Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has dropped 4% in the last 24 hours to $89,427 as Michael Saylor’s company, Strategy, continues its aggressive accumulation of the cryptocurrency.

Last week, the company purchased 22,305 BTC for $2.13 billion, at an average price of $95,284 per coin, according to a U.S. Securities and Exchange Commission filing. This latest purchase brought Strategy’s total Bitcoin holdings to 709,715 BTC, bought for roughly $53.92 billion at an average cost of $75,979 per coin.

JUST IN: 🇺🇸 Michael Saylor’s STRATEGY now holds 709,715 bitcoin worth $64.5 BILLION

3.3% of the total supply 🔥 pic.twitter.com/00lCgEXZgn

— Bitcoin Archive (@BitcoinArchive) January 20, 2026

The company now holds about 3.37% of the total 21 million BTC supply and 3.55% of the 19.98 million currently in circulation, according to Blockchain.com. Strategy’s recent buying spree marks its largest Bitcoin acquisition since February 2025, when it purchased over 20,000 BTC for around $2 billion. Earlier this month, the company also bought 13,627 BTC ($1.3 billion), signaling a sharp acceleration in buying compared with most of last year.

Strategy Maintains Bitcoin Accumulation

The surge in purchases came amid Bitcoin briefly surpassing $97,000 and Strategy’s shares (MSTR) rising past $185, boosted further by Morgan Stanley Capital International’s (MSCI) decision not to exclude digital asset treasury companies from its market index.

Despite the recent price pullback, Strategy remains committed to its Bitcoin accumulation strategy. Analysts suggest that the market is now focusing on which digital asset treasury companies can survive through disciplined management and realistic expectations.

James Butterfill of CoinShares emphasized that long-term success depends on credible business models, disciplined treasury practices, and prudent handling of digital assets on corporate balance sheets. Strategy’s continued buying underscores Michael Saylor’s conviction that Bitcoin should remain a core part of corporate treasury strategy, even as volatility in cryptocurrency markets persists.

