Bitcoin extended its corrective phase, trading around $87,575, with the BTC to PKR rate hovering near ₨24.3 million, as on-chain data showed a fresh wave of selling by long-term holders. The move highlights shifting market dynamics after months of elevated prices.

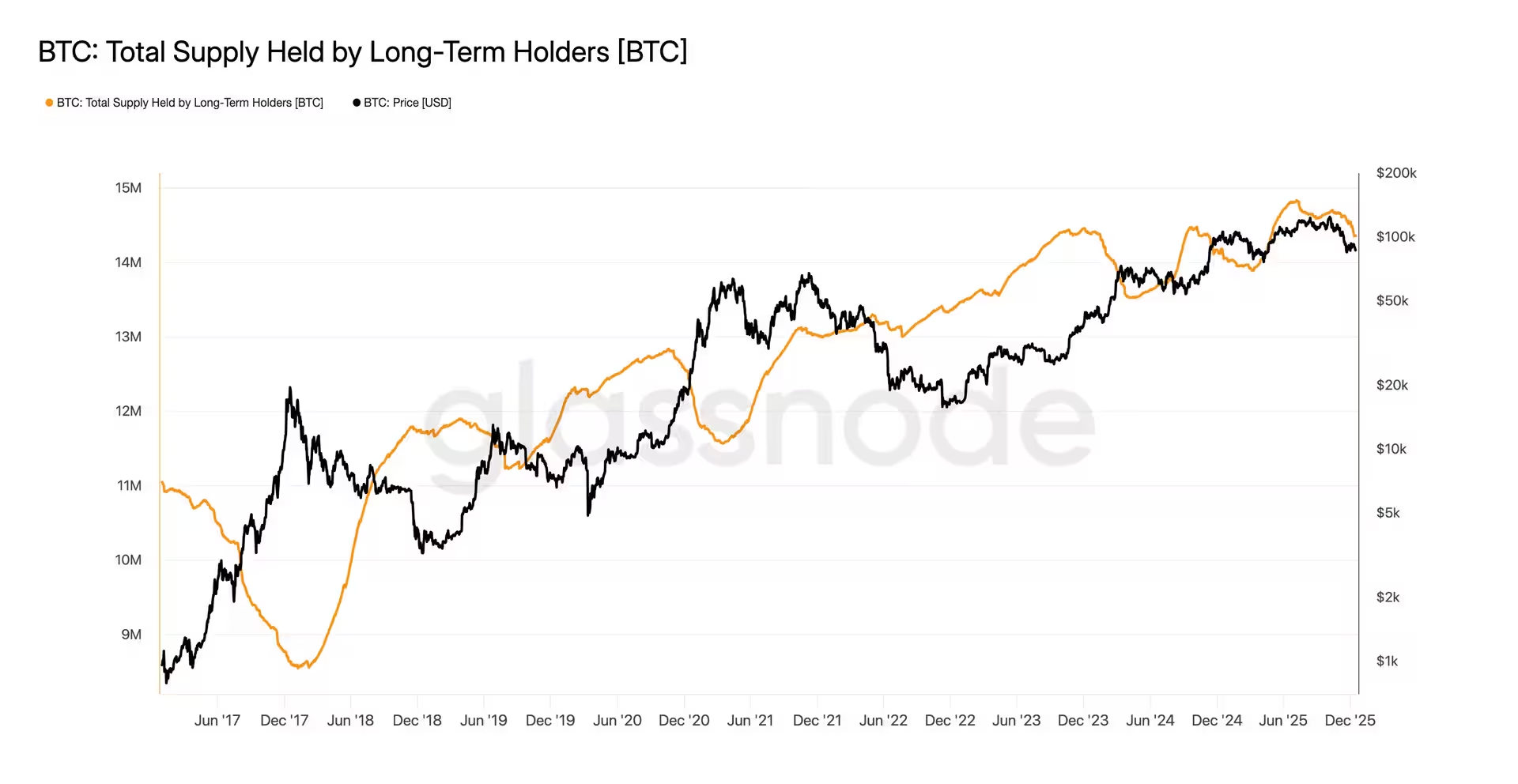

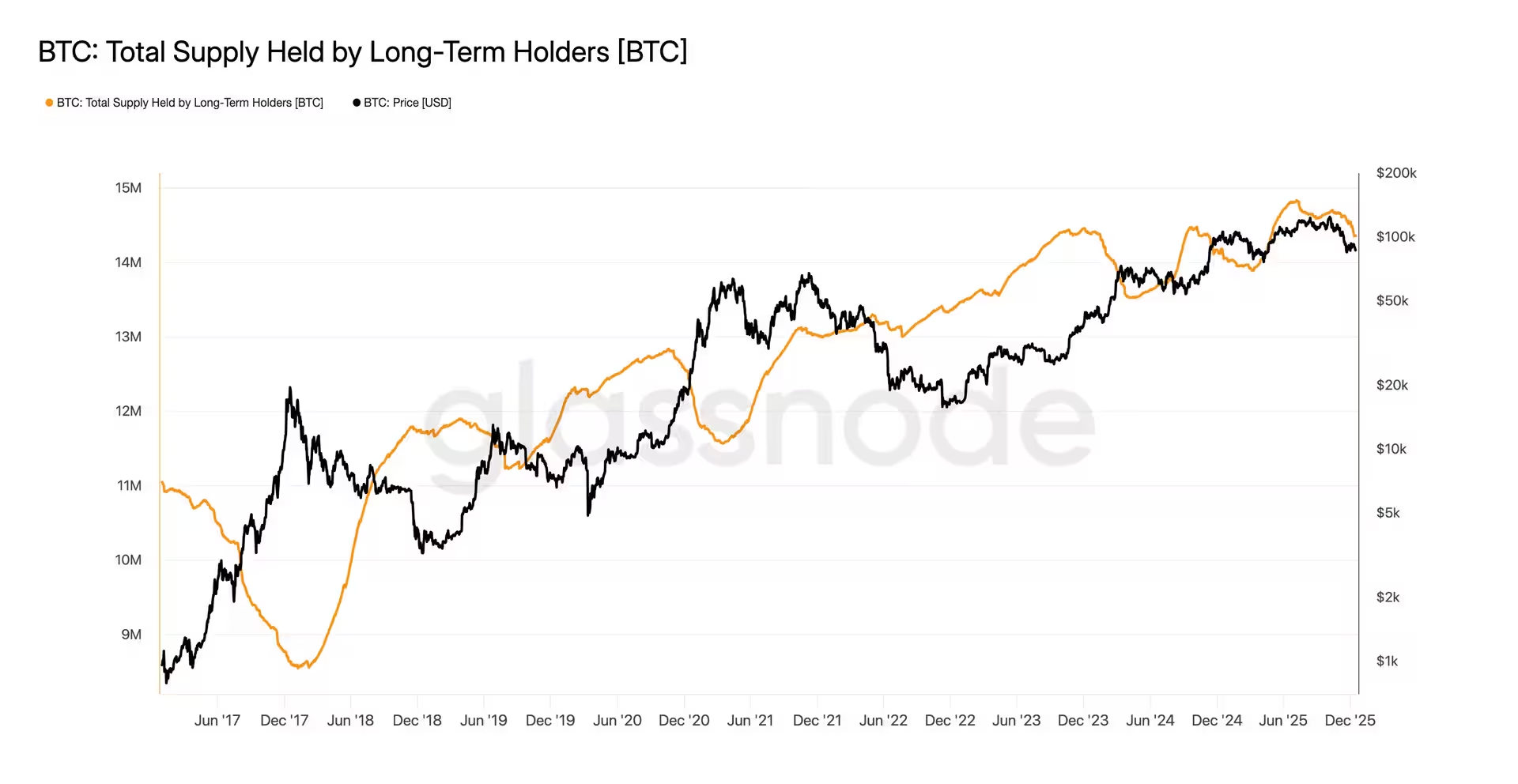

According to Glassnode data, Bitcoin’s long-term holder (LTH) supply has dropped to about 14.34 million BTC, the lowest level in nearly eight months and a level last seen in May. Long-term holders are defined as investors who have held Bitcoin for at least 155 days, placing the current cohort cutoff around mid-July. The decline in supply coincides with Bitcoin falling almost 40 percent from its October all-time high.

Analysts say this is the third wave of LTH distribution in the current cycle. The first wave followed the launch of U.S. spot Bitcoin ETFs, when prices surged from around $25,000 to nearly $73,000. A second wave emerged as Bitcoin rallied toward the $100,000 mark after optimism linked to President Donald Trump’s election victory. The market is now witnessing a third round of selling, even as prices had remained elevated for much of the year.

Blockchain analysts note that unlike previous bull markets, which typically saw a single blow-off distribution phase, this cycle is marked by multiple sell waves that the market has so far absorbed. Commenting on the trend, an on-chain analyst said,

“Long-term holder spending this cycle is unlike anything seen in recent history, yet demand continues to absorb the pressure.”

Outlook for Bitcoin

LTH distribution remains one of the largest sources of sell-side pressure in Bitcoin and has played a key role in the ongoing correction. Market participants are now watching whether prices stabilize at current levels or face further downside before renewed accumulation begins.