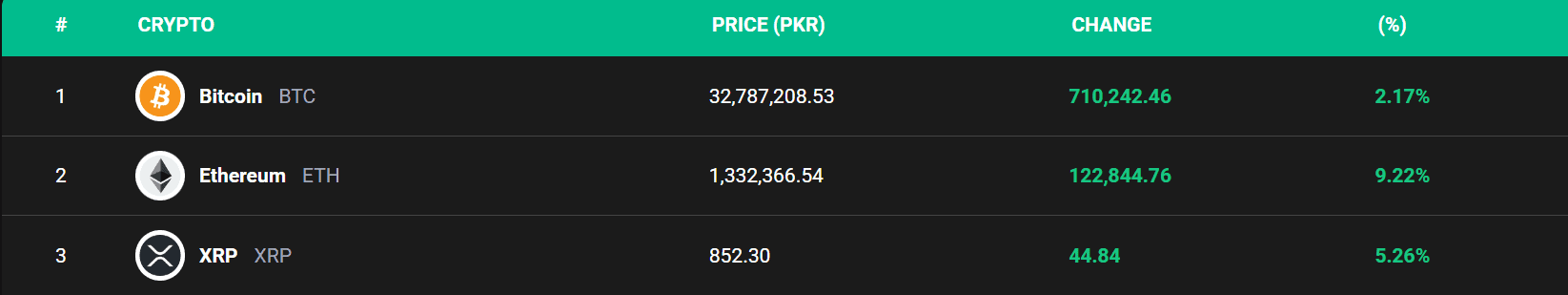

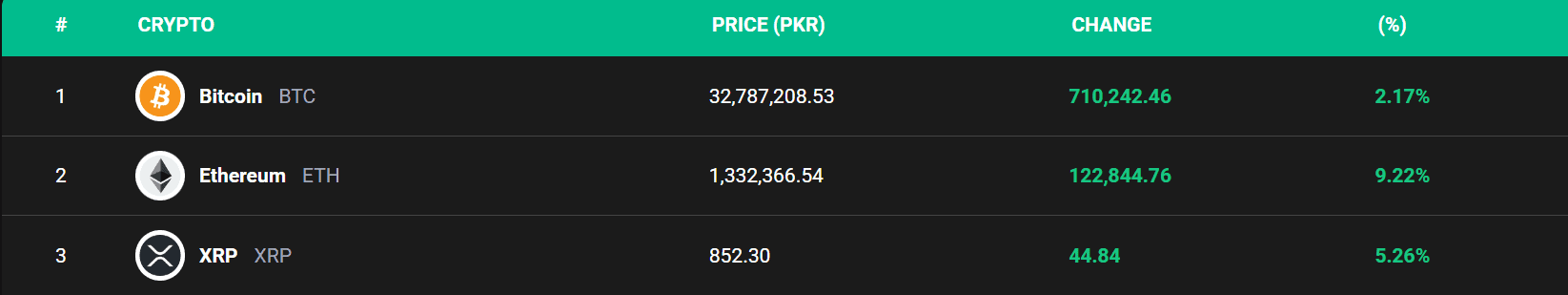

The crypto markets just got their jolt of adrenaline. After Fed Chair Jerome Powell dropped hints at Jackson Hole that fed cuts are imminent, digital-asset stocks took a breather. Experts saw a sharp uptick from $112,000 (PKR 3.17 crore) to more than $116,000 in a matter of hours, before settling down at $115,700 (PKR 3.28 crore).

Crypto-linked equities followed suit. MicroStrategy (MSTR) leapt 5%, while Coinbase (COIN) jumped nearly 7% as Wall Street’s appetite for risk assets suddenly came back to life.

BTC, ETH Steal the Show, Altcoins Join the Rally

If Bitcoin was the spark, Ethereum was the explosion. The world’s second-largest crypto soared nearly 14% to $4,789 (PKR 13.5 lac) before settling down to $4,727 (PKR 13.4 lac).

Not to be left behind, Solana, XRP, and Dogecoin all posted gains between 6% and 10%, signaling that this was not just a Bitcoin bounce, but a full-on altcoin party.

Traders Bet Big on Rate Cuts

The CME FedWatch tool now puts the chances of a September rate cut at 87%, up from 75% before Powell’s remarks. That’s a dramatic shift in sentiment, one that pulled both crypto and stocks higher in tandem. The S&P 500 rallied 1.5%, while the Dow surged nearly 2% to record highs.

When interest rates fall, speculative assets shine and no asset class embodies speculation (and reward) like cryptocurrency. Powell’s acknowledgment of a weakening labor market gave traders the green light to bet on a softer Fed.

For crypto, that means one thing: momentum is back. After weeks of fear and red charts, Bitcoin, Ethereum, and the broader altcoin market may finally be entering their next bullish chapter.