Bitcoin price fell sharply over the past 36 hours, sliding more than 5% over that time and briefly dipping below $90,000 early Tuesday as macroeconomic uncertainty and renewed scrutiny of corporate bitcoin treasuries weighed on the market.

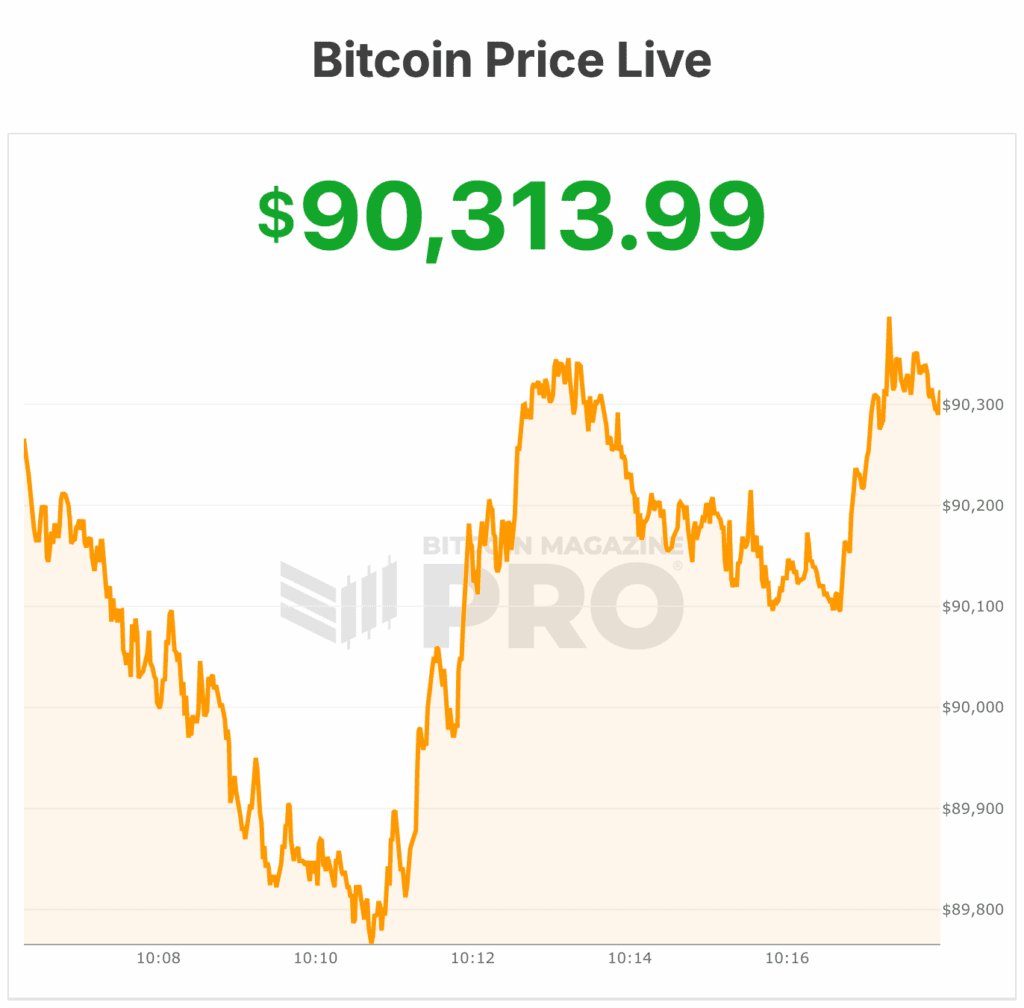

The world’s largest cryptocurrency was trading near $95,500 on Sunday night but fell to around $89,800 by Tuesday morning, extending losses that began with a violent sell-off late Saturday and into Sunday evening and Monday morning.

The move erased nearly $5,700 from bitcoin’s price in less than two days, according to Bitcoin Magazine Pro data.

The initial leg lower came Sunday night, when the bitcoin price plunged nearly $4,000 in a two-hour window amid heavy selling across crypto markets.

Around 6 p.m. EST, a wave of liquidation-driven selling hit derivatives markets, wiping out more than $500 million in leveraged long positions in roughly an hour, with total crypto long liquidations topping $525 million during the period.

Tariff drama

The sell-off coincided with heightened macro uncertainty after U.S. President Donald Trump announced plans to impose sweeping new tariffs on European nations beginning February 1.

Under the proposal, a 10% tariff would apply to goods from eight countries — Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands and Finland — rising to 25% by June 1 if no agreement is reached.

Trump tied the measures to U.S. efforts to secure Greenland, further escalating transatlantic tensions.

European leaders pushed back strongly, warning the tariff threats could trigger a “dangerous downward spiral.”

All this is happening as gold surges to a new all-time high near $4,750, underscoring a flight toward traditional safe-haven assets as risk markets sold off. This flight hasn’t been reflected in the bitcoin price.

Adding to uncertainty, the U.S. Supreme Court is expected to rule on whether Trump had the authority to impose broad tariffs under emergency powers.

The case centers on the use of the International Emergency Economic Powers Act (IEEPA) to declare trade deficits a national emergency.

A ruling against the administration could force the government to refund more than $100 billion in tariffs already collected, potentially disrupting budget and defense funding assumptions.

Corporations affecting the bitcoin price

On-chain data shows GameStop allegedly transferring a total of 2,396 BTC to Coinbase Prime in January, including 100 BTC on Jan. 17 and 2,296 BTC on Jan. 20.

The transfers represent roughly 51% of the company’s original 4,710 BTC holdings, sparking speculation that the meme-stock retailer may be preparing to sell part of its bitcoin position.

GameStop added bitcoin to its corporate treasury in mid-2025, purchasing 4,710 BTC during a brief window in May at an average price near $106,000 per coin.

While transfers to brokerage wallets are often interpreted as potential selling signals, the company has made no official announcement confirming a sale.

In contrast, Strategy (MSTR), the world’s largest publicly traded corporate bitcoin holder, continued to buy aggressively last week.

The company disclosed the purchase of 22,305 BTC for approximately $2.13 billion at an average price of $95,284 per bitcoin. As of Jan. 19, Strategy holds 709,715 BTC acquired at an average price of $75,979, representing more than 3% of bitcoin’s circulating supply.

Despite the accumulation, Strategy shares fell about 7% in early trading as the bitcoin price slid below $90,000, highlighting the growing sensitivity of bitcoin-exposed equities to short-term price moves.

The bitcoin price is trading at $90,252, down 3% over the past 24 hours on $45 billion in volume, leaving it about 3% below its seven-day high of $93,302.

The network’s market capitalization stands at roughly $1.8 trillion, with 19.98 million BTC in circulation out of a capped supply of 21 million.