The retiring investor says a lot with his actions during times of market froth.

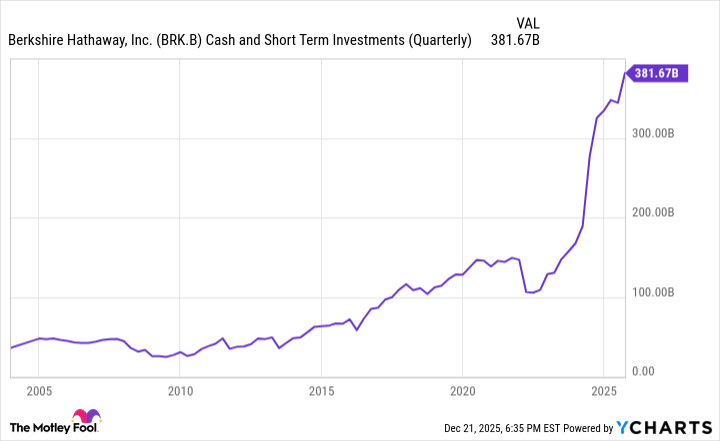

Berkshire Hathaway (BRK.B 0.61%) has more cash than the market caps of many large, well-known companies. With an estimated cash pile pushing $400 billion, the conglomerate run by the retiring Warren Buffett is hoarding a safe haven asset in U.S. Treasuries while the rest of the investing world chases the artificial intelligence (AI) trade.

What is Buffett trying to tell investors? If we look at his long history as an investor in stocks, it is clear that Buffett is giving a loud warning to investors, even if he hasn’t said anything publicly. With the legendary investor retiring at the start of 2026, this could be considered a final warning to Wall Street.

Here’s why you should be paying attention to Buffett’s massive cash pile, and what it means for investors in 2026.

Today’s Change

(-0.61%) $-3.04

Current Price

$498.30

Key Data Points

Market Cap

$1.1T

Day’s Range

$496.83 – $501.56

52wk Range

$440.10 – $542.07

Volume

2.2M

Avg Vol

4.7M

Gross Margin

24.85%

Record cash pile

Berkshire Hathaway has been raising cash since the bull market began in 2023, bringing its pile up from $100 billion to close to $400 billion as of last count. A lot of these proceeds are coming from its stake in Apple, which used to be valued at close to $200 billion but is now down to “only” $60 billion in the Berkshire portfolio.

Buffett has also trimmed or completely sold many of his other stocks, such as Bank of America. He has mostly avoided the AI craze, although the company did recently take a small stake in Alphabet, the parent company of Google. Either way, Buffett and the Berkshire team are saying no thank you to the AI stocks that dominate market conversation.

This cash is being held in short-term U.S. Treasuries, which currently pay an annual yield of just 3.6%. That means Buffett does not see returns in the stock market that surpass this risk-free rate, which is barely yielding above inflation right now.

Image source: Getty Images.

Buffett’s history in bull markets

While Buffett will not come out and directly say what he thinks about the stock market and valuations in general, his actions always speak louder than words.

In 1968, when growth stocks were running hot, Buffett decided to close his investment fund and return money to his partners. The market subsequently had some of its worst inflation-adjusted returns from then until 1974. Buffett was called a laggard and behind the times in 1999 during the dot-com boom. He was subsequently vindicated for avoiding the aftermath of the bubble popping from 2000 to 2002.

What about today? Buffett has raised a record level of cash for Berkshire Hathaway at a time when a new technology (AI) is causing the bull market emotions to take hold among investors. The S&P 500 index is trading at close to a record average price-to-earnings ratio (P/E), with every “Magnificent Seven” AI stock trading at P/E ratios above 30.

Buffett is not raising cash because he believes the bull market is going to end tomorrow. But he is a veteran of the business cycle and understands that now is closer to bubble times than bust. If history is a guide, anytime Buffett starts raising a lot of cash, it means the stock market is in for a poor performance in the coming years.

BRK.B Cash and Short Term Investments (Quarterly) data by YCharts

What should investors do?

Nobody knows what will happen to the stock market in 2026. It may head into a bear market next year, the year after, or maybe not for a few years. A bull market (or bubble) can go on for longer than many of the cynics think. Buffett is simply saying with his cash position that there are few attractive buying opportunities for investors today, and that he’d rather sit patiently on his hands until cheaper valuations materialize. At this point, it will be his successors who deal with the aftermath.

An individual doesn’t need to directly follow Buffett and start selling off their entire stock portfolio. Every individual is in a different situation and may have many years of income that can be deposited into a brokerage account, which Berkshire Hathaway does not have the luxury of.

However, I think Buffett’s cash position should be a warning sign to anyone who thinks stocks only go up. Investors who trade on margin, use numerous options, or are heavily invested in highly speculative AI or technology stocks could get caught off guard quickly in a market correction. Buffett is not going to let that happen to Berkshire Hathaway. Don’t let it happen to you.