The bitcoin price experienced several intraday spikes on Wednesday, swinging by several thousand dollars as traders reacted to shifting geopolitical headlines and fresh comments from U.S. President Donald Trump.

The world’s largest cryptocurrency started the day near $88,000 before surging above $90,000 in early trading. The rally proved short-lived, however, with bitcoin sliding back into the upper $87,000 range after markets opened and dipped. Prices then roared higher once again, rebounding toward $90,000 after Trump announced a delay to planned trade tariffs.

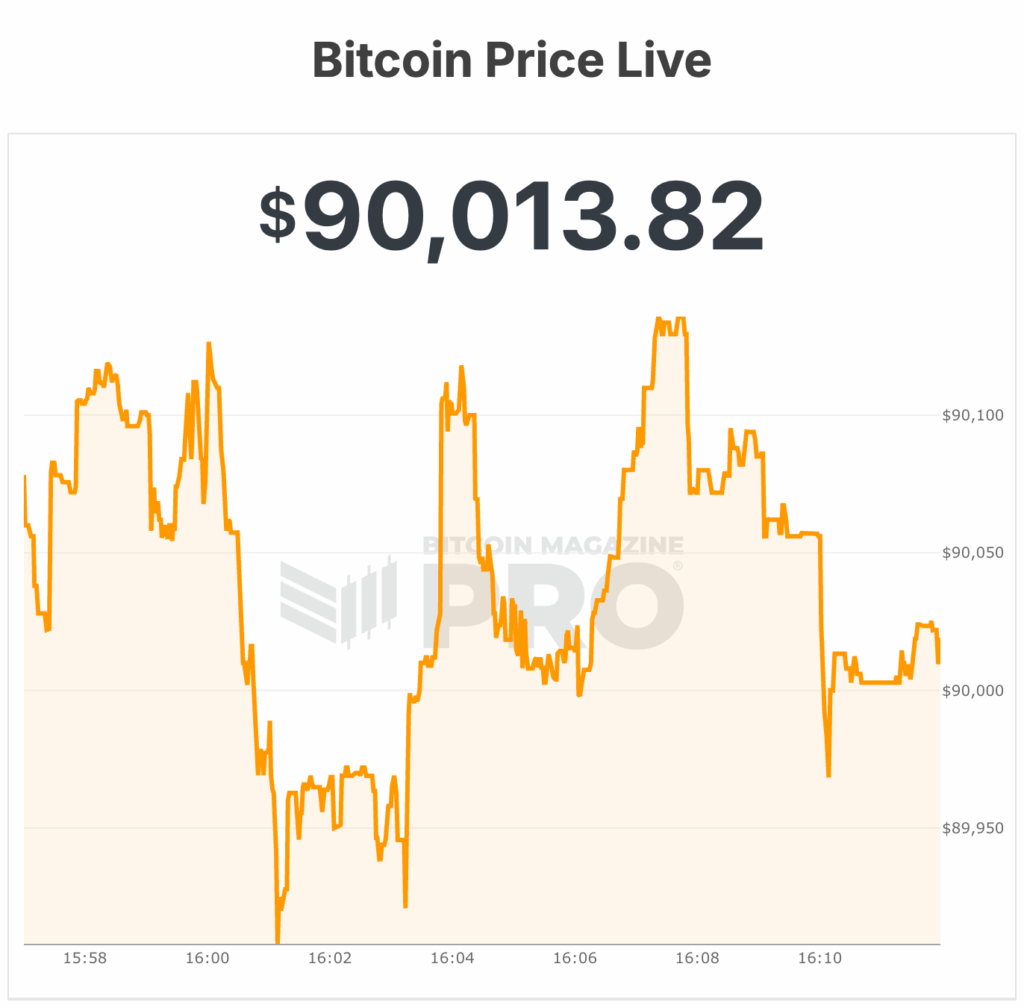

Bitcoin price was last trading around $90,000 at the time of writing, having briefly reclaimed the level for the second time in the same session.

Trump comments spark bitcoin price rally

The latest move followed comments from Trump at the World Economic Forum in Davos, Switzerland, and a subsequent post on his Truth Social platform.

Trump said he would delay tariffs that were scheduled to take effect on February 1 after what he described as a “very productive meeting” with NATO Secretary General Mark Rutte.

In the post, Trump outlined a preliminary framework for a broader agreement involving Greenland and the Arctic region, calling the potential deal “a great one for the United States of America, and all NATO nations.” He added that, based on the discussions, the planned tariffs would not move forward.

Markets responded positively to the news. U.S. equities bounced sharply, with the S&P 500, Nasdaq and Dow Jones Industrial Average all rising roughly 1.5% on the day.

Risk assets across the board followed suit, lifting the bitcoin price and other major cryptocurrencies back toward recent highs.

During his Davos remarks, Trump also reiterated his support for digital assets, saying he hopes to sign comprehensive crypto market structure legislation “very soon.”

“Now, Congress is working very hard on crypto market structure legislation — Bitcoin, all of them — which I hope to sign very soon, unlocking new pathways for Americans to reach financial freedom,” Trump said.

Bitcoin price analysis as macro risks linger

Despite the relief rally, macroeconomic concerns remain in the background. Analysts have pointed to renewed stress in Japan’s bond market as a potential headwind for global risk assets.

Japan’s 10-year government bond yield has climbed to around 2.29%, a level not seen since 1999. QCP Capital highlighted in a note that Japan’s government debt exceeds 240% of GDP, with debt servicing costs projected to consume roughly a quarter of fiscal spending by 2026.

According to Bitcoin Magazine analysis, the bitcoin price held its bullish structure above $90,000 last week, rallying to $98,000 and closing around $93,600, keeping a mildly bullish bias.

Bulls will want the bitcoin price to reclaim $94,000 and retest $98,000 this week, with a sustained break potentially reaching $103,500 and the $106,000–$109,000 resistance zone.

Key support is at $91,400, with a loss possibly leading to a deeper pullback toward $87,000 or $84,000.

While momentum has improved, the $103,500–$109,000 area is expected to be strong resistance, where rejection could decide whether the rally continues or drops toward sub-$80,000 levels.

Wednesday’s dramatic price action proved costly for leveraged crypto traders. According to CoinGlass data, more than $1 billion in crypto positions were liquidated over the past 24 hours as prices whipsawed higher and lower and then higher.

Long positions bore the brunt of the damage, accounting for approximately $672 million in liquidations, while short positions made up about $335 million.

Bitcoin led the losses with roughly $426 million in liquidations, followed by Ethereum at around $366 million.

Currently, the bitcoin price is trading at $90,019 with a 24-hour volume of $67 B, holding steady over the past day. Its market cap stands at $1.798 T, just below its 7-day high of $90,296 and above the 7-day low of $87,304.