Bitcoin price has moved into a decisive phase as BTC price trades above a former consolidation ceiling. Price just left an accumulation range that limited upside since the end of November. This move coincided with increased macro sensitivity, which was caused by the uncertainty concerning the tariff decision by the U.S. Supreme Court.

While the ruling remains unresolved, Bitcoin price has continued responding to internal structure rather than headline volatility. Price behavior is now characterized by sustained participation and not by range-bound hesitation.

Tariff Ruling Outcome Keeps Bitcoin Price Exposed

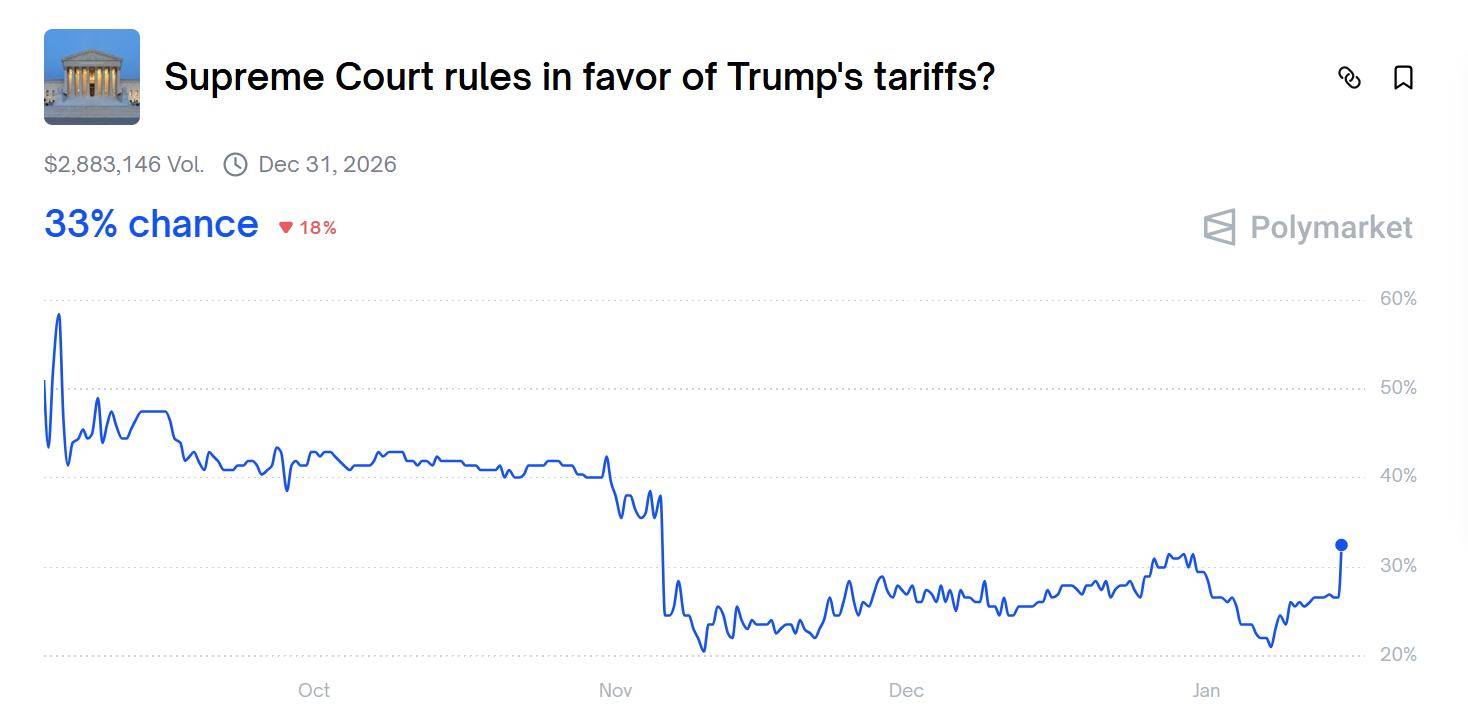

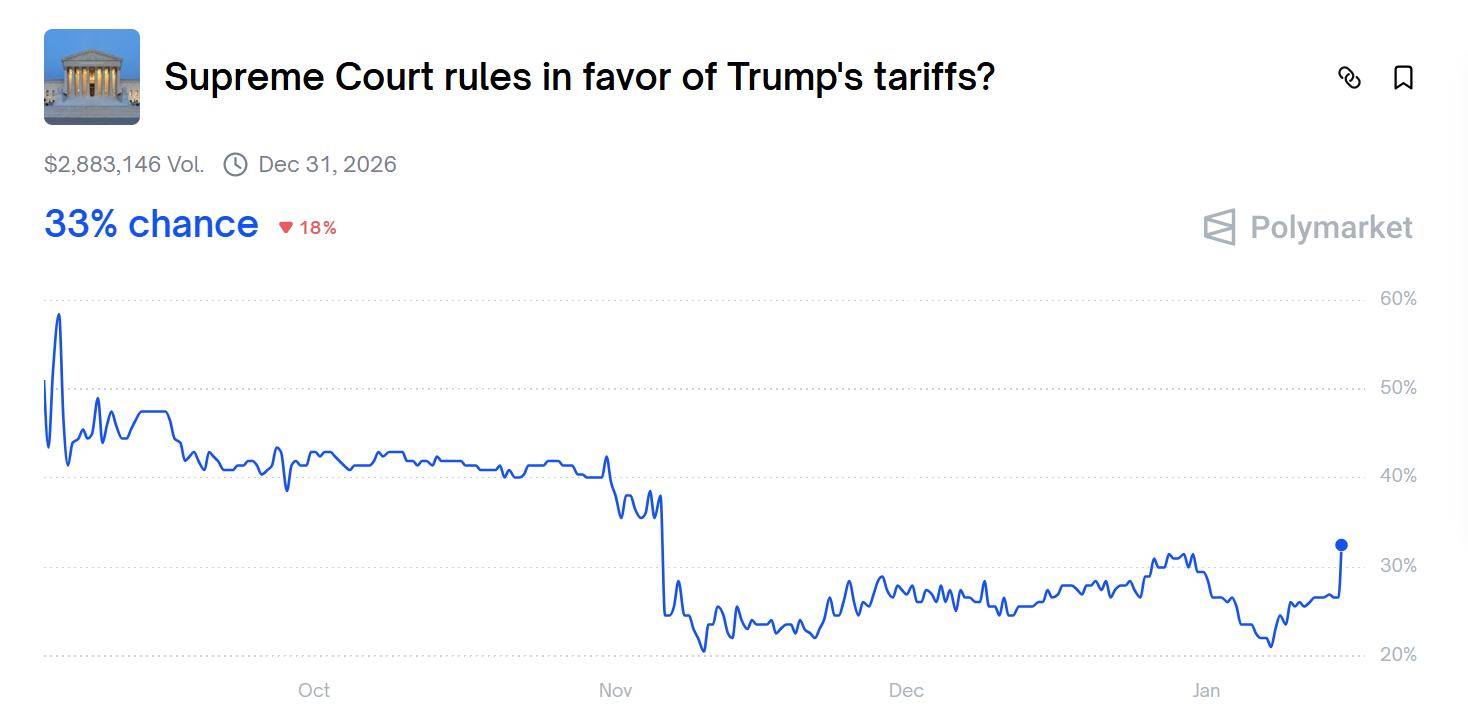

BTC price remains sensitive to the Supreme Court tariff case because the outcome carries asymmetric macro consequences. While the supreme court delayed issuing a ruling, markets are already pricing the decision itself.

According to Polymarket, the likelihood of the court declaring the tariffs to be illegal sits around 67%. Such an outcome would mean more than $600 billion in potential refunds, which would have a significant relaxing effect on the financial situation.

This matters for Bitcoin price because such an outcome would weaken fiscal restraint and raise liquidity expectations. Risk assets usually gain in that case because the capital does not move towards defensive positioning. Bitcoin historically responds positively when liquidity expectations expand, even before policy changes materialize.

However, a ruling in favor of the tariffs would still reshape market expectations. The decision supporting the tariffs would also strengthen stricter terms and maintain ambiguity regarding the trade expenses. That scenario could pressure risk appetite and slow BTC price momentum.

