Data shows that the crypto derivatives market has seen a large number of liquidations in the past day as Bitcoin has crashed to $59,000.

Bitcoin Has Seen A Sudden Crash Under $60,000 In The Last 24 Hours

The price action in the past day has shocked Bitcoin investors as the cryptocurrency has taken a plunge, erasing all the asset’s recovery in the last week.

The chart below shows the asset’s trajectory over the last few days.

Looks like the price of the asset has taken a notable hit in recent days | Source: BTCUSD on TradingView

During this crash, the coin dropped to under $59,000 but has since recovered to $59,900. Despite the rebound, BTC has still been down around 4% over the last 24 hours.

As is usually the case, the rest of the sector has followed the original cryptocurrency in this bearish direction. However, many altcoins have managed to restrict their losses to a size lower than BTC’s.

Given the volatility the sector as a whole has seen in the past day, it’s not surprising that the derivatives market has been shaken up.

Crypto Derivatives Market Has Just Seen $319 Million In Liquidations

According to data from CoinGlass, the cryptocurrency derivatives market has seen the liquidation of a large amount of contracts during the last 24 hours. “Liquidation” here naturally refers to the forceful closure that any open contract undergoes after it has amassed losses of a certain degree.

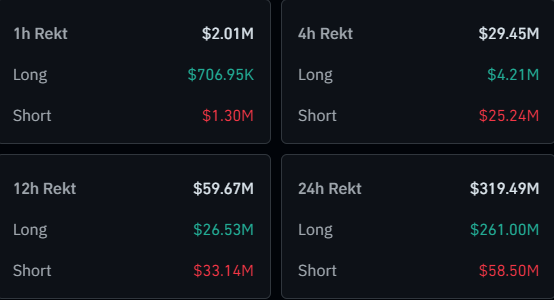

Below is a table that displays the relevant data related to the latest mass liquidation event in the sector.

The liquidations appear to have been dominated by the long side of the market | Source: CoinGlass

As is visible, the total cryptocurrency market liquidations have stood at $319 million in this window. Of this, $261 million of the liquidations have come from the long contract holders, representing over 80%.

The disproportionality between longs and shorts makes sense, as most of the derivatives flush has occurred because of the crash that Bitcoin and others have observed during this period.

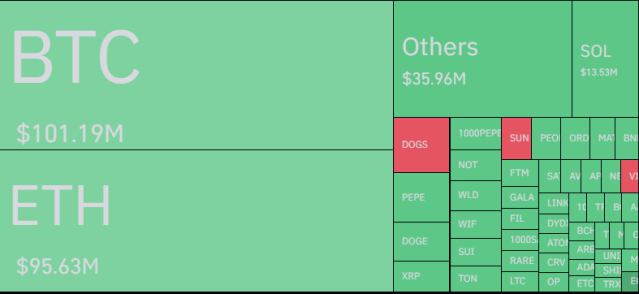

Regarding the individual contribution towards these liquidations by the various symbols, Bitcoin and Ethereum, the two largest coins in the space, have also come out on top.

The breakdown of the mass liquidation event by symbol | Source: CoinGlass

Interestingly, the gap between the two has been less than $6 million, when usually BTC has notably higher liquidations. This is even though ETH’s negative returns have been similar to BTC’s.

The trend suggests that Ethereum has just had higher-than-usual speculation behind it recently, with investors opting for higher risk in the form of leverage. The volatility has wiped out many of these speculators, so it remains to be seen how interest in the asset will look in the coming days.

Featured image from Dall-E, CoinGlass.com, chart from TradingView.com