Bitcoin and XRP prices showed stability on Monday as China advised its banks to reduce exposure to US Treasuries. Bitcoin price hovered around $70,000, recovering from last week’s downturn driven by global financial concerns.

Over the weekend, XRP moved steadily, around the $1.40 mark. Ethereum had also been robust as it stood over $2,000. The wider crypto market was cautiously optimistic, responding to tensions of the geopolitical environment.

China Urges Major Banks to Cut U.S. Treasury Holdings

Chinese regulators have recently directed major domestic banks to begin reducing their exposure to U.S. Treasury bonds. The shift is motivated by issues of volatility and risks of excessive holding of U.S. government securities in the market.

The financial institutions that have a lot of U.S. debt are being encouraged to reduce those positions in stages.

BREAKING: China has told domestic banks to stop adding and begin reducing exposure to U.S. Treasuries.

This removes a steady source of foreign demand for U.S. government debt. Lower external demand for Treasuries can push yields higher and increase U.S. borrowing costs over… pic.twitter.com/riloI93nd9

— Bull Theory (@BullTheoryio) February 9, 2026

This directive is said not to concern the official state holdings of China but has been directed to part of the biggest commercial banks of the country. It is claimed that the guidance was published prior to the phone call between the U.S. President Donald Trump and Chinese President Xi Jinping last week. In the same call, Trump affirmed that he will be coming to China in April.

The statistics indicate that direct ownership of U.S. Treasuries by China has dropped to 682 billion a 17 year low compared with a high of approximately 1.3 trillion. After the report, the 10-year Treasury yields increased marginally to 4.24 indicating that the markets reacted to the declining foreign backing.

