After its stock price rose fivefold in two years, Sprouts Farmers Market has cooled off dramatically in 2025.

I initially scooped up shares of better-for-you, attribute-driven grocer Sprouts Farmers Market (SFM 0.10%) for around $35 in 2023, and thought I was well on my way to experiencing my next multibagger investment. And indeed, the stock quintupled in value over the next two years. However, since then, it has dropped by 55% from its peak.

I don’t tell this story as some “woe is me” tale, but rather to highlight that even the simplest of growth stocks — such as a grocer like Sprouts — will face major pullbacks at some point. More importantly, though, these sell-offs can often prove to be excellent buy-the-dip opportunities, provided the company’s underlying operations and growth prospects remain intact.

I believe that is the case for Sprouts Farmers Market.

Why Sprouts Farmers Market is a buy

The main reason I’m happy to keep adding to my winning position in Sprouts Farmers Market is the company’s unique array of offerings. Its items tend to be more health-focused than those found at chains like Kroger or Walmart, but more affordably priced than those sold at premium chains like Whole Foods.

Sprouts focuses on selling groceries with specific attributes that some customers are seeking — organic, responsibly sourced, locally sourced, kosher, vegan, non-GMO, gluten-free, and more. With this niche focus, Sprouts aims to offer a “farmers market” experience at scale.

Here are four key reasons why Sprouts Farmers Market looks like a no-brainer stock to buy on the dip.

1. Its store count and its margins are both rising

With 464 stores across 24 states, Sprouts is steadily marching toward its goal of becoming a national chain. It added 37 stores in 2025 and hopes to return to 10% annualized growth in store count over the medium term.

With 140 new store locations already approved in its pipeline — and an impressive track record of growth — I’m not betting against the company.

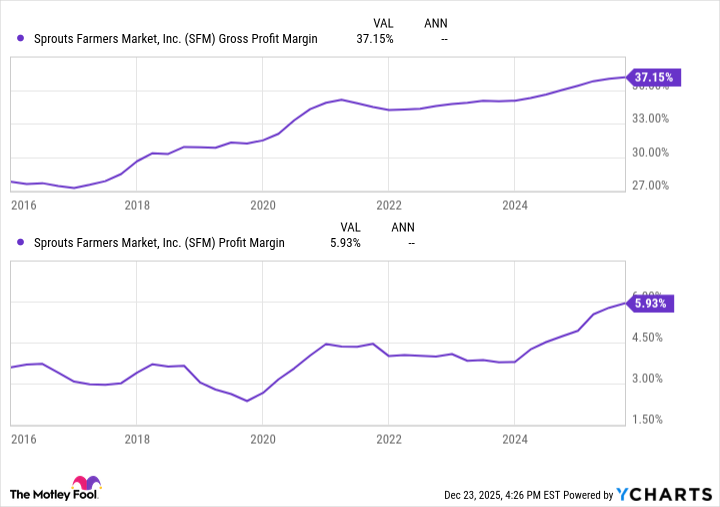

Beyond its focus on growing its store count, Sprouts’ smaller-format stores have supported its strong profitability. Its margins soared even as the company delivered 10% annualized sales growth over the last decade.

SFM Gross Profit and Net Profit Margin data by YCharts.

At a conference earlier this year, Chief Executive Officer Jack Sinclair said he believed the chain could triple its store count to over 1,400 in the long term. Sprouts could be a steal at today’s price if it maintains this improving profitability while it grows.

2. E-commerce sales, private-label goods, and a new loyalty program

In 2018, e-commerce sales only accounted for 1% of Sprouts’ revenue. This year, they made up 16% of it, and grew by 21% compared to 2024. That booming e-commerce business is vital for the company as it increases order frequency and basket size while improving the customer experience.

Meanwhile, Sprouts-branded items now account for about 25% of sales — a figure that has grown from 16% in 2021. These private-label offerings not only carry higher margins but also enable the company to develop product innovations inspired by its customers — and now, its Sprouts Rewards loyalty program members.

Launching over 7,000 new product ideas last year, Sprouts’ private-label offerings will complement its recently launched rewards program, which should further enhance the success of the new ideas it develops. This level of product development is unusual for a grocer, and could become a “secret weapon” of sorts for the company as it tailors its new product ideas to match what members of its rewards program are requesting.

3. Back at a discounted valuation

Despite its positives, the company’s valuation remains discounted. The stock plummeted by more than 50% this year following slight earnings misses (but otherwise solid operational success), and now trades at just 17 times free cash flow (FCF) and 15 times earnings, though it grew sales by 13% this year.

SFM P/E and P/FCF Ratio data by YCharts.

Not only is this a great valuation for investors to buy the stock at, it’s also a great valuation for management to repurchase shares at — and it’s doing so hand over fist. Over the last decade, Sprouts has lowered its number of shares outstanding at 4.5% annualized rate, and it has nearly $1 billion left on its current buyback authorization. In a way, it’s a win-win for investors. If the stock continues to struggle, the buybacks will be an even better deal for the company. If the stock recovers, that’s great, too.

One risk to watch

Sitting here in Iowa (where it’s a toasty 43 degrees as I write this), I look forward to seeing a Sprouts Farmers Market closer to me than Kansas City. That said, I’m curious (and slightly worried) to see how the company performs when it expands into colder climates. The chain’s policy has been to source much of its produce locally, but it will have to perform some logistical magic to support stores higher up in the Midwest and the Northeast. While Sprouts’ distribution centers typically serve a 250-mile radius, this may be tested in the wintertime.

Currently, roughly three-quarters of its stores are located in just five states: California, Arizona, Colorado, Texas, and Florida. Therefore, this expansion “problem” is probably a long way off, but it may be something to monitor. Ultimately, I look forward to Sprouts facing this challenge one day, and I believe it remains a no-brainer, steady-Eddie growth stock to buy on the dip.