- There’s increasing analysts’ consensus that BTC’s recovery could extend to $70K.

- However, the recent BTC bounce was preceded by over-leverage–a potential price risk.

According to Glassnode founders Jan Happel and Yann Allemann, Bitcoin [BTC] was in a great position to retest $70K. The duo, who go by Negentropic on X, warned that speculators eyeing to short the crypto at $68K or $69K could be severely liquidated.

‘Shorts eyeing this long-term #Bitcoin compression range will be liquidated when the $68k to $69k level is surpassed…’

The marked compression channel was part of the megaphone pattern chalked as BTC continued consolidating following the new high hit in March.

Why BTC could rally to $70K

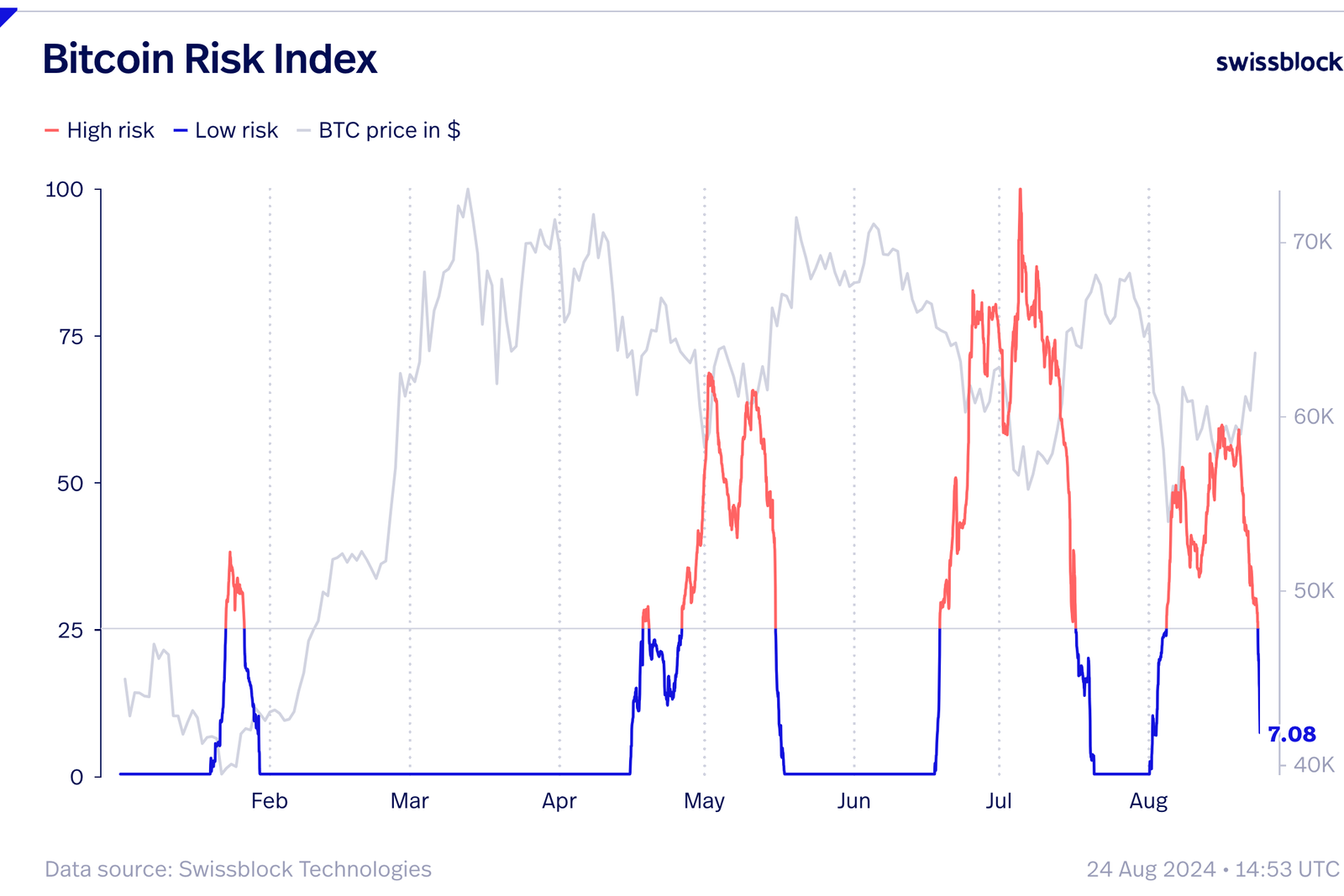

According to Glassnode founders, through their crypto insights platform Swissblock, BTC could hit $70K because of current low-risk levels and an uptick in network activity.