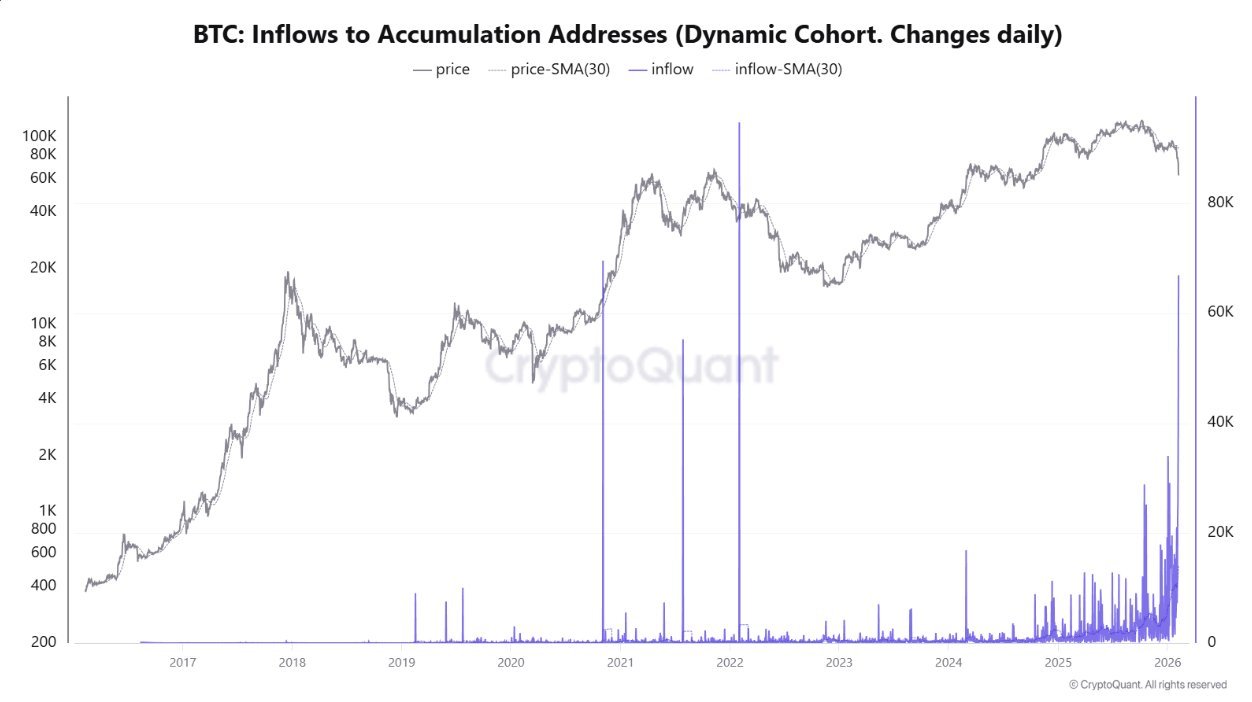

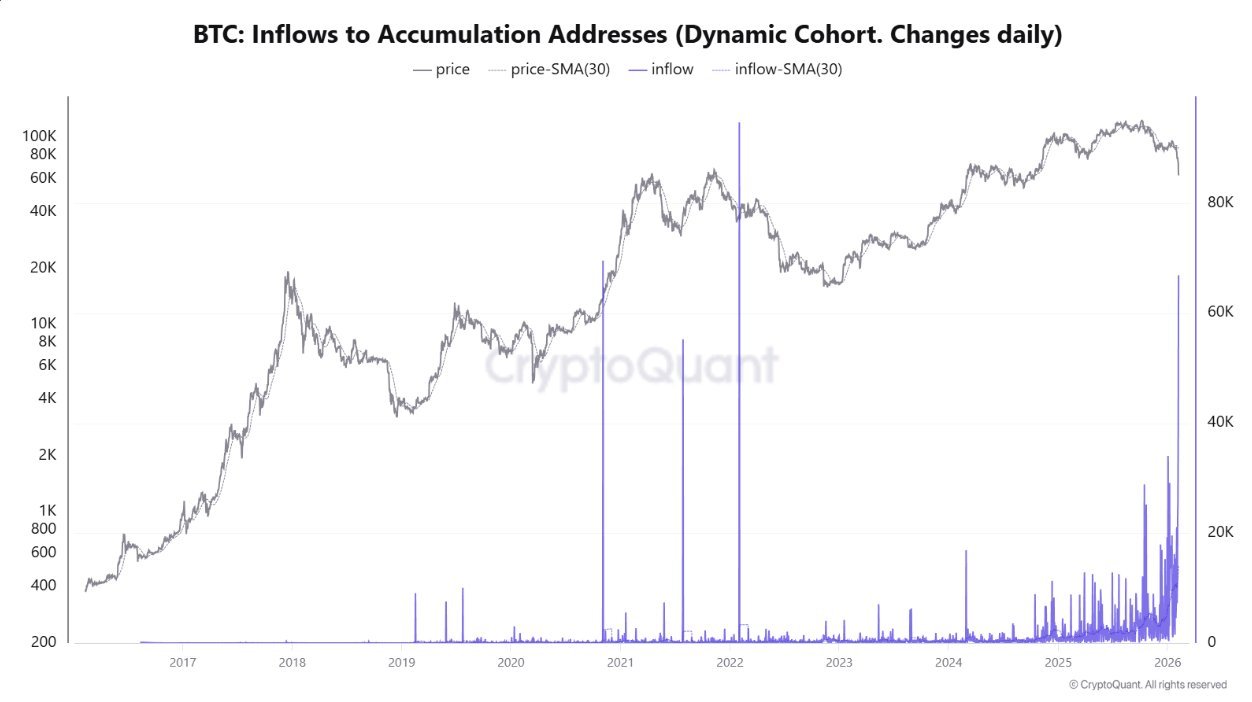

Bitcoin Price Holds Near $70K as Accumulation Hits 2021 High

Bitcoin price traded at $70,100 on Monday, with a 24-hour drop of 0.96%. The previous week recorded a significant downward trend of almost 10% and Bitcoin dropped to $60,000 on Friday but recovered over the weekend. On Sunday, it retested resistance at close of $73,072.

If the recovery holds, further gains could push the Future Bitcoin outlook toward the next resistance at $73,300. However, holding above the $69,000 support is crucial for consolidation.

A failure would cause a retest of $65,000. Interestingly, accumulation addresses have registered their greatest inflows since 2021, which indicates increased purchases by smart money under this consolidation.

