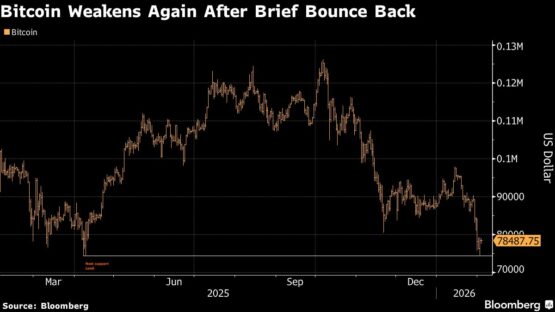

Bitcoin remained under pressure Tuesday, stalling after a brief rebound from a 10-month low as trader caution persisted in options activity.

Trading was mostly flat by early afternoon in Singapore, with the original cryptocurrency hovering below $78 500 a day after bearish sentiment nearly pushed it to the lowest level since US President Donald Trump returned to the White House just over a year ago.

Put options — contracts that protect against downside risk — have eased, but strike price concentrations show the market has not shaken off its jitters. The highest concentrations of put options indicate buy-side support at $75 000, making it a key support level, according to Deribit data. The token dropped as low as $74 541 on Monday before recovering. The next key support level is $70 000.

ADVERTISEMENT

CONTINUE READING BELOW

“The BTC options market is showing signs of stabilizing as extreme downside fear begins to mean-revert,” said Sean McNulty, APAC derivatives trading lead at FalconX. “However, a weekly close below $75,000 would invalidate the current bounce higher, and potentially open a vacuum toward that $69 000 to $70 000 zone.”

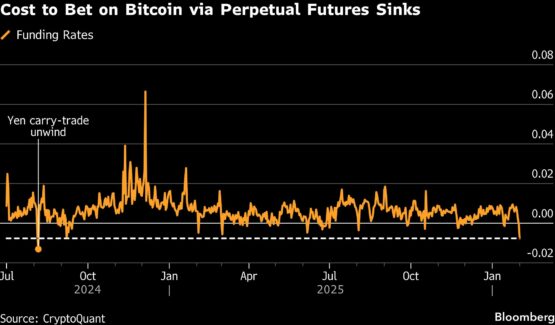

Bitcoin perpetual futures — derivatives that do not expire and make up the bulk of crypto trading volume — also signal a more pessimistic mood in the market. Funding rates, which help keep the contracts’ prices aligned with Bitcoin, have turned negative, falling to their lowest level since the August 2024 unwind of the yen carry trade, according to CryptoQuant data. When rates turn negative, short sellers make up the majority of the market and pay those holding long positions to keep their trades open.

ADVERTISEMENT:

CONTINUE READING BELOW

Bitcoin was up as much as 0.83% in early Asia trading on Tuesday, breaking past $79 100 before giving up those gains. The cryptocurrency’s implied volatility index remained elevated at around 48.8, similar to Monday’s level, according to charting platform TradingView.

“Turnaround Tuesday seems to be in effect,” said Jeff Anderson, head of Asia at STS Digital. “Markets got over their skis selling risk assets, and now that everyone has calmed down a bit, things rally off the lows.”

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.