- Bitcoin price breaks above the consolidation zone between $57,000 and $62,000, signaling an impending rally ahead.

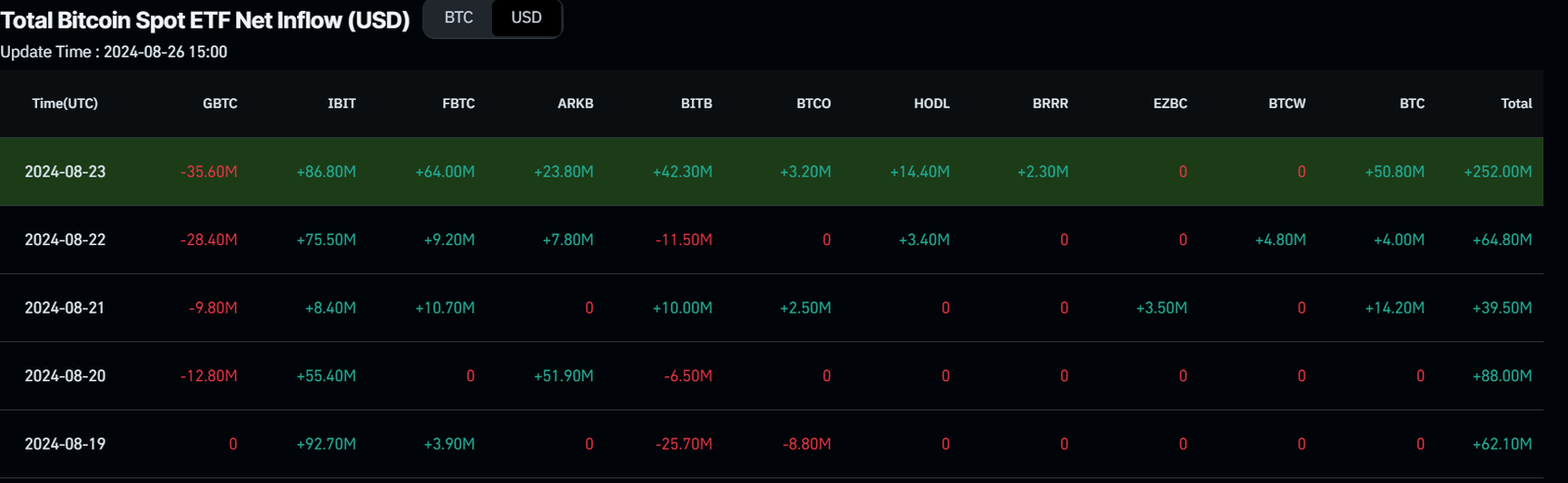

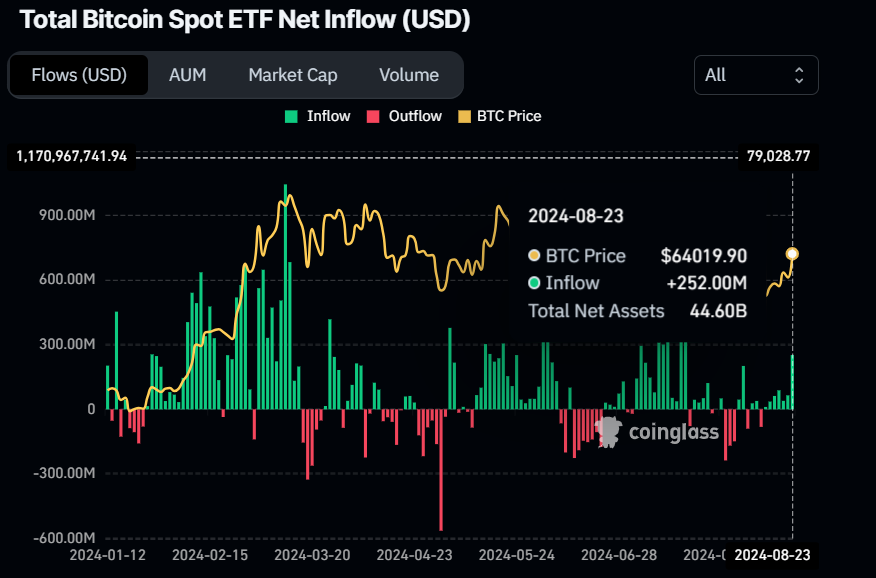

- US spot Bitcoin ETFs recorded net inflows of $506.40 million last week.

