A growing exodus from the United States is fuelling increased demand for prime London property, research has suggested.

The research from international mortgage broker Enness Global revealed 5,228 US citizens expatriated over the course of 2025, an increase of 8.5 per cent on the previous year.

This represented a continuation of trends established in previous years as there was also a sharp rise in 2024 when the number of US expatriates jumped by 47.8 per cent compared to 2023.

Americans are buying UK property because the strong US dollar makes prices attractive, and the UK is seen as a stable, safe place to hold wealth

The analysis also highlighted that, since Donald Trump first took over the office of the presidency in 2017, the number of US citizens choosing to leave the country is estimated to have increased by an average of 25.7 per cent per year.

Enness Global CEO, Islay Robinson, stated: “Whether people agree with President Trump and his policies or not, there’s no denying that periods of political change and uncertainty can create volatility and leave sections of the population feeling unsettled.

“As a result, the number of US citizens choosing to expatriate has risen in 2025 following his re-election, and the longer-term trend since his first term in office has been striking.

“With President Trump beginning 2026 amid renewed controversy, it’s reasonable to expect this trend to continue, however from a UK perspective, the consequence has been a clear increase in American interest in London property — particularly across prime neighbourhoods.

“With interest rates now trending downwards and prime London property values remaining subdued, the current market presents a compelling window of opportunity and for US buyers with the ability to act, now is very much the time to do so.”

Increased demand

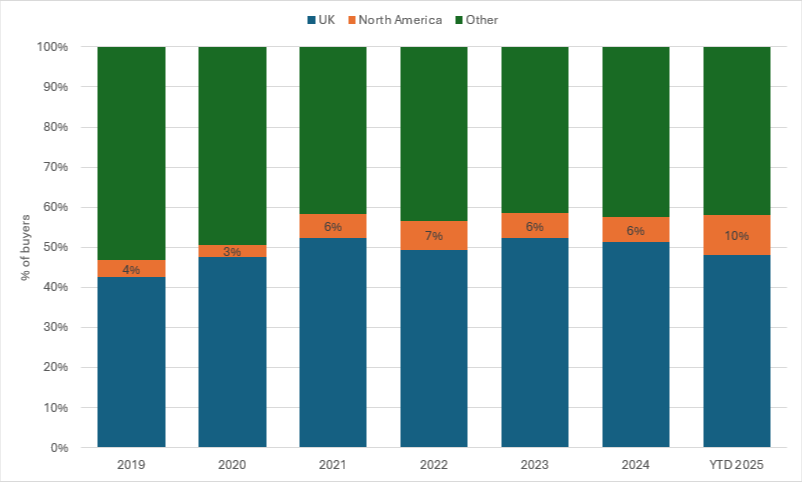

Enness Global’s suggestion of this migration contributing to the prime London property market is supported by data from Savills who charted an increase in the percentage of buyers coming from America.

Savills’s data detailed that 10 per cent of prime London buyers in 2025 were from North America, an increase on the 6 per cent that was recorded in both 2023 and 2024.

This also represents a large increase on 2019 which saw just 4 per cent of buyers originating from North America, suggesting an increased presence of Americans recently.

Additionally, The Acorn Group CEO, Neil Louth, provided insight into why these expatriated Americans may be choosing the London Prime market, saying it represents “a combination of the familiar and the compelling”.

He explained that London represents a global city in a workable timezone for transatlantic investors with a good jobs market, world-class culture, and schooling and housing.

“Americans are buying UK property because the strong US dollar makes prices attractive, and the UK is seen as a stable, safe place to hold wealth,” he said.

Additionally, Louth suggested that 2026 could provide a particular window of opportunity for Americans seeking prime housing in the capital, stating that the property market itself provides a reason for settlement.

“As Rightmove has reported, parts of central London have seen price adjustments for properties in prime locations, which has brought more choice and created a buyers’ market for offers to be accepted.

“For decisive buyers that can translate into better value alongside less frantic competition as we saw in the post-pandemic peak.

“Investors are drawn by reliable rental demand and long-term value, while London in particular retains appeal for its global status, liquidity, and prestige.”

tom.dunstan@ft.com

What’s your view?

Have your say in the comments section below or email us: ftadviser.newsdesk@ft.com