Spot Bitcoin exchange-traded funds (ETFs) are experiencing one of their strongest months since launching in January 2024, with inflows surpassing $3 billion so far in October.

This surge in demand has led ETF issuers to purchase Bitcoin at levels far exceeding the newly mined supply.

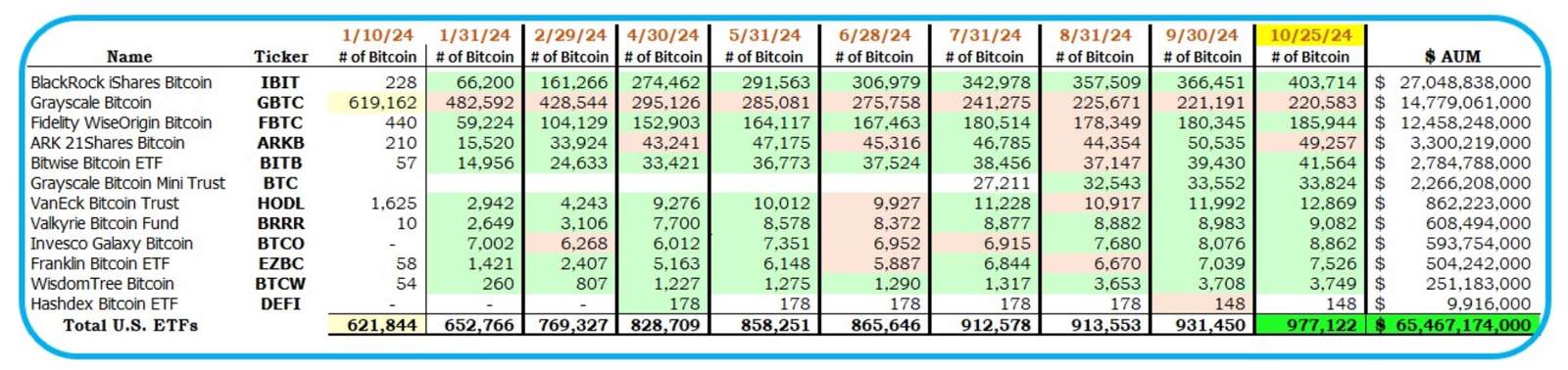

US Spot Bitcoin ETFs Amass 45,000 BTC in October

During the trading week of October 21-25, the 11 spot Bitcoin ETFs bought a combined 15,194 BTC, which is nearly five times the 3,150 BTC mined in that period, according to data from HODL15Capital. Inflows during this week totaled around $1.83 billion, reflecting the strong demand that has fueled unprecedented levels of BTC acquisition by ETF issuers.

“If you sold any Bitcoin today, this week, or this year, it’s been bought by the ETFs. Demand for U.S. Bitcoin ETFs far exceeds new supply, but weak hands willingly sell their BTC day after day, week after week,” HODL15Capital wrote.

Read more: What Is a Bitcoin ETF?

Since early October, these issuers have collectively purchased 45,557 BTC. This is the fourth-highest month for BTC acquisitions since spot ETFs received approval on January 10, 2024.

Meanwhile, aggressive buying has brought ETF issuers’ combined BTC holdings close to one million BTC. As of October 25, the Bitcoin ETF issuers collectively held 977,122 BTC — just 22,878 BTC short of the million-BTC threshold. BlackRock has the largest BTC reserve, holding approximately 403,714 BTC, which equates to nearly 2% of Bitcoin’s total supply.

Notably, if the ETFs’ current accumulation rate continues, their combined holdings could soon surpass that of Satoshi Nakamoto, the pseudonymous creator of the top asset.

“Not yet 10 months old and the ETFs are 97% of the way to holding 1 million BTC, and 87% of the way to passing Satoshi as biggest,” Bloomberg ETF analyts Eric Balchunas stated.

Read more: How to Invest in Ethereum ETFs?

Market observers have pointed out that with the ETF issuers now holding a substantial portion of BTC’s supply, their influence on market liquidity and price stability is likely to grow.

Indeed, as the ETFs continue accumulating the top asset, there may be greater volatility risk during periods of high inflows or outflows, particularly given the relatively fixed supply of BTC. Analysts caution that such concentration could lead to increased price sensitivity in response to market dynamics.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.