- On-chain data shows positive funding rates and a decreasing Miners Position Index, further giving chances for a bullish move.

Bitcoin’s (BTC) price clings to gains on Monday after rising 10% last week and closing above $64,000. BTC price rallied on Friday, driven by Federal Reserve (Fed) Chairman Jerome Powell’s confirmation that an interest-rate cut in the US is coming in September. This positive market sentiment led US spot Bitcoin ETFs to register net inflows of more than $500 million last week, while on-chain data such as the decreasing Miners Position Index and positive funding rates suggest a bullish outlook.

Daily digest market movers: Powell supports Bitcoin

- Fed Chair Jerome Powell opened the door on Friday to an interest-rate cut in the US after the central bank’s next policy meeting scheduled for September 17-18. Lower interest rates tend to support risk assets such as cryptocurrencies. Expectations of lower rates propelled Bitcoin price to a high of $64,955 on Friday, a level that broadly held up during the weekend.

- Coinglass’s US spot Bitcoin ETFs data shows that on Friday, it recorded an inflow of $252 million, the highest single-day inflow since July 22. Monitoring these ETFs’ net flow data is crucial for understanding market dynamics and investor sentiment. The combined Bitcoin reserves held by the 11 US spot Bitcoin ETFs stand at $44.60 billion.

Bitcoin Spot ETF Net Inflow chart

- Cryptoquant’s Miners Position Index (MPI), which is the ratio of the number of miners’ outflows in USD divided by the 365-day moving average, presents a bullish price outlook for Bitcoin. If the metric increases, miners become more active in selling, increasing the selling pressure and thereby decreasing Bitcoin’s price. On the contrary, a decrease in the index suggests miners are becoming less involved in selling. In BTC’s case, the metric decreases from -0.63 to -1.46 from Friday to Monday, suggesting less selling pressure.

-638602714311797502.png)

