Key Notes

- BlackRock absorbed over $1 billion in Bitcoin and Ether in three days.

- The largest buys hit near $90K BTC.

- Accumulation is visible, but breakout confirmation depends on BTC holding $90K.

BlackRock added 9,619 Bitcoin

BTC

$91 084

24h volatility:

0.2%

Market cap:

$1.82 T

Vol. 24h:

$48.52 B

worth about $878 million and 46,851 Ether

ETH

$3 110

24h volatility:

1.7%

Market cap:

$375.59 B

Vol. 24h:

$24.72 B

worth about $149 million across three straight days.

The combined total stands near $1.03 billion, based on on-chain tracking from LookOnChain. The buys hit during market weakness, not during a breakout, which matters.

On January 6 alone, BlackRock picked up 3,948 Bitcoin worth about $371.9 million and 31,737 Ether worth about $100.2 million.

This flow dominated early-2026 ETF activity and marked the largest single-day intake of the year so far.

BlackRock has been accumulating $BTC and $ETH for 3 consecutive days, with a total of 9,619 $BTC($878M) and 46,851 $ETH($149M). pic.twitter.com/80IYyvPfM4

— Lookonchain (@lookonchain) January 8, 2026

At the time of writing, Bitcoin is trading near $90,212 and ETH near $3,118 at press time, both lower on the day. While BTC’s trading volume fell 24%, Ether’s dropped 19%.

It is important to note that during the holiday period, BlackRock moved 1,134 Bitcoin and 7,255 Ether to Coinbase Prime.

The transfers raised sell-off concerns, but price action stayed heavy rather than sharp

ETF Flows Meet a Reset Market

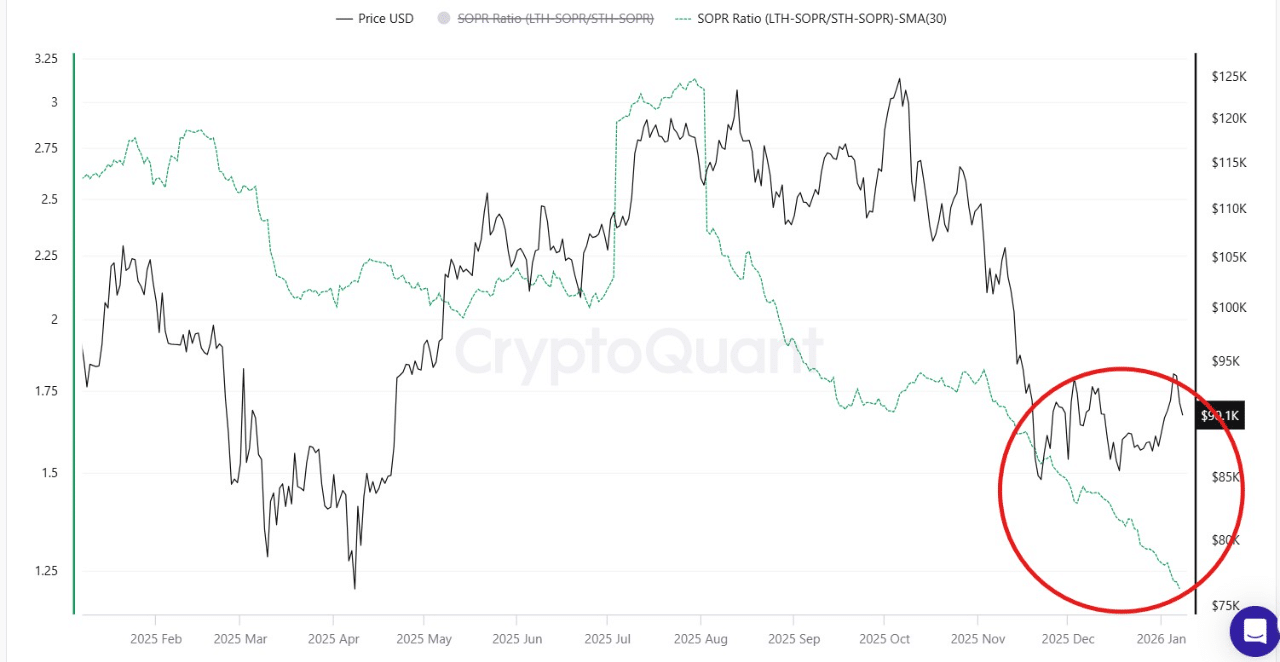

Bitcoin entered 2026 after a sharp pullback from the $110,000-$120,000 zone to the low $90,000s. On-chain data from CryptoQuant shows the SOPR ratio near exhaustion levels seen in prior resets.

Short-term holders locked losses through December, while long-term holders kept profit without heavy selling. This pattern often marks a transfer from weak hands to strong balance sheets.

Bitcoin SOPR Ratio. | Source: CryptoQuant

A hold above the current $90K zone keeps $100,000-$110,000 in play. A break below $88,000 opens risk toward $80,000.

Glassnode data shows a cleaner structure after year-end positioning washed out. More than 45% of options open interest cleared.

Futures interest has now turned higher while ETF flows have reappeared after late-2025 exits.

“The early-January breakout thus reflects a market that had effectively reset its profit-taking pressure, allowing the price to move higher,” Glassnode noted.

For now, Bitcoin support sits near $90,000. Overhead supply caps move between $95,000 and $104,000.

With options flow now favoring calls and volatility dropping near cycle lows, Glassnode painted an optimistic picture for the near future.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

A crypto journalist with over 5 years of experience in the industry, Parth has worked with major media outlets in the crypto and finance world, gathering experience and expertise in the space after surviving bear and bull markets over the years. Parth is also an author of 4 self-published books.