The founders also noted that BTC’s rally to $64K flipped the asset’s risk profile from high to low.

Interestingly, the May, June, and July recoveries happened after the asset flashed a low-risk profile. Hence, the trend might repeat and tip the crypto to $70K.

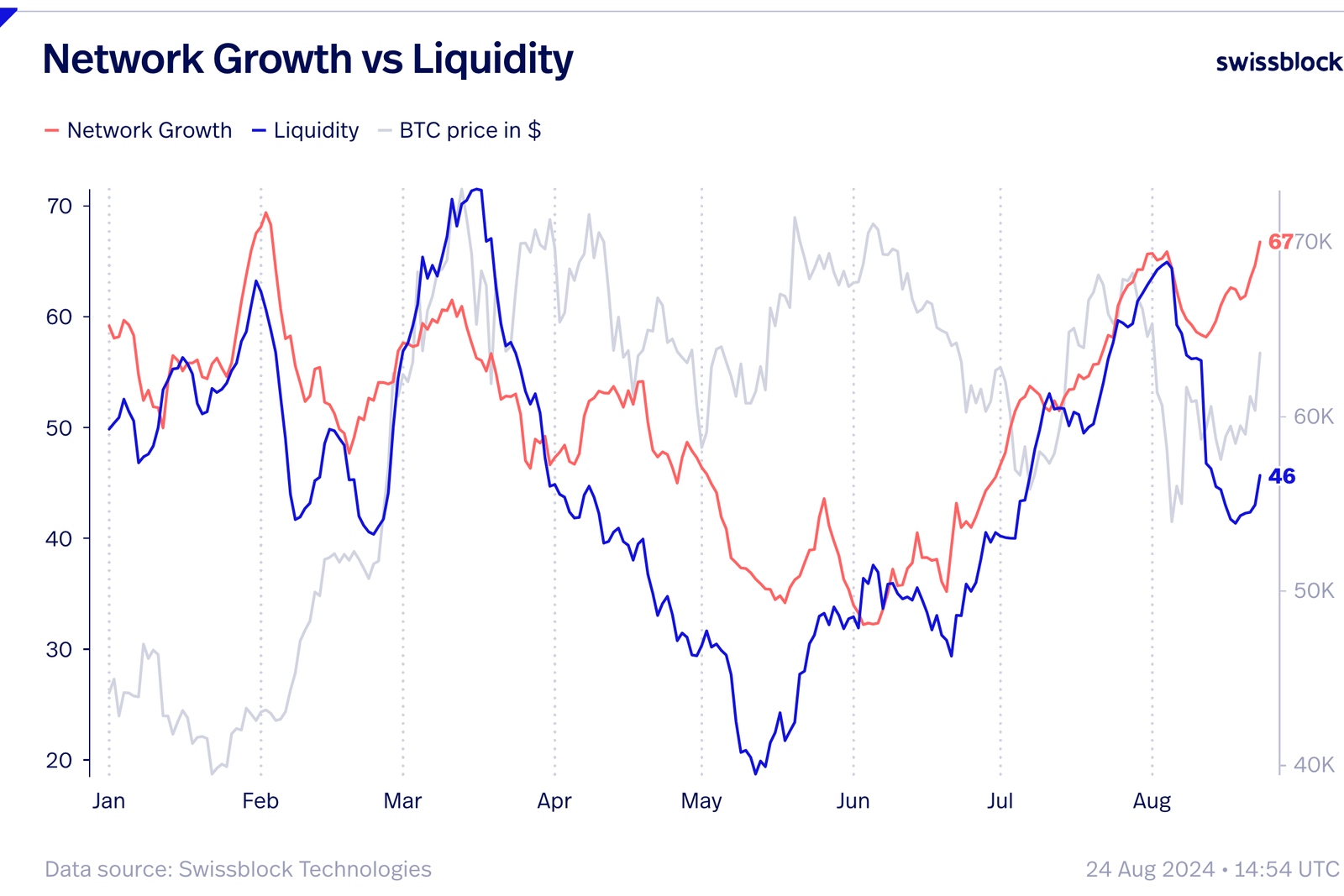

Additionally, Swissblock cited an improved Bitcoin network growth that could confirm the sustainability of the uptrend.

‘The network growth is resuming its upward trajectory and even challenged the highs seen in July, where we not only witnessed notable growth but also the breaking of a downward movement that had occurred post-halving.’

Network liquidity lagged growth, but the analytic platform highlighted signs of slow improvement that could boost BTC.

Besides, the negative funding rates in BTC perpetual markets could accelerate the recovery, per Swissblock.