Bitcoin Miners Position Index chart

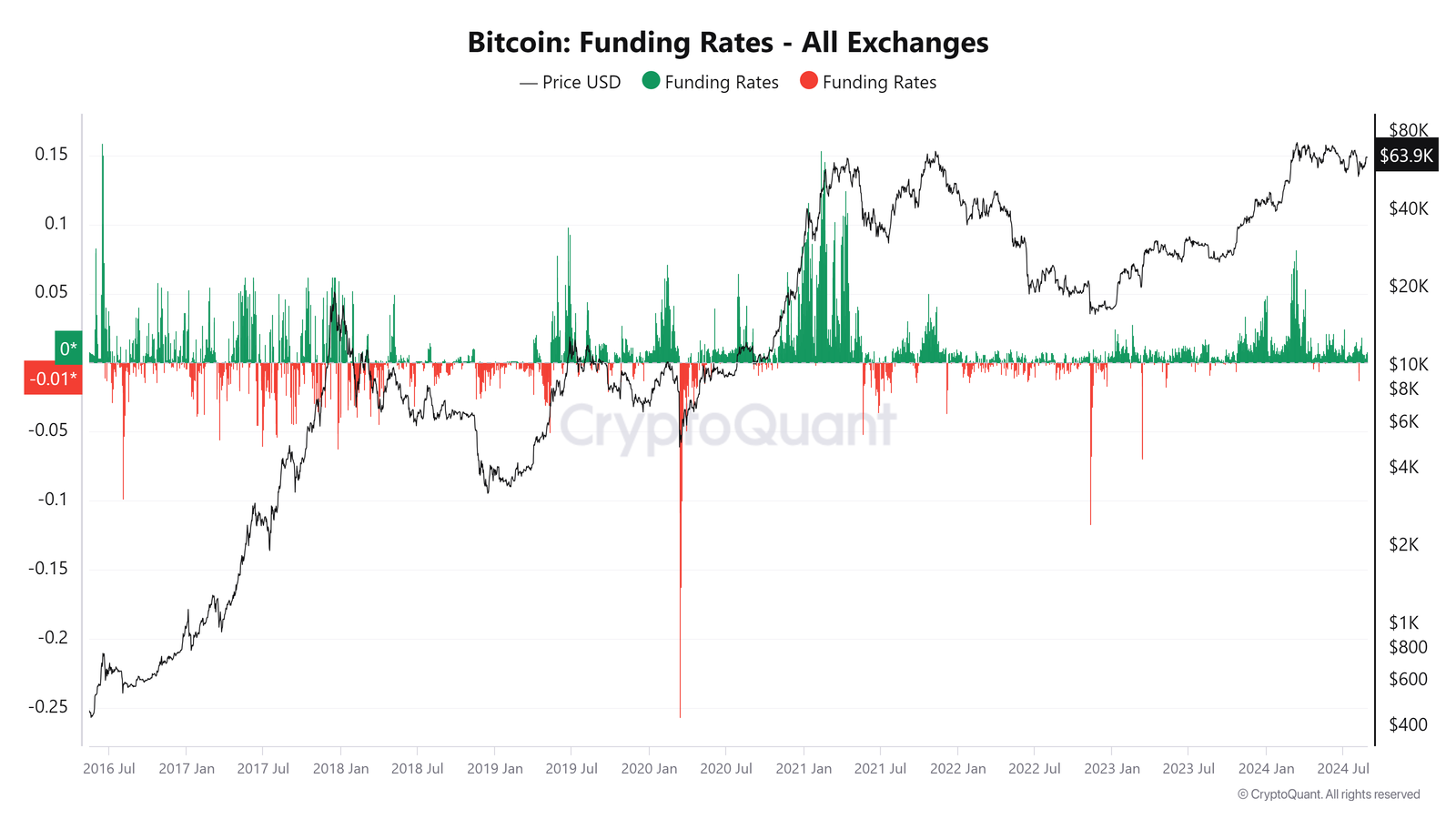

- CryptoQuant’s funding rates, a key indicator gauging futures market sentiment, is also positive for Bitcoin’s price outlook. Funding rates represent traders’ sentiments in the perpetual swaps market and are proportional to the number of contracts. Positive funding rates indicate that long-position traders are dominant, while negative funding rates indicate that short-position traders are dominant and are willing to pay long traders. As for BTC’s case, the funding rates are positive and stand at 0.008, reflecting bullish sentiment and buyer dominance. t.

Bitcoin Funding rates chart

Technical analysis: BTC price breaks above the 200-day EMA

Bitcoin price broke above its resistance level, the 200-day Exponential Moving Average (EMA) at $62,280 and its 61.8% Fibonacci retracement level (drawn from the high on July 29 to the low on August 5) at $62,042 on Friday. At the time of writing on Monday, it is slightly down 0.3% at $64,021.

If the 200-day EMA at $62,280 holds as support and BTC closes above the $65,596 level, it could rally 7% to restest its July 29 high of $70,079.

This bounce is supported by indicators like the Relative Strength Index (RSI) and Awesome Oscillator (AO) on the daily chart, which sit comfortably above their respective mean levels of 50 and zero. These momentum indicators strongly indicate bullish dominance.

BTC/USDT daily chart

However, if Bitcoin’s price closes below the August 21 low of $58,783, a 5% decline towards daily support at $56,022 would be on the cards, as it would set a lower low on the daily chart. Thus invalidating the bullish thesis.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.