The bitcoin price climbed back above $70,000 on Saturday, rebounding from a sharp drawdown earlier this month as cooler-than-expected U.S. inflation data helped revive risk appetite across markets. The recovery comes after a brutal stretch that saw billions in realized losses and persistent signs of investor anxiety.

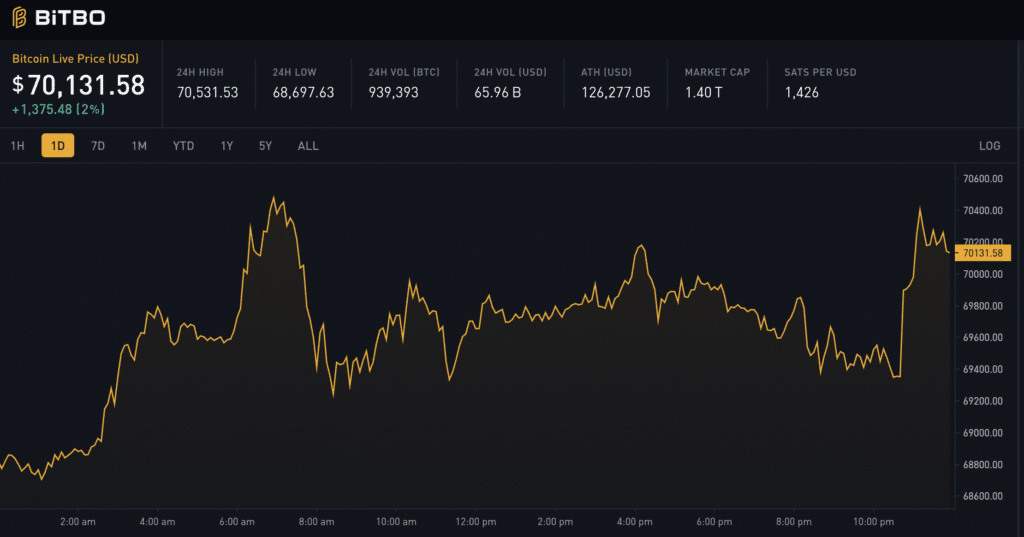

Bitcoin was trading around $70,215 at press time, up roughly 2% over the past 24 hours, with daily volume near $43 billion. The move leaves the bitcoin price sitting just below its seven-day high of $70,434, according to market data, and pushes its global market capitalization back above $1.4 trillion.

The latest upside followed January’s Consumer Price Index report, which showed inflation rising 2.4% year-over-year, slightly under the 2.5% forecast. The softer print strengthened expectations that the Federal Reserve could begin cutting rates sooner than previously anticipated, a shift that typically benefits higher-beta assets like cryptocurrencies.

Prediction markets reflected the change in sentiment. Traders on Kalshi increased the implied odds of an April rate cut to 23%, while Polymarket pricing also moved higher over the week.

Bitcoin price analysis and related equities

The rebound in bitcoin price into the weekend also spilled into crypto-linked equities. On Friday, Coinbase (COIN) surged 18% and Strategy (MSTR) jumped 10% as investors rotated back into digital-asset exposure.

The move came even as Coinbase continues to navigate a difficult earnings backdrop, including a $666.7 million Q4 2025 loss tied to weaker trading revenue.

Strategy, meanwhile, remained closely tethered to bitcoin’s volatility, while reaffirming its long-term treasury approach. The company disclosed another bitcoin purchase of more than 1,100 BTC this week and posted a steep quarterly loss driven largely by mark-to-market declines on its holdings, underscoring the balance-sheet risks of its aggressive positioning.

It’s been a rough couple of months for the bitcoin price, with Bitcoin sliding sharply from its October peak above $120,000 into the mid-$60,000 range after an extended multi-month downturn.

The sell-off intensified in early February when BTC broke below the key $70,000 psychological level

Research firm K33 suggested the plunge toward $60,000 may have marked a “local bottom,” pointing to capitulation-like conditions in volume, funding rates, options positioning, and ETF flows.

Still, the rally has not erased the deeper unease lingering beneath the surface. The Crypto Fear & Greed Index remains stuck in “extreme fear,” levels last associated with the 2022 bear market and the collapse of major industry players.