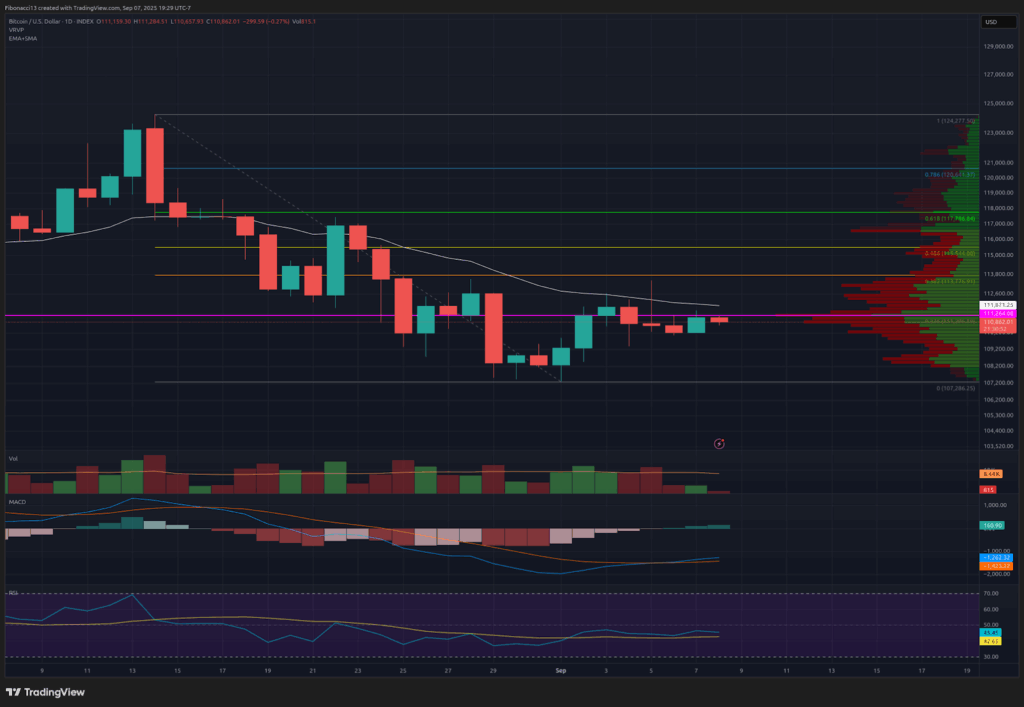

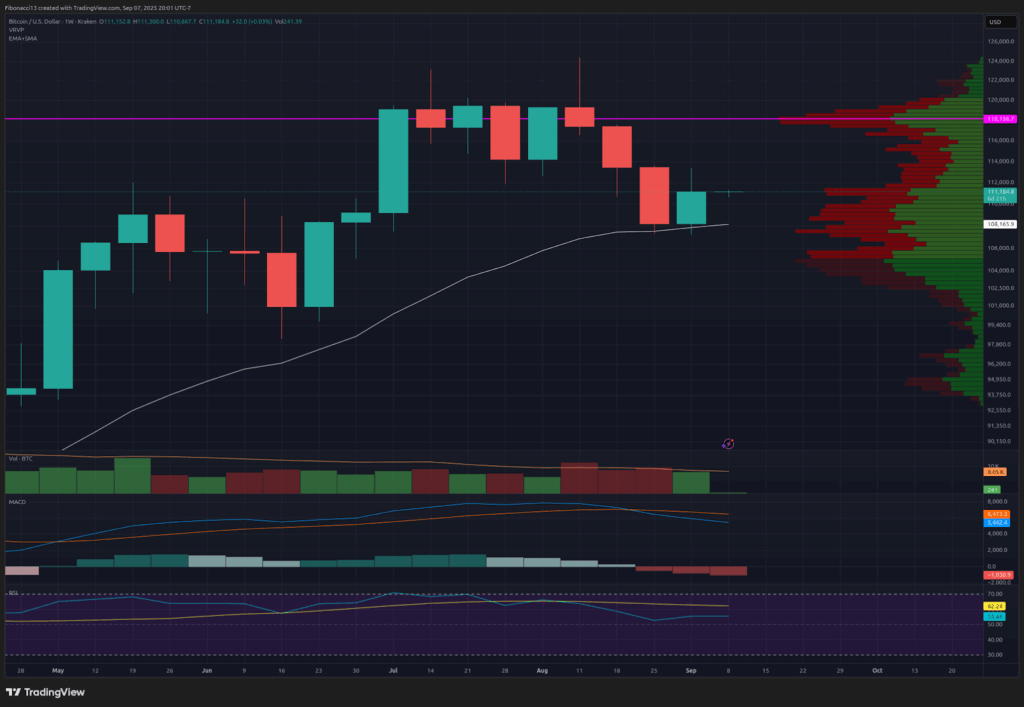

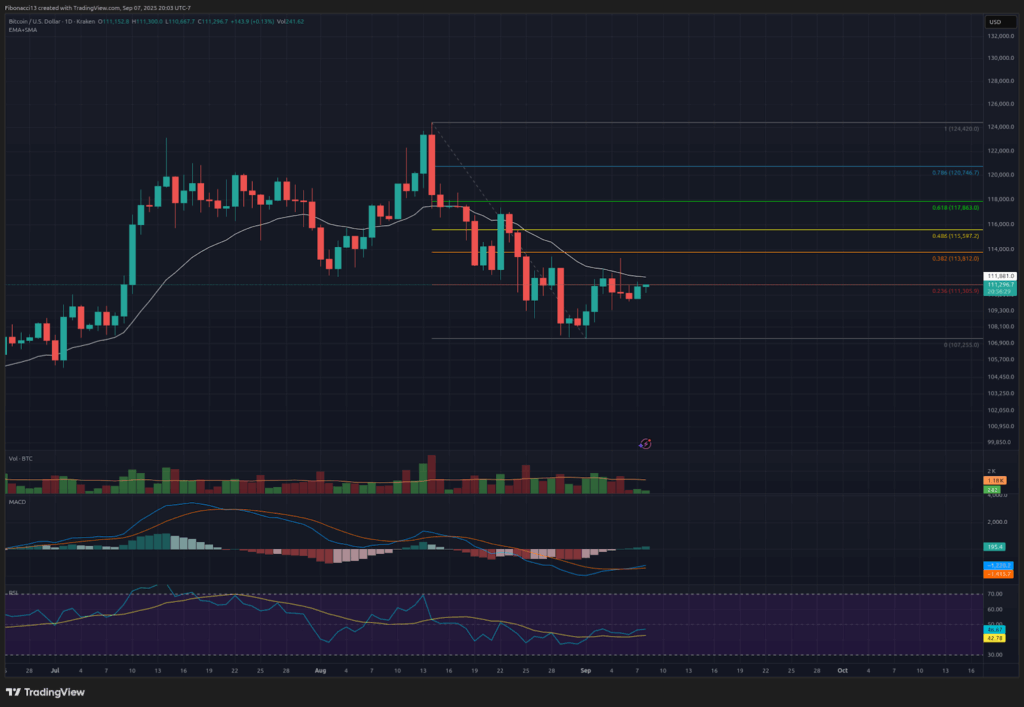

Bitcoin Price found support at the 21-day EMA last week, avoiding a deeper slide after closing at the prior week’s lows. Bulls managed to defend the $107,000 level, but momentum stalled just below resistance. From Wednesday through Friday, Bitcoin failed to close above $112,500 and ended the week at $111,162.

The inability to reclaim $112,500 highlighted a pause in the recent recovery. Still, holding above $107,000 has kept the bias slightly to the upside for now. Traders are closely watching whether this consolidation develops into a base or a continuation of the downtrend.

Key Support and Resistance Levels Now

At present, $107,000 is the most important line of defense for Bitcoin Price. A breakdown below there would shift the focus to lower support zones at $105,000, $102,500, and potentially $96,000.

On the upside, $112,500 is the first resistance that needs to flip into support. If bulls manage to close the daily above that level, the next target is $115,500. Beyond there lies $118,000 — a formidable barrier that would need a weekly close to confirm a renewed uptrend.

