Bitcoin, Ethereum (ETH), XRP price and the broader crypto market rebound as the Senate reaches a deal to end the longest-ever US government shutdown. Traders are bullish as Bitcoin price has bounced over the 50-week moving average, with sentiment for exchange-traded funds (ETFs) approval, including XRP ETFs, growing.

US Government Shutdown Ending as Senate Reaches Deal

The Senate votes 60-40 to advance a funding bill that would pave the way for ending the government shutdown. Democrats and Republicans reach a bipartisan agreement to advance a House-passed measure to end the government shutdown following 14 unsuccessful attempts.

The agreement was negotiated by eight Democratic Senators including Angus King, Jeanne Shaheen and Maggie Hassan. According to Fox News report, there were enough Democratic caucus members in favor of the deal.

Before the voting, US President Donald Trump said, “It looks like we’re getting close to the shutdown ending. You’ll know very soon.”

.@POTUS: “It looks like we’re getting close to the shutdown ending. You’ll know very soon.” pic.twitter.com/Qp2qR1DeaF

— Rapid Response 47 (@RapidResponse47) November 10, 2025

Spot Crypto ETF Floodgates Open as Government Shutdown Ends

The end of the prolonged US government shutdown will enable the Securities and Exchange Commission (SEC) to decide on pending crypto ETF approvals. Bitcoin, ETH, XRP and the broader crypto market crashed as the SEC missed final deadlines on multiple key ETFs.

ETF expert Nate Geraci spotlights on opening of crypto ETF floodgates now with the government shutdown ending. He added that the first spot XRP ETF under the 1933 Act will launch this week. As CoinGape reported earlier, Canary Capital XRP ETF updated its filing to launch on November 13.

Other issuers, including Bitwise, 21Shares, and Franklin Templeton, also updated their S-1 filings to become automatically effective amid the US government shutdown.