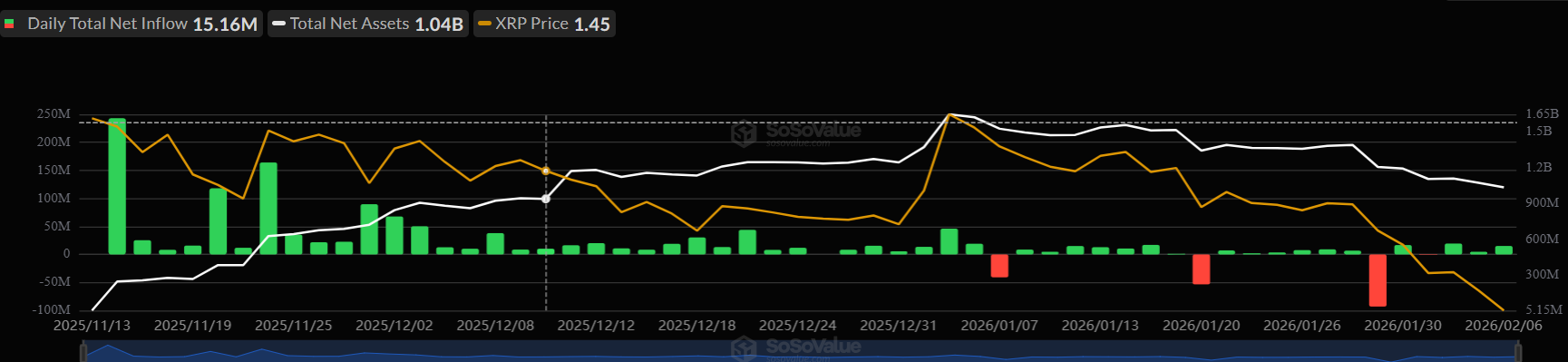

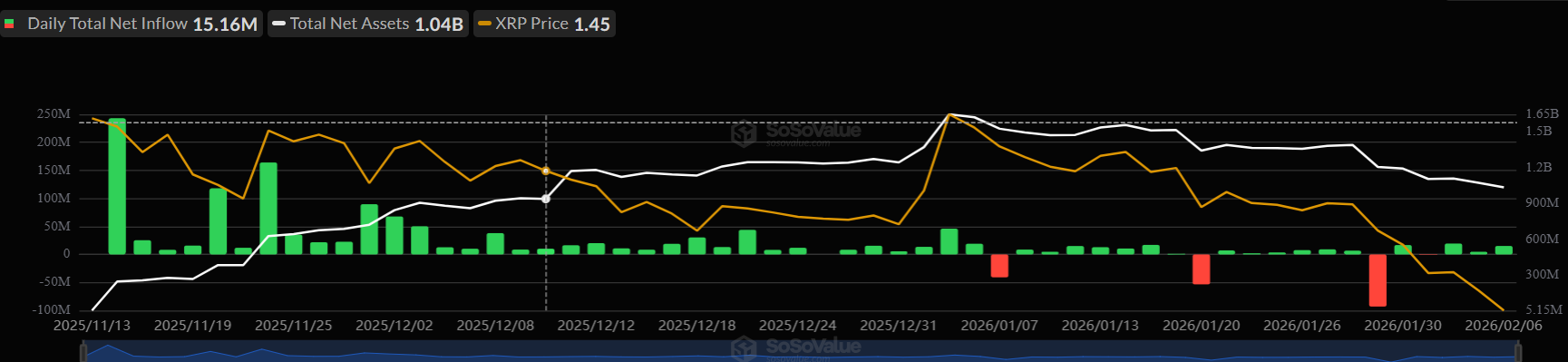

XRP Price Struggles to Hold $1.40 Amid Rising ETF Inflows

XRP price slipped by 2% to $1.40 over the last 24 hours, signaling possible weakness in momentum. On Thursday, XRP broke below its lower trendline and dipped to a $1.11 low on Friday. The token has since hovered around the same level throughout the weekend after briefly retesting the broken trendline.

Should XRP price continue to be supported at a price point above $1.40, it may consolidate. A breakdown would, however, send the prices towards the support of $1.30. Nevertheless, XRP spot ETFs recorded net inflows of $39.04 million last week.

What’s Next For Bitcoin And XRP Price?

Bitcoin and XRP prices are resistant to the emerging uncertainty in the world as China encourages banks to reduce U.S. Treasury holdings. The mood on the market remains optimistically reserved, but further price changes will likely depend on geopolitical processes and reactions of investors to the macroeconomic evolution.