Therefore, despite the delay, Bitcoin price continues reacting to the expected outcome, not the timing. Markets trade probabilities, which keeps Bitcoin price structurally responsive rather than directionless.

Cup-and-Handle Breakout Reshapes Price Structure

Bitcoin price has finally broken the accumulation range that limited a break since late November last year. The breakout confirms the cup and handle pattern breakout above the supply zone around $94,000. BTC has managed to flip this resistance zone to support. At the time of writing, Bitcoin market value sits around $97,000.

This move followed a 4% daily surge ignited by the CPI data release. The CPI catalyst came with a positive impact on the price structure. BTC is now targeting to reclaim the $100,000 level. The structure reflects stronger buyer control than the prior range behavior.

The DMI indicator highlights extremely bullish conditions. The +D signal line crossed above the -D signal line at the 21 level. This occurred on Monday, 12 Jan. BTC gained momentum below the $92k level. This activity signalled buyers taking control of the structure.

After the crossover, the +D signal surged to 47.30. At the same time, the -D dropped to 9.8. The ADX confirms momentum strength at 32, above the 25 threshold. Ultimately, BTC reclaiming $100k appears a matter of time, strengthening the long-term BTC price prediction.

To sum up, Bitcoin price continues to trade from a position of structural control as long as the BTC price holds above the $94,000 support zone. Notably, the the price action expansion does not reflect reactive positioning , but rather sustained buyer dominance.

Continuation would only be weakened in the case of a breakdown below this level. However, the technical structure, momentum alignment, and macro uncertainty resilience are currently in favor of reclaiming $100,000.