New data from the crypto intelligence platform Swissblock reveals that Bitcoin (BTC) and altcoins are on the cusp of a reset phase that should have them seeing green.

In a new thread on X, Swissblock says the aggregated impulse technical indicator – or the measurement of the exponential price structure of the top 350 digital assets – shows that most assets are about to bottom out and reset.

“We’re in the reset phase. The last 7 times this signal triggered since 2024, it marked a major bottom. What happened next? BTC rallied +20-30%. Altcoins surged +50-150%.

We track this with the most accurate tops and bottoms signal in the market: Aggregated Impulse, by Altcoin Investor, It measures exponential price structure across the top 350 assets.”

Swissblock says the indicator shows 22% of altcoins are at a negative impulse, with bottoms usually forming when 15-25% of them are displaying a negative impulse. According to the crypto analytics platform, Ethereum (ETH) and alts tend to rise after the reset completes.

“What’s it telling us now? 22% of altcoins show negative impulse. Historically, bottoms form in the 15-25% zone. Once the reset completes, ETH and alts tend to lead the next rotation.”

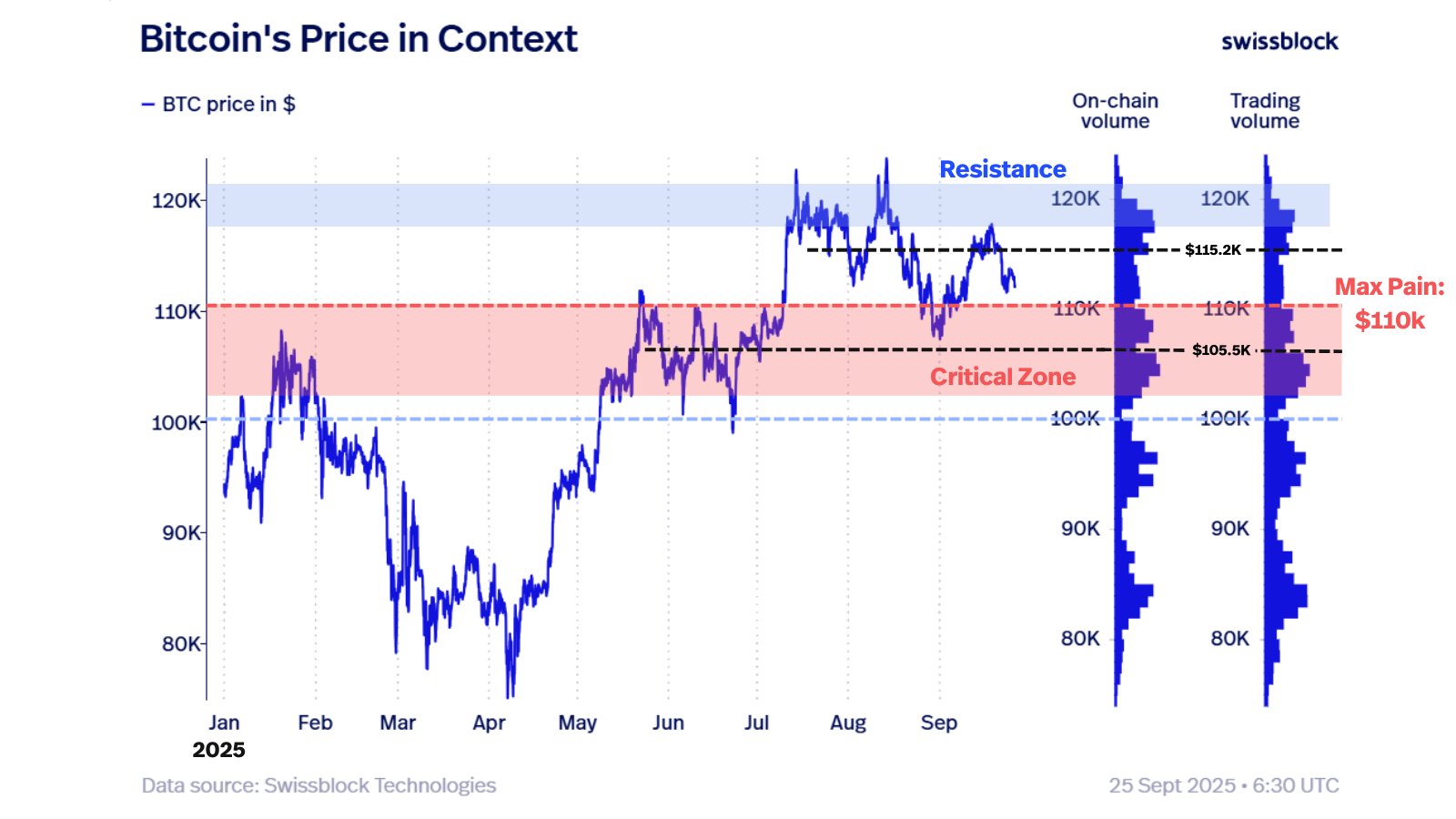

Concluding its analytics with the crypto king, Swissblock says that a retest of the $110,000 area appears imminent and if it were to fail, it could be feeling “max pain.”

“Bitcoin lost $113,000 and hovers under $112,000: a retest of $110,000 looks imminent. BTC sits in a delicate balance: Above $115,200 ? opens $120,000. Below $110,000 ? exposes $105,500-$100,000. $110,000 = max pain. Likely to be touched, leaving Friday’s options worthless.”

Bitcoin is trading for $109,053 at time of writing while Ethereum is valued at $3,948.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney