In brief

- Bitcoin hovers near $90,600 after failing to break above $94,000, stuck in death cross territory despite a brief ETF-fueled spike.

- Total crypto market cap sits at $3.06 trillion, down 1.14% with bearish technical indicators suggesting further downside ahead.

- Prediction markets remain resiliently bullish, with traders giving a new “Crypto Winter” only a 4.9% chance.

That brief spike of hope in the crypto market? Probably gone. Bitcoin’s trading around $90,600 after a quick trip above $93,000 earlier this week, and the broader crypto market’s feeling the chill. The total market cap sits at $3.06 trillion—down about $35 billion, or 1.14%—and a quick scan of the top 100 coins shows 80% are underperforming today. So much for that New Year’s resolution rally.

The macro picture isn’t exactly screaming “buy everything.” Traditional markets are showing cracks. The S&P 500 just wrapped up its third consecutive year of gains above 14%, but analysts are warning that the AI-fueled party might be running out of champagne. Gold, meanwhile, is flexing hard—up over 60% in 2025 and pushing toward $4,500 per ounce as investors hunt for safe havens amid geopolitical tensions and questions about AI spending sustainability.

The entire crypto market is also back in bearish territory at $3 trillion of total capitalization. It would need to hold over the $3.2 trillion mark to get traders talking about a general market recovery again.

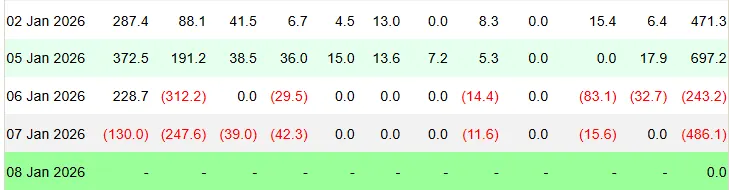

But for crypto the concern isn’t just about weak price action. It’s what happens when institutional money gets skittish. Bitcoin ETFs, investment funds that track the spot price of BTC, saw $1.2 billion flow in during the first two trading days of 2026—the largest single-day inflow since October at $697 million—but then immediately hit the brakes with $243 million in outflows on day three and $476 million flowing out yesterday.

That kind of whiplash suggests the institutional bid is back, but it’s fragile.

What Bitcoin gives, Bitcoin takes

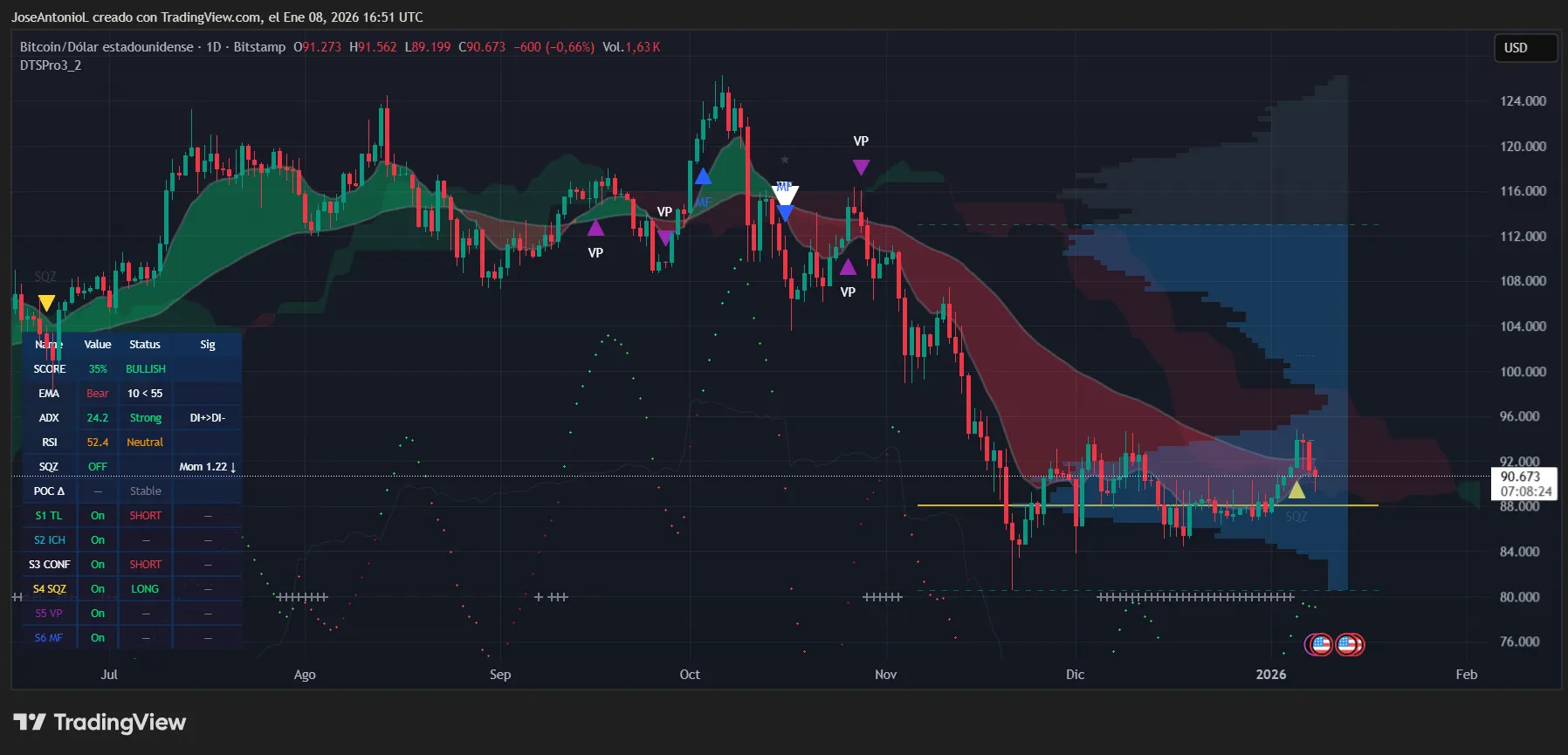

Bitcoin’s technical setup tells the same story. The price is currently trading at $90,673, down about 0.66% on the day, yet still up 3% in the last seven days after a major spike earlier this week that took prices out of the death cross area for a day.

The death cross—when the 50-day exponential moving average, or EMA, crosses below the 200-day EMA—remains in place, a pattern that typically signals traders to expect more downside or prolonged sideways action. With prices now below both averages, the gap is set to widen again, making that coveted golden cross—the opposite of a death cross—harder to appear.

The gap is very slim right now, so there appears to be an even fight between bulls and bears trying to set the course for the next few months. With such a small gap, even if prices remain bearish, the pace should be slower now than it was months ago, back when Bitcoin began its slide from an all-time high above $126,000.

The Average Directional Index, or ADX, sits at 24.2, just below the 25 threshold that confirms a strong trend. ADX measures trend strength on price charts regardless of direction on a scale from 0 to 100, with readings above 25 generally telling traders there’s a strong trend in place. After the spike earlier this week, Bitcoin’s ADX tanked. But now, its ADX is creeping higher, which could mean the current bearish trend is getting a bit of steam again.

The Relative Strength Index, or RSI, reads 52.4, placing Bitcoin squarely in neutral territory. RSI tracks momentum on a scale from 0 to 100, with readings above 70 considered overbought and below 30 oversold. At 52, Bitcoin isn’t giving off any extreme signals in either direction. Traders see this as a market stuck in limbo—not hot enough to chase, not cold enough to panic-sell.

Support is holding around the $88,000-$90,000 zone, where Bitcoin’s found buyers during recent dips. If that level breaks, the next major floor sits closer to $80,000—a level that Bernstein analysts called the bottom back in late November. On the upside, resistance clusters around $94,000-$97,000. The price briefly kissed $94,000 this week but couldn’t hold it, and that level now acts as a psychological barrier that bulls need to reclaim before anyone starts talking about new highs.

That said, sentiment on prediction markets remains relatively bullish, and these traders aren’t buying the doom narrative.

On Myriad, a prediction market developed by Decrypt’s parent company Dastan, traders say there’s only a 4.9% chance now of a new “Crypto Winter” in 2026.

Myriad traders appear to be eyeing a market recovery, though not necessarily a major bullish run. The odds on Myriad for a new Bitcoin all-time high before July sit at just 20%.

The charts are bearish, the technicals are weak, and yet the smart money on prediction markets isn’t screaming panic. So what gives?

The answer might lie in time horizons. Short-term technicals suggest more chop or downside ahead, but longer-term structural factors—like institutional adoption, spot ETF flows, and macroeconomic tailwinds from potential Federal Reserve rate cuts—keep the bull case alive. Fundstrat’s Tom Lee expects a pullback in the first half of 2026 before a rally in the second half, with a year-end target of $115,000.

If that plays out, it would break the historical pattern, since 2026 would normally line up as a crypto winter year under the usual cycle of one major crash following three bullish years.

For now, though, bulls need to see Bitcoin reclaim $94,000 with conviction—ideally with rising ADX above 25 to confirm momentum. Until that happens, expect more sideways grind with occasional dips that test the $88,000-$89,000 support. The death cross doesn’t guarantee disaster, but it does mean the easy money’s been made. What comes next depends on whether institutions keep showing up—or if they decide to sit this one out.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.