Outlook For This Week

The week ahead could bring more volatility. On Thursday, September 11th, U.S. inflation data is due at 8:30 AM Eastern. A hotter-than-expected print may spark risk-off sentiment and drag Bitcoin lower, while a softer number could provide relief for bulls.

If Bitcoin Price can reclaim $112,500 early in the week, a push toward $115,500 is likely. Failure to do so keeps the market vulnerable to another test of the $107,000 low.

Market mood: Neutral, leaning bullish — support is holding, but resistance remains firm.

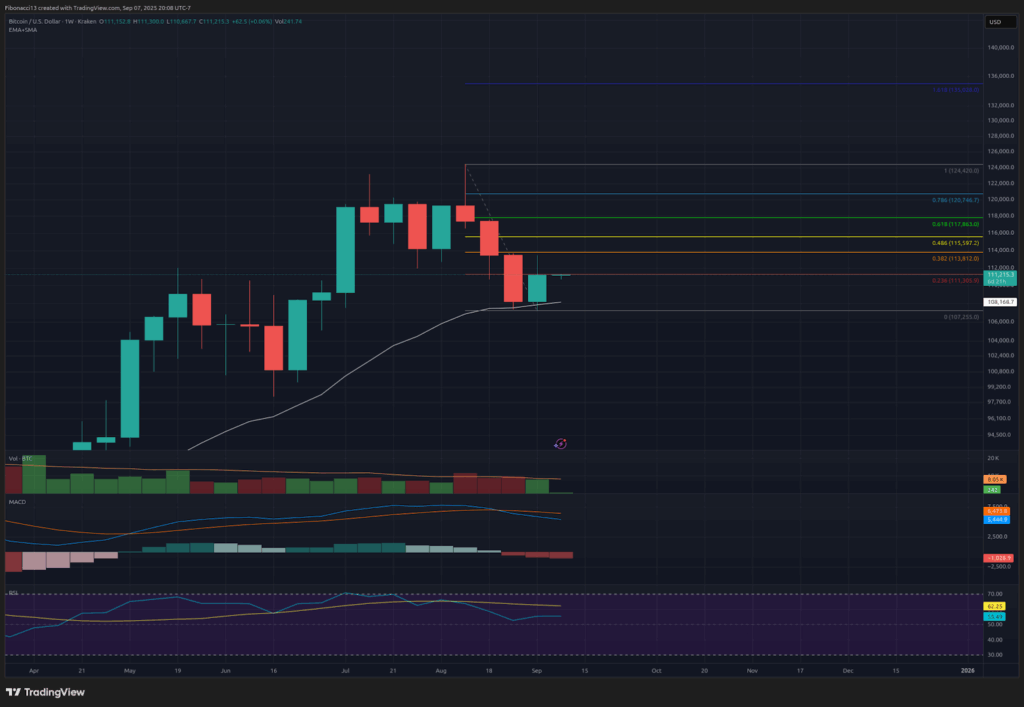

The next few weeks

Looking further out, Bitcoin must eventually clear $118,000 with conviction to re-establish the uptrend and fend off bears. A decisive weekly close above this level would likely draw in momentum buyers and improve sentiment into October.

If $107,000 breaks instead, the path opens toward $105,000 and $102,500, with the possibility of a sweep as low as $96,000 before a durable bottom is found. Given the pattern of recent closes, some analysts caution that one more dip cannot be ruled out.

Terminology Guide:

Bulls/Bullish: Buyers or investors expecting the price to go higher.

Bears/Bearish: Sellers or investors expecting the price to go lower.

Support or support level: A level at which price should hold for the asset,at least initially. The more touches on support, the weaker it gets and the more likely it is to fail to hold the price.

Resistance or resistance level: Opposite of support. The level which is likely to reject the price, at least initially. The more touches at resistance, the weaker it gets and the more likely it is to fail to hold back the price.

EMA: Exponential Moving Average. A moving average that applies more weight to recent prices than earlier prices, reducing the lag of the moving average.