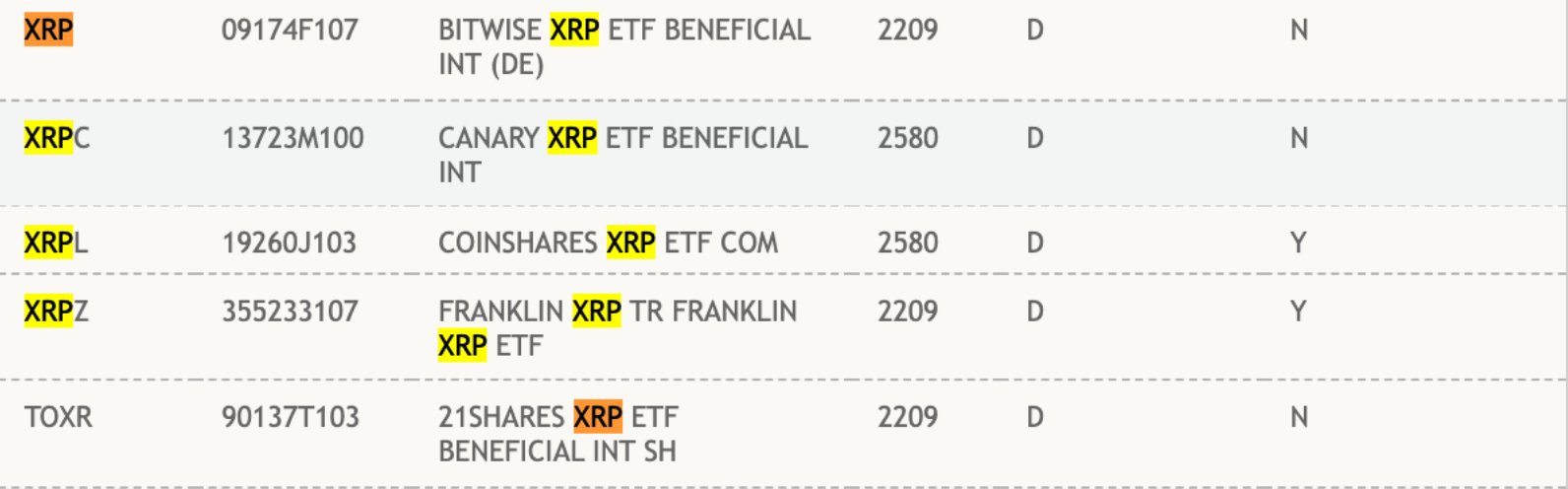

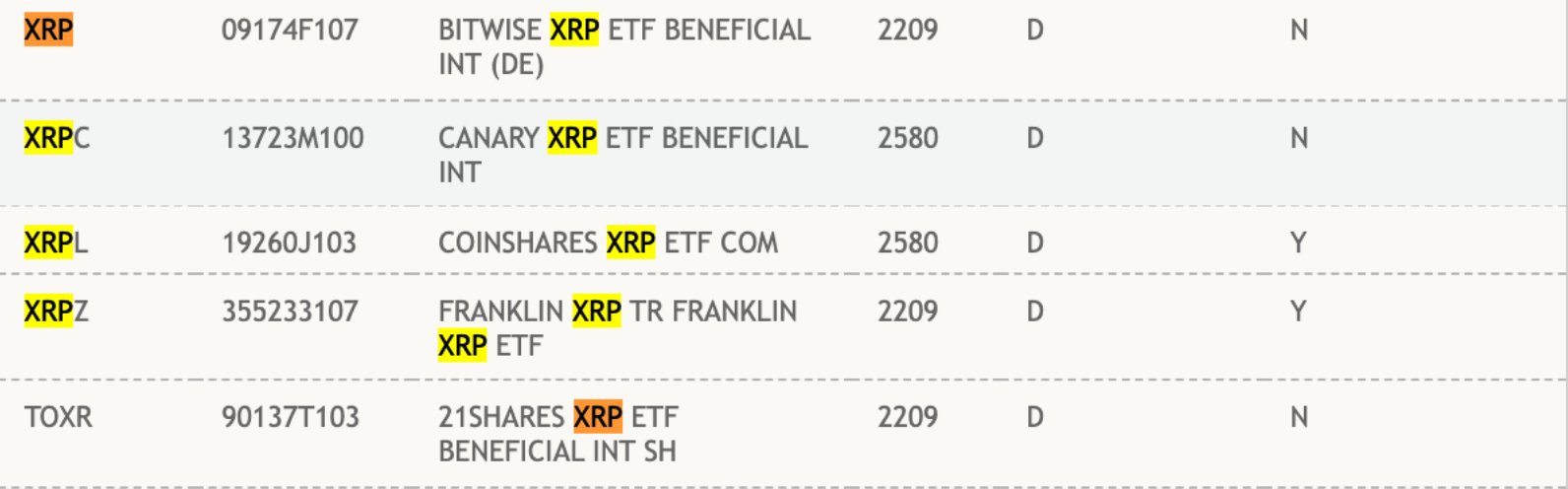

Meanwhile, five spot XRP ETFs from Franklin, Bitwise, 21Shares, Canary, and CoinShares have appeared on the DTCC website. The ticker symbols are XRPZ, XRP, TOXR, XRPC, and XRPL, respectively. The launch signals a big step for XRP adoption.

Bitcoin, ETH, XRP Price Recovery

Bitcoin, Ethereum (ETH), XRP and the broader crypto market saw a much-needed rebound. The global market cap bounces more than 4.50% to $3.57 trillion over the last 24 hours.

Bitcoin price reclaims $106,000, up more than 4% in the last 24 hours. The 24-hour low and high are $101,521 and 106,564, respectively. Nearly $700 million in Bitcoin open interest has been added since Trump’s dividend for Americans post. The funding rate is spiking, which means longs are entering.

ETH price jumped 7% in the last 24 hours, with the price currently trading at $3,622. The 24-hour low and high are $3,383 and $3,656, respectively.

Meanwhile, XRP price has jumped nearly 10% over the past 24 hours. Trading volume and futures open interest have spiked in the last 24 hours.