Eric Trump and Donald Trump Jr. used a CNBC interview this week to renew their public support for Bitcoin, calling it the defining asset class for a new generation and predicting a major price expansion ahead.

Speaking during a wide-ranging discussion that touched on stablecoins and broader cryptocurrency adoption during the World Liberty Forum, Eric Trump said he remains “a huge proponent of Bitcoin” and argued the asset could eventually reach $1 million.

He pointed to Bitcoin’s long-term performance, touching on its recovery from lows near $16,000 two years ago and claiming it has delivered strong average annual gains over the past decade.

Trump framed volatility as a natural feature of an emerging asset with significant upside, contrasting BTC with lower-yielding traditional investments such as municipal bonds or U.S. Treasuries.

“I’ve never been more bullish on bitcoin in my life,” Trump said.

The Trump sons also highlighted what they see as accelerating institutional acceptance. Eric Trump cited major financial firms including Fidelity, Charles Schwab, JPMorgan, BlackRock, and Goldman Sachs as examples of Wall Street’s increasing engagement with digital assets.

He claimed private wealth clients are being allocated higher percentages of crypto exposure than in past years, positioning Bitcoin as an investment theme for people under 50.

Goldman Sachs CEO owns bitcoin

The comments came as traditional finance leaders signaled a cautious shift in tone. Goldman Sachs Chief Executive Officer David Solomon disclosed that he now holds a small amount of BTC, speaking at the World Liberty Forum held at Mar-a-Lago in Florida.

Solomon described his holdings as “very, very limited” and said he is not a “great Bitcoin prognosticator,” casting himself as more of an observer than an advocate.

His remarks reflect the growing proximity between established financial institutions and the crypto sector after years of regulatory constraints that kept firms like Goldman largely on the sidelines.

Solomon has previously expressed skepticism about BTC’s practical role. In a 2024 CNBC interview, he characterized the asset as speculative and questioned its real-world use case, while acknowledging its volatility and investor interest.

Coinbase Chief Executive Officer Brian Armstrong also addressed Bitcoin’s recent price weakness during his appearance at the forum. Armstrong said the latest decline appears driven more by market psychology than by underlying fundamentals.

He dismissed speculation that macro political factors were behind the move and argued that volatility remains part of crypto’s normal cycle.

Armstrong maintained that BTC remains one of the best-performing assets of the past decade and said Coinbase does not take a short-term view of price swings.

Armstrong also pointed to the policy environment in Washington, suggesting crypto legislation could advance under President Donald Trump’s administration.

He described a potential “win-win-win” outcome for the industry, banks, and consumers if regulatory clarity is achieved, adding that proposed measures could reach Trump’s desk within months.

Yesterday, Armstrong said the company expects a market structure bill to pass and argued that statutory clarity would provide long-term certainty beyond shifting leadership at agencies like the SEC.

If legislation stalls, he said Coinbase would continue operating under existing rules while seeking clarity through regulators or the courts.

“I think the bill will get done,” Armstrong said. “It’s in everyone’s interest at this point.”

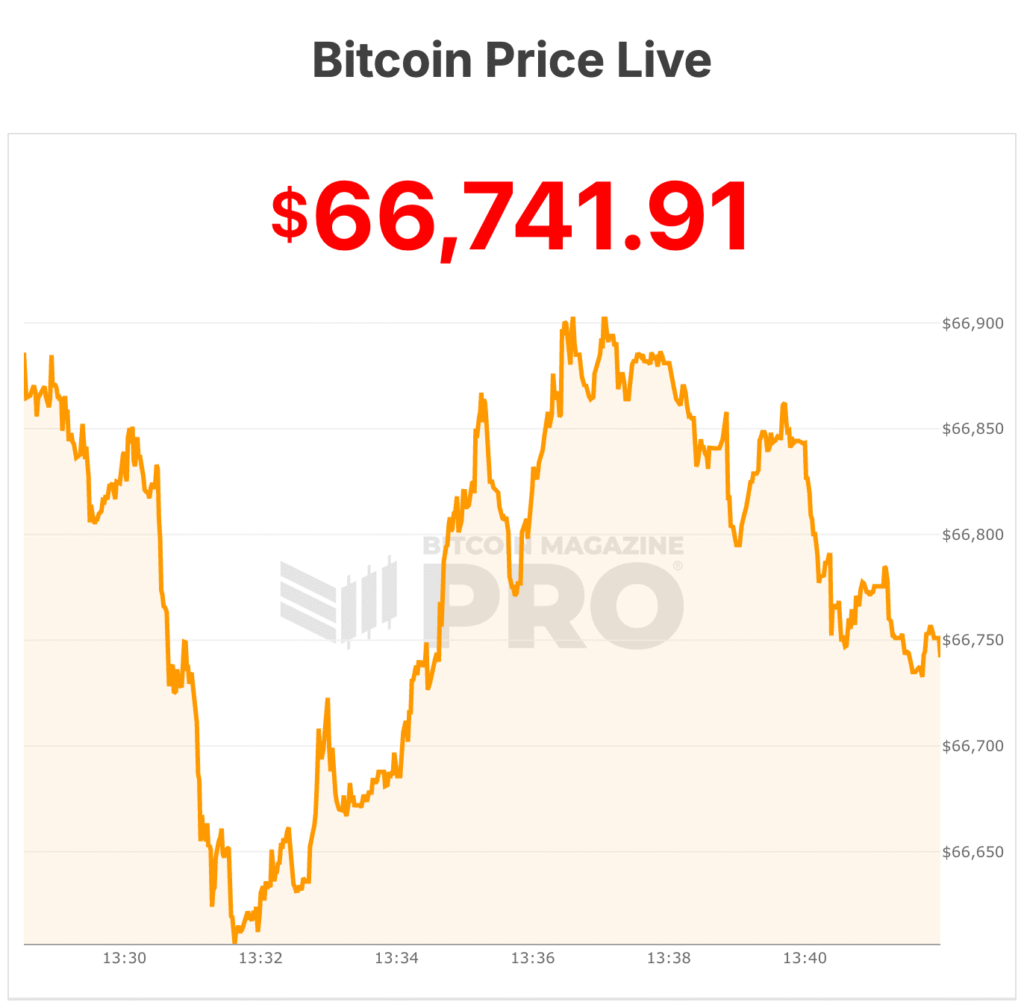

BTC is trading at $66,800 today, with $33 billion in 24-hour volume. The asset is down 1% over the past day as price action remains tight inside its weekly range.

BTC is sitting about 2% below its 7-day high of $68,328 and essentially flat from its 7-day low of $66,834, signaling continued consolidation rather than a decisive breakout.

Bitcoin’s circulating supply stands at 19,991,396 BTC, against a fixed maximum of 21 million. The total market capitalization is now roughly $1.34 trillion, down 1% from the previous day.