The co-founders of the market intelligence firm Glassnode say that the same bullish signal that preceded Bitcoin (BTC)’s rallies in April is suddenly flashing again.

Jan Happel and Yann Alleman, who go by the pseudonym Negentropic, tell their 63,900 X followers that Bitcoin has entered “oversold” territory similar to April, when markets plummeted after Trump announced steep tariffs on countries around the world.

“We are currently as oversold as April 7th, the global bottom in 2025. Short euphoria is becoming greedy, and the boy that cried wolf on US regulation is being ignored. Maybe he is the catalyst that sends everything higher.”

The analysts say that macroeconomic conditions remain bullish for Bitcoin.

“It’s all about patience and not over-leveraging, fundamentals are still intact. Macro backdrop does not indicate a local top yet. We are getting closer to the final innings, but biggest moves are still ahead of us.”

The analysts also say that crowd sentiment is turning negative on Bitcoin, suggesting a local bottom is forming.

“We are nearly there, engines are warming up. I am seeing a lot of denial on our feed, exactly what is needed for the big melt up.”

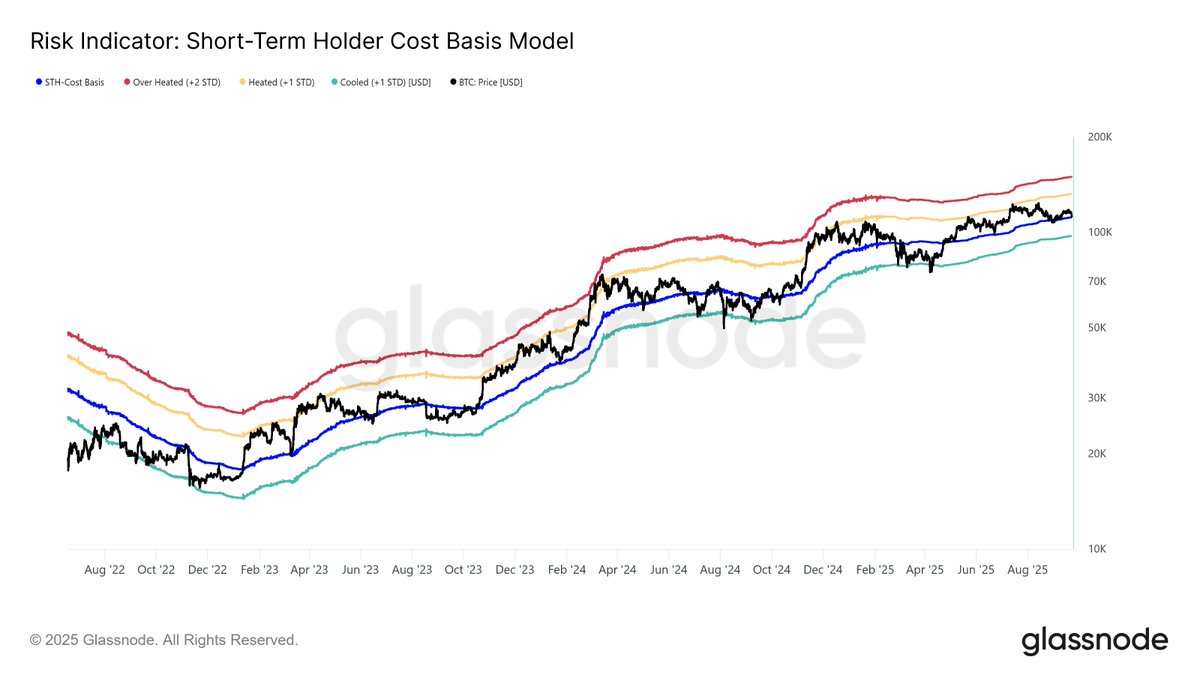

However, the analysts warn that the bullish trend may be invalidated if Bitcoin drops below $111,400 based on the short-term holder (STH) cost basis model.

The STH cost basis model is an on-chain metric that estimates the average price at which short-term Bitcoin holders acquired their coins. The metric can be used to spot potential entry and exit points.

“The short-term holder cost basis is often treated as the key battle line between bulls and bears, and currently sits at $111,400. Sustained trading below this level could signal a shift toward a mid- to long-term bearish market structure.”

Bitcoin is trading for $112,291 at time of writing, flat on the day.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney