Digital asset investment products recorded $533 million in inflows last week, the largest in five weeks according to the latest CoinShares report.

This surge followed Federal Reserve Chairman Jerome Powell’s speech, signaling renewed investor confidence in the sector. Notably, Bitcoin led the charge with $543 million in inflows, while Ethereum saw outflows of $36 million.

Per CoinShares data, multi-asset funds attracted $20.3 million in inflows over the past week, bringing their month-to-date (MTD) inflows to $61.7 million and their year-to-date (YTD) inflows to $290 million.

With assets under management (AUM) for multi-asset funds standing at $4.339 billion, these funds continue to draw interest, signaling that investors remain keen on diversified exposure.

Meanwhile, Solana saw a slight inflow of $0.1 million during the week but faced significant MTD outflows of $34.3 million. Despite these short-term outflows, YTD figures for Solana remained positive, highlighting ongoing long-term support.

Mixed Trends in Crypto Assets

Litecoin experienced consistent inflows, recording $0.5 million in the last week and maintaining a steady YTD inflow of $35 million. Similarly, XRP saw moderate inflows of $0.3 million over the week, contributing to MTD inflows of $1.3 million and a YTD inflow of $22 million.

These figures suggest growing investor interest in alternative cryptocurrencies like Litecoin and XRP.

Conversely, BNB saw no change in weekly inflows, with MTD outflows of $1.2 million, showing mixed sentiment towards the asset.

Grayscale Trusts See Diverging Trends

A month after the launch of Ethereum ETFs, inflows totaled $3.1 billion. However, these gains were partially offset by outflows from the Grayscale Trust, which reported $189 million weekly outflows.

Other prominent funds, such as iShares and ProShares, saw weekly inflows of $346 million and $38 million, respectively. Meanwhile, CoinShares XBT continued to face challenges, recording outflows of $2 million over the week.

Global and Regional Flows

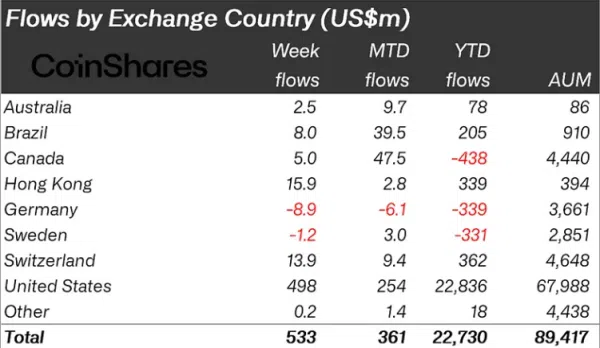

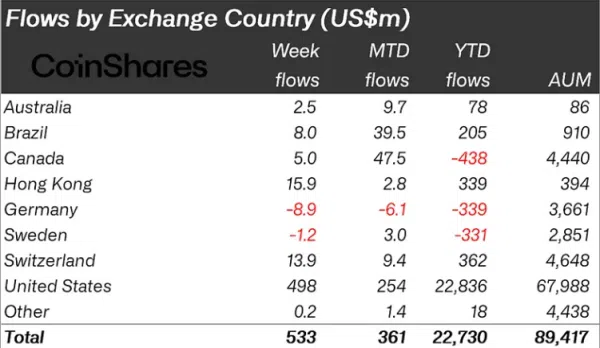

Regionally, the United States led the way, contributing $498 million of the total inflows, reflecting its dominant position in the digital asset market. Other regions, such as Hong Kong and Switzerland, also saw weekly inflows of $15.9 million and $13.9 million, respectively.

However, Germany posted minor weekly outflows of $8.9 million, contrasting with the generally positive global trend. Countries like Brazil and Canada showed moderate activity, with Brazil recording $8 million in inflows for the week, while Canada added $5 million.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.