before the 2024 US election.

Bitcoin (BTC/USD) Technical Analysis: Navigating the “Three Black Crows”

Bitcoin price prediction seems bearish as BTC’s technical indicators show the market is going through a needed correction. The weekly chart shows a “Three Black Crows” candlestick pattern, which points to ongoing selling pressure.

Key Technical Levels to Watch:

- Support: The 200-week Exponential Moving Average (EMA) near $68,400 remains the critical floor.

- Resistance: A reclamation of the $83,598 level (the previous support-turned-resistance) is required to invalidate the current bearish bias.

- Momentum: The RSI (Relative Strength Index) is around 30, which means the market is oversold. This could mean a bounce is coming, but experienced traders want to see RSI divergence before calling a bottom.

RWA and DeFi: The Fundamental Bull Case

Even though Bitcoin’s price is flat in the short term, its uses are growing quickly. Mercado Bitcoin, a top digital asset company in Latin America, has issued over $20 million in tokenized private credit on the Rootstock Bitcoin sidechain and aims for $100 million by April. This helps connect traditional private debt with Bitcoin-backed liquidity.

At the same time, Fireblocks announced it will add the Stacks layer to bring institutional-level DeFi to Bitcoin.

This change cuts transaction times to about 29 seconds, much faster than Bitcoin’s usual 10-minute blocks, and lets institutions use BTC for lending and earning yield. Right now, about $5.5 billion is locked in Bitcoin DeFi, providing a strong base for the next phase of growth.

2026 Forecast: The Road to Recovery

The “Path Tool” on the chart suggests a period of re-accumulation between $68,000 and $72,000 for the remainder of Q1. If Bitcoin can maintain its position above the 200-week EMA, a double bottom could act as the springboard for a move back toward $83,000 and eventually a rally toward psychological resistance at $100,000.

For long-term investors, the current drop is a “quantum-ready” transition. As AI keeps changing traditional software, Bitcoin’s appeal as a decentralized and independent settlement system is growing.

The combination of RWA tokenization and faster DeFi shows that even though prices are calm now, the groundwork for the next bull run is quietly being put in place.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

d for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

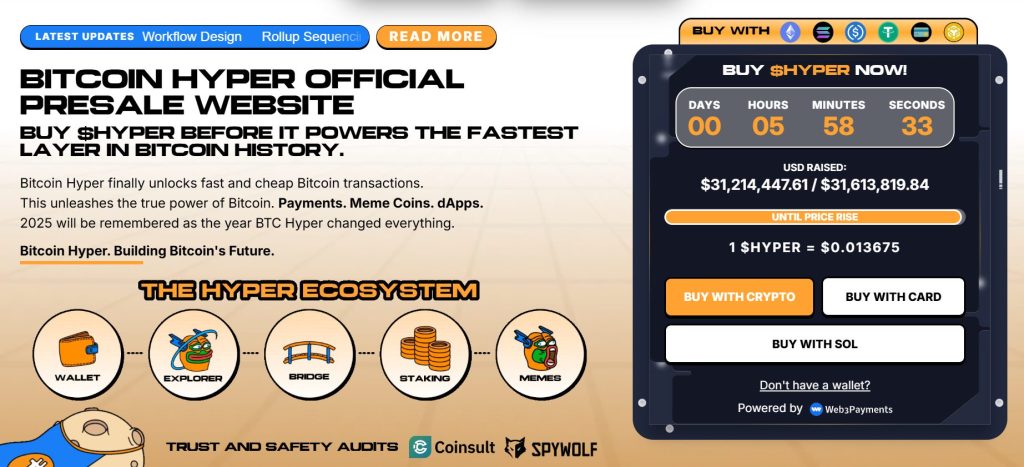

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $31.2 million, with tokens priced at just $0.013675 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale