Bitcoin and Ethereum prices faded after marching to March 2024 peaks. After Bitcoin soared to fresh all-time highs of around $73,800, it only took nearly five months for prices to flash crash sharply, dumping below $50,000 in early August.

Amid this sell-off, Ethereum wasn’t also spared. By August 5, the coin fell to as low as $2,100. Even though prices bounced on the days that followed these losses, the uptrend momentum has been shaky, and there are doubts that buyers will sustain the leg up.

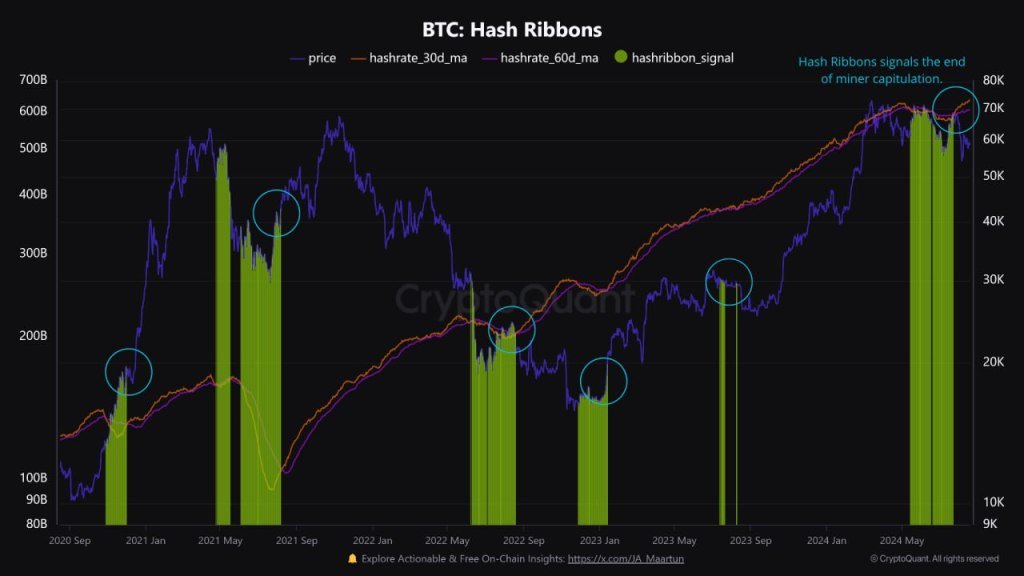

Bitcoin Hash Rate Rising: Miner Capitulation Over?

However, as traders watch the market, closely monitoring how the top two coins perform and whether they will regain their footing, on-chain data points to encouraging developments.

Data from CryptoQuant indicates that Bitcoin and Ethereum might be in the last phases of a market lull and will likely rip higher in a buy trend continuation, confirming gains of Q1 2024.

In a post on X, CryptoQuant analysts pointed to the state of Bitcoin mining and whether miners have recovered after the capitulation in July. Pointing to the Hash Ribbon indicator, a tool analysts often use to measure capital capitulation, CryptoQuant observes that the network hash rate is rising, recently spiking to fresh all-time highs of 638 EH/s.

This development means miners, after the flush of May through July following the Halving event on April 20, have upgraded their gear and are pushing out more computational power to remain competitive.

It can also be inferred that miners are bullish on what lies ahead, explaining their decision to re-invest in new and efficient gear.

Historically, analysts said that the end of miner capitulation, as is currently the case, often precedes sharp price increments.

Even so, since past prices don’t repeat but rhyme, the probability of the price recovering, breaking above $60,000, and the local resistance at $63,000 remains high.

Tailwinds for this growth will be primarily due to optimistic miners’ reduction of BTC selling pressure.

Ethereum Buyers Taking Charge As Open Interest Rises

Meanwhile, one analyst, citing CryptoQuant, notes that Ethereum could also be primed for gains. Currently, ETH bulls are struggling to unwind August 4 and 5 losses.

The immediate liquidation line is around $2,800. If bulls push on, a close above this zone could form the base of another leg up, lifting prices to $3,500 in a refreshing recovery.

The analyst notes that the Ethereum Taker Buy Sell ratio has been rising, which gauges the balance between buying and selling pressure. This development suggests that buyers are growing in strength, a net positive for bulls.

At the same time, Ethereum’s open interest across leveraged positions in various futures trading platforms has been rising after dipping, especially in June 2024. More positions being opened means that investors are gradually regaining their confidence, possibly fueling a rally.

Feature image from Canva, chart from TradingView