Bitcoin extended its weekend slide on Sunday, dropping below $87,000 as a fresh wave of liquidations swept through the crypto market, wiping out roughly $200 million in leveraged positions over the past 60 minutes, per Coinglass data.

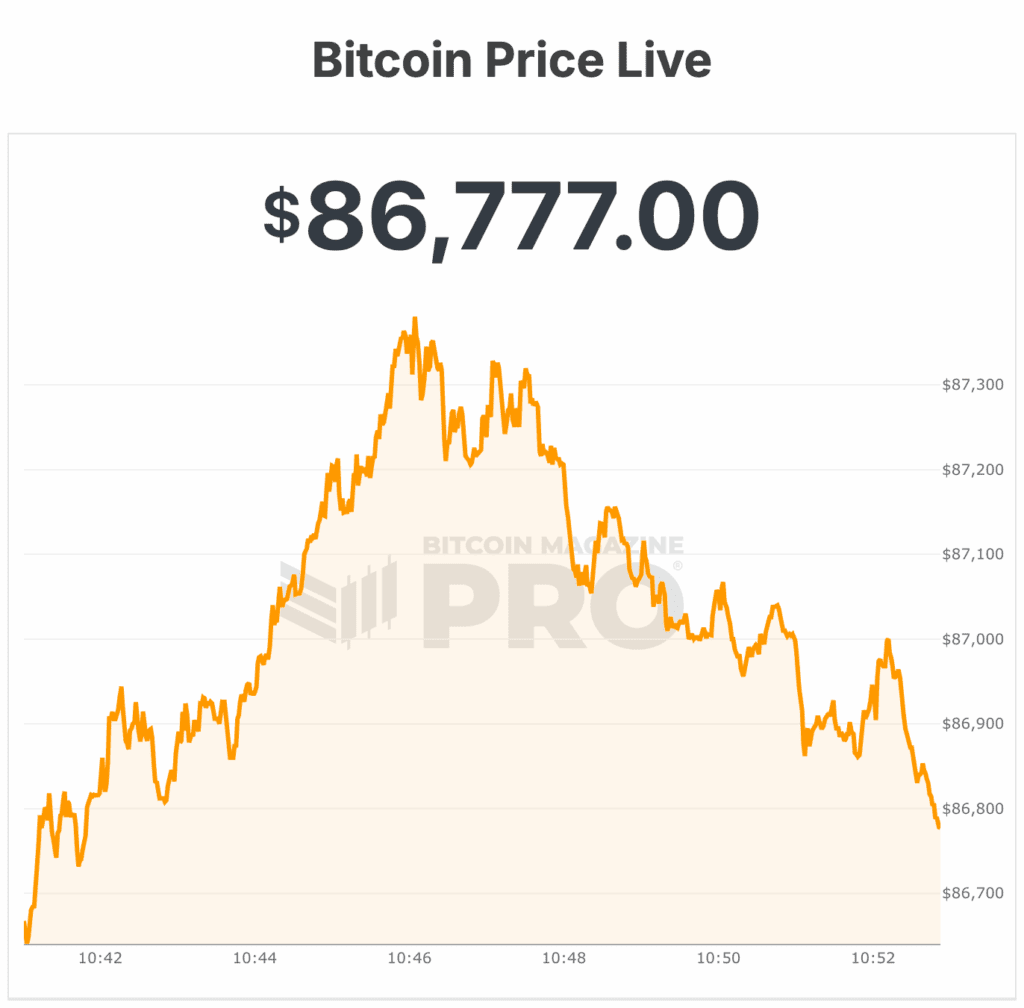

At the time of writing, the bitcoin price stood at $86,751, down about 2% over the past 24 hours, according to market data.

Trading volume totaled roughly $38 billion, while BTC was down 4% from its seven-day high near $89,935 and hovering just above its weekly low around $87,152.

BTC’s circulating supply currently sits at 19.96 million BTC, with a fixed maximum of 21 million, giving the network a market capitalization of approximately $1.73 trillion, down 2% on the day, according to Bitcoin Magazine Pro data.

The latest leg lower follows another grim weekend for price action. Bitcoin bled from the low-$92,000 range on Thursday to weekend lows near $87,000, as thin liquidity and persistent sell pressure weighed on risk appetite.

The decisive move below $90,000 occurred during typically illiquid Sunday trading, amplifying downside volatility as traders positioned cautiously ahead of a dense slate of U.S. economic data and central bank events this week.

Strategy buys $1 billion in Bitcoin

Strategy, the world’s largest publicly traded BTC holder, added nearly $1 billion in bitcoin last week, acquiring 10,645 BTC at an average price of $92,098 per coin.

This marks the company’s second consecutive mega-purchase, bringing its total holdings to 671,268 BTC, purchased for $50.33 billion at an average cost of $74,972 each.

The acquisition was primarily funded through equity issuance, with $888.2 million raised via common stock sales and the remainder through STRD preferred shares, despite ongoing shareholder concerns about dilution.

Historically, the company’s weekly purchases had been modest due to fundraising constraints, but Executive Chairman Michael Saylor has recently accelerated buying, signaling renewed conviction despite market volatility.

Separately, Strategy will also remain in the Nasdaq 100 and pushed back against MSCI’s proposed digital asset threshold, which could exclude BTC treasury firms from benchmarks.

Critics note Strategy now operates more like a bitcoin investment vehicle than a software company, yet Saylor remains unapologetic.

The firm reports a year-to-date BTC yield of 24.9%, underscoring its commitment to accumulating BTC regardless of short-term market fluctuations.

At the time of writing, Bitcoin is trading at $86,770.