‘The funding rates of perpetual futures have not only remained negative since our last reading but have also increased in magnitude: Highly unusual for times of bullishness. This positioning is such that it may fuel an even stronger rise in case of their liquidations.’

The low BTC funding rates were linked to the dominance of US spot BTC ETFs, which have a greater price impact than derivative markets.

Additionally, Swissblock speculated that recent BTC staking in the Babylon staking platform could have led to the negative funding rates.

VanEck recently shared the same recovery outlook, citing a similar risk appetite for BTC seen in previous market recoveries.

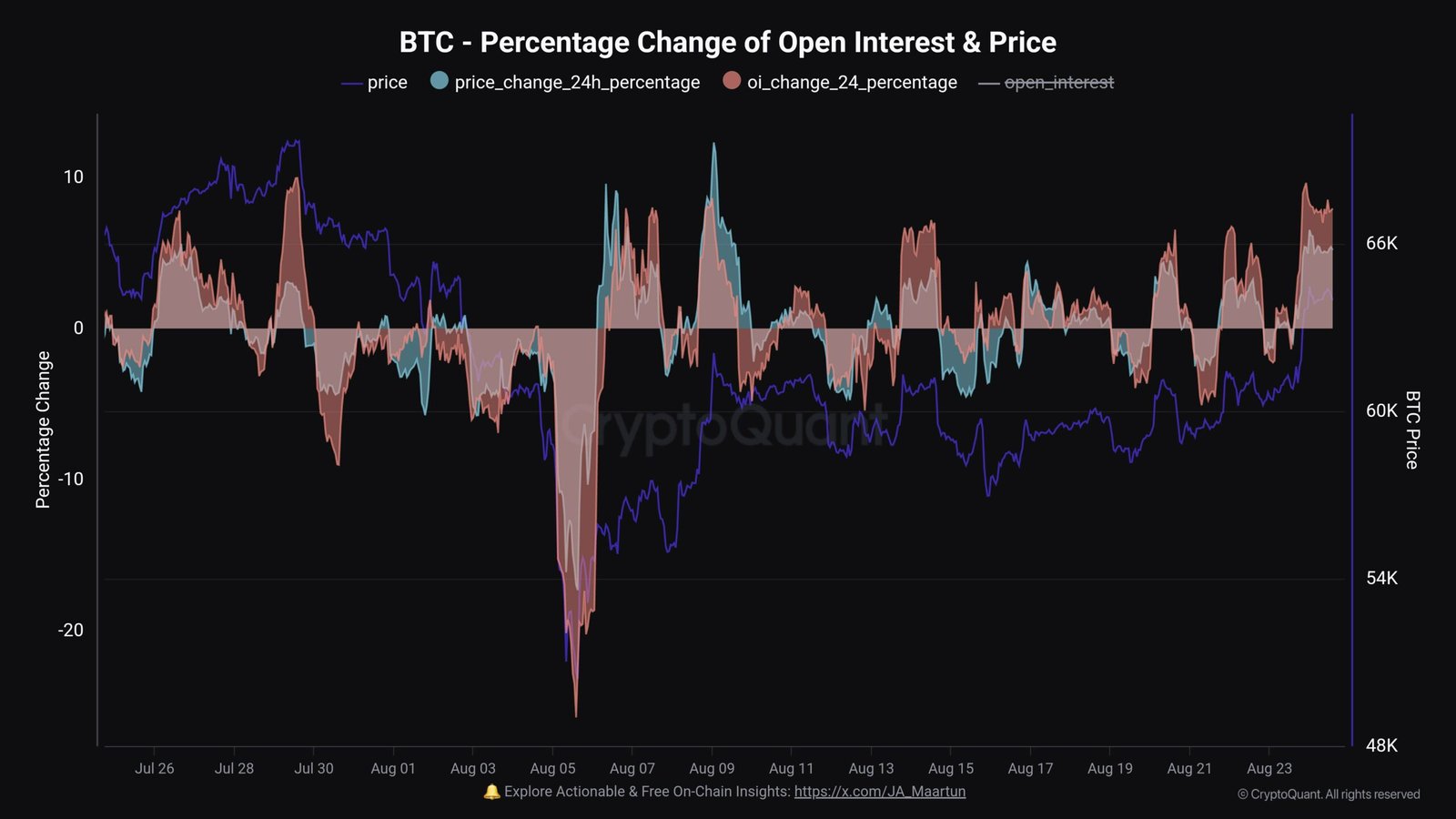

However, a CryptoQuant analyst cautioned that over-leverage (Open Interest rates) was driving BTC’s price, which could trigger a price reversal as seen in past trends.

‘Same setup again? Open Interest increased harder than the Bitcoin price. Last two time, it was a quick win.’