Bitcoin Tests Major Support Zone Near $85K

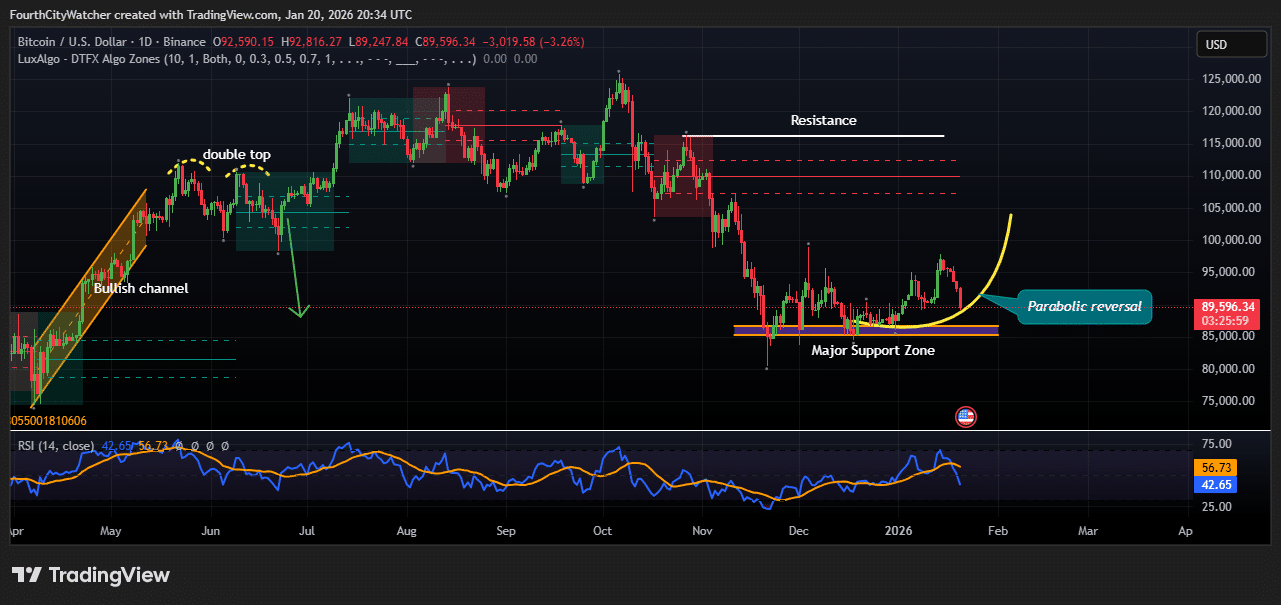

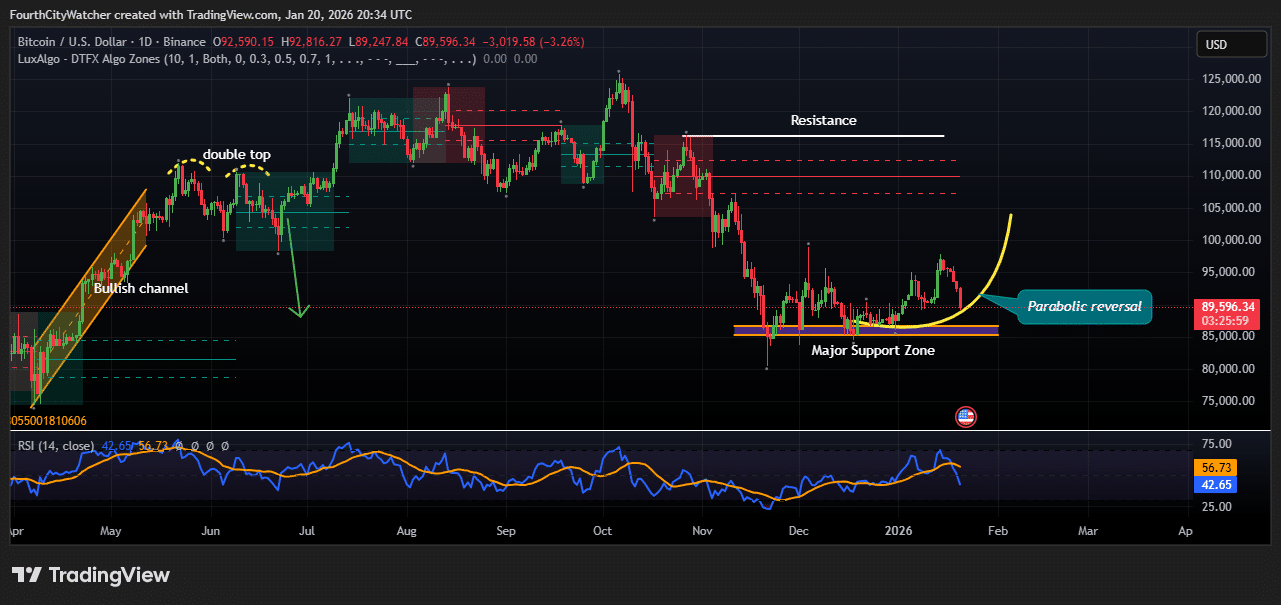

Bitcoin has pulled back to $89,596, marking a 3.26% drop in the past 24 hours, but technical indicators indicate a potential rebound may be forming. The daily chart shows Bitcoin currently hovering near a major support zone around $85,000–$87,000, which has historically acted as a strong floor for price declines.

Analysts are watching this level closely, as a bounce from here could trigger a parabolic reversal, pushing prices back toward $100,000. Earlier price action shows Bitcoin forming a bullish channel in April–May 2025, followed by a double top pattern in June, which led to a significant correction in the months that followed.

The market then entered a prolonged downtrend, facing repeated resistance levels near $115,000 and $110,000, which it failed to break multiple times. The repeated rejection at these highs reinforced selling pressure, while the support zone now serves as a key area for potential accumulation by investors.

BTCUSD Chart Analysis Source: Tradingview

The Relative Strength Index (RSI) is currently at 42.65, indicating that Bitcoin is neither oversold nor overbought but is approaching a level that often precedes upward momentum. Traders are likely monitoring RSI in combination with price action at the support zone to identify entry points for a potential bullish move.

If Bitcoin manages to hold above the support area and gains upward momentum, the chart suggests a parabolic recovery path toward previous resistance levels. However, failure to defend this zone could lead to further downside, potentially testing lower levels near $80,000. Overall, market sentiment remains cautious, with investors balancing optimism over a potential rebound with concerns over near-term volatility.

This technical setup highlights the ongoing tug-of-war between buyers and sellers, emphasizing that Bitcoin’s next major move will depend on how it reacts to the current support zone and whether it can reclaim momentum toward $100,000 and beyond.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage