Peter Schiff has joined the growing calls of an upcoming Bitcoin crash in the crypto market. This comes as Gold and silver continue to rise on the back of the weakening U.S. dollar.

Gold and Silver Rally Rekindles Bitcoin Crash Fears

Top investor Peter Schiff warned that Bitcoin may very well be the first big asset to fall as money flows back into more traditional safe havens. He believes that the rising price of gold and silver may have a long-term effect of deflating the Bitcoin hedge tool balloon.

The first casualty of the gold and silver surge will likely be Bitcoin. Before a U.S. dollar crash, we will likely get a Bitcoin crash. This will surprise Bitcoin HODLers, who bought Bitcoin to protect themselves from a dollar crash. They jumped from the frying pan into the fire.

— Peter Schiff (@PeterSchiff) December 17, 2025

In his opinion, investors who purchased the coin as a hedge to protect themselves from a potential collapse of the dollar may find themselves caught off guard if a Bitcoin crash occurs.

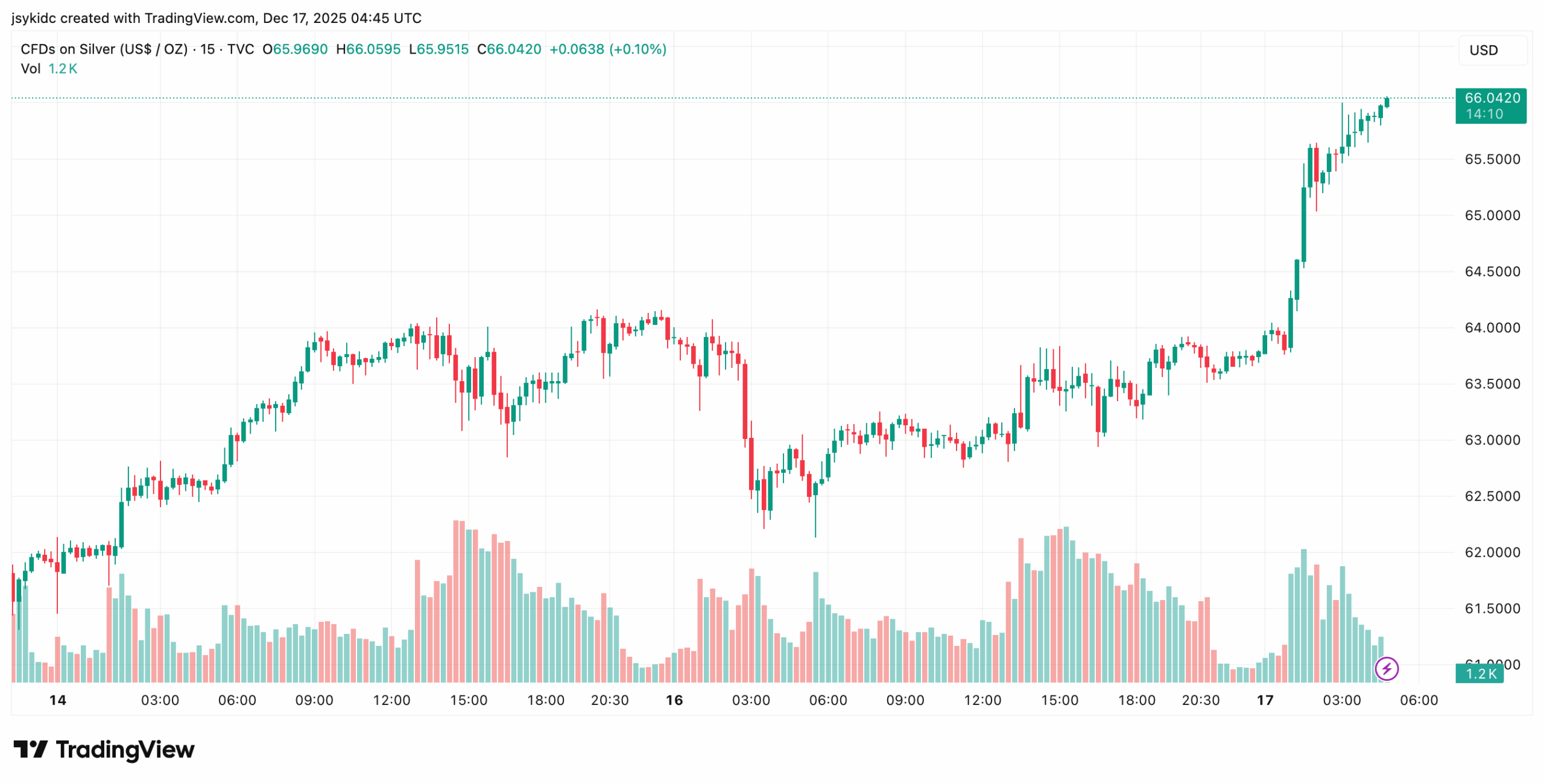

Schiff made these remarks amid sharp gains in silver which gained above $1.60 within a single trading session. The rise took the metal beyond $66, a record high, as gold moved above $4,300.

He also forecasted that it could test levels of $70 by year-end, while gold could move on to record another high in the near future.

Elaborating on the reasons behind this, Schiff is of the view that the U.S. economy is nearing what he calls a major historical crisis. He said the rising precious metals prices are one indication of losing confidence in the U.S. dollar and Treasury bonds.

He explained that this trend could see the beginning of increasing consumer prices or even more unemployment. This could be responsible for a Bitcoin crash rather than serving as protection against one.

He is not the first to make these kinds of predictions recently. Bloomberg Intelligence strategist Mike McGlone recently stated that BTC may return to much lower levels if demand drops further.

Moreover, Research firm 10x Research also predicts up to $10-$20 billion worth of redemptions from crypto hedge funds. This could pressure the market during the end-of-the-year sales.

Why are Gold and Silver Surging?

An easier US dollar and market anticipation of monetary easing are causing precious metals prices to rally. The US dollar has maintained levels close to a two-month low. This has raised attractiveness towards dollar-denominated assets.

Markets are also looking at the release of more US job data. This might have an effect on the policy intentions of the Federal Reserve in the year 2026.

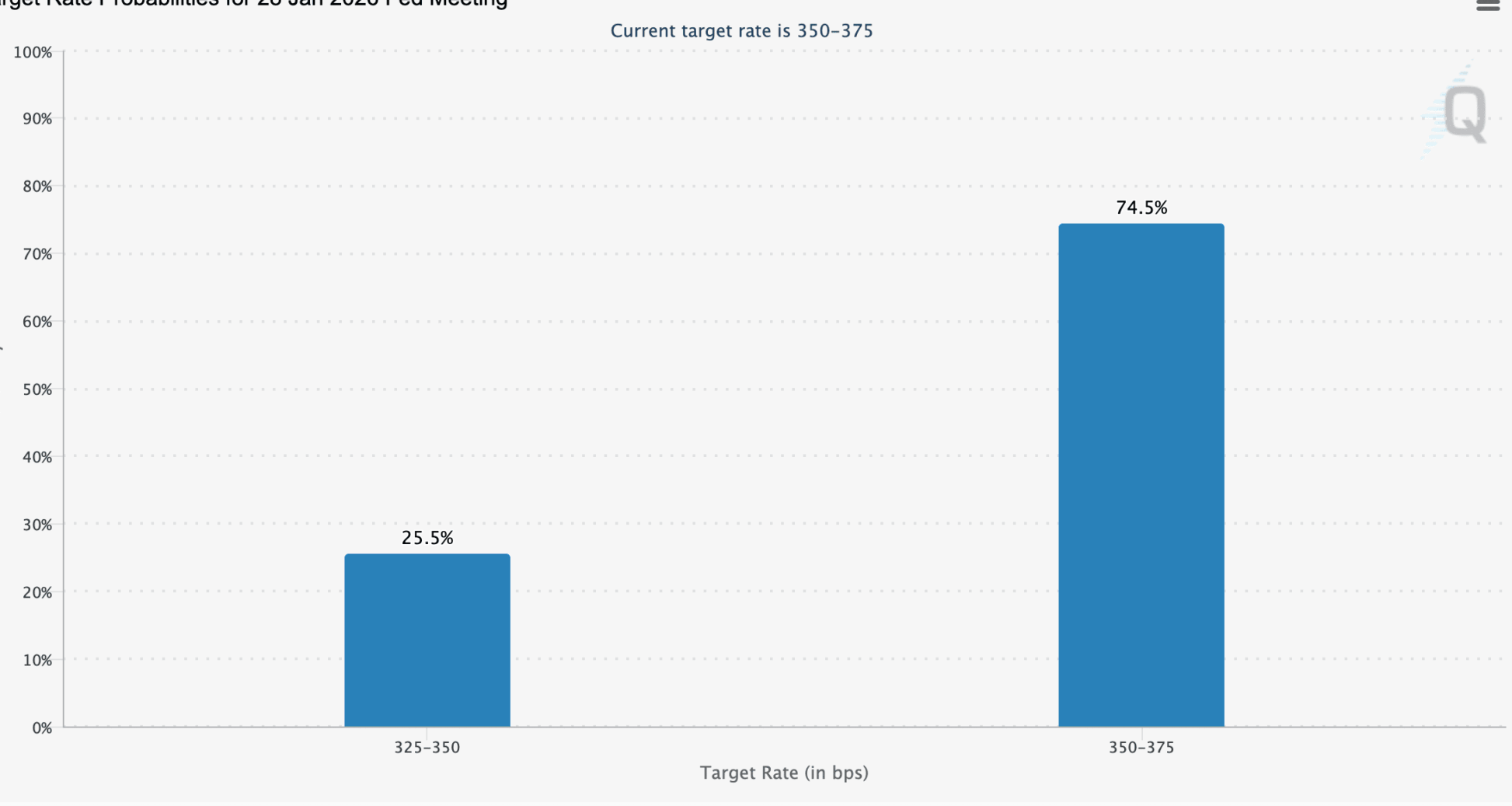

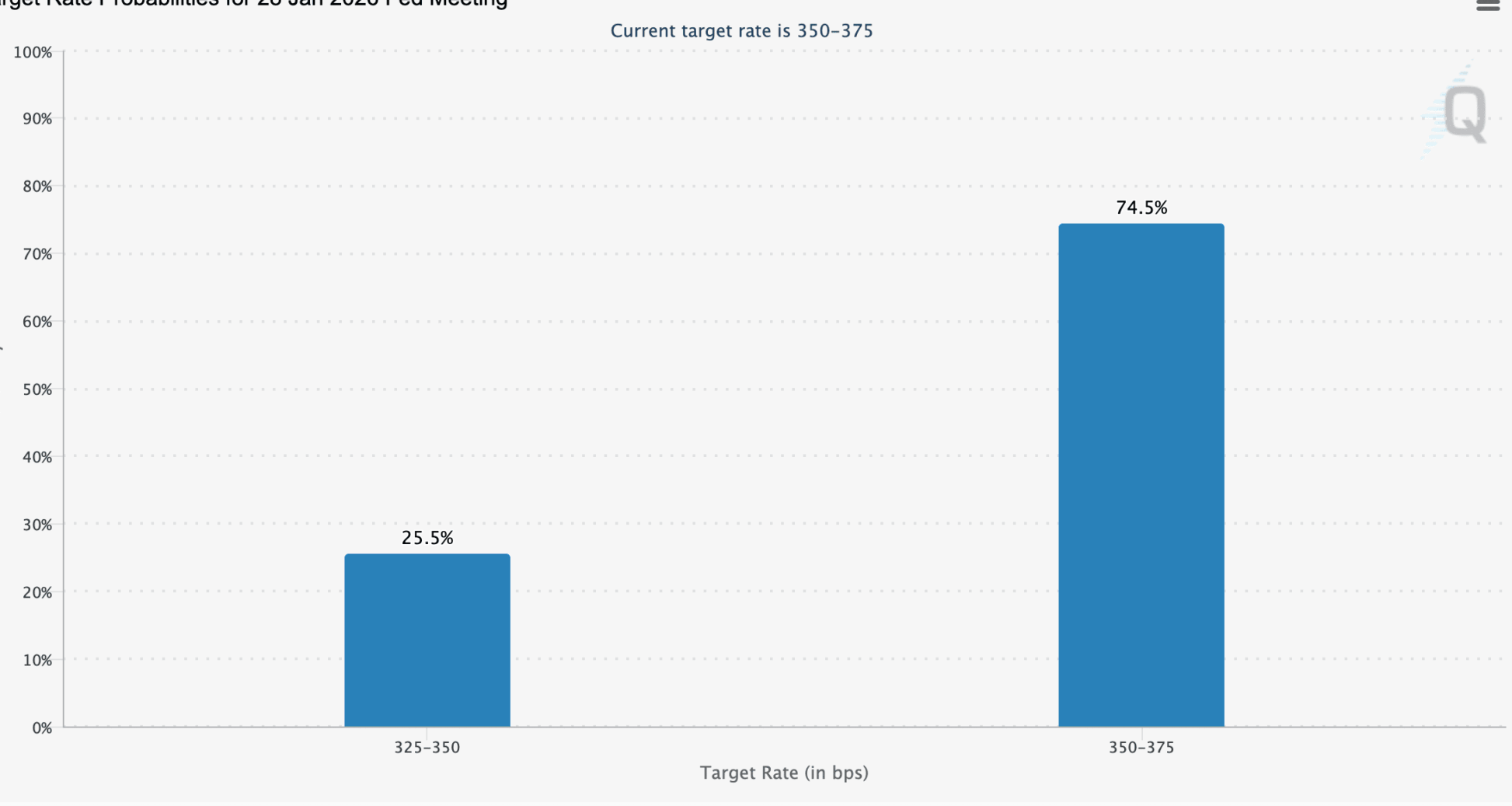

The current market is already factoring a high possibility of cutting interest rates early next year, with some analysts projecting two rate cuts. Lower interest rates are generally good for investments that do not earn interest.

Despite predictions of a Bitcoin crash, Michael Saylor still believes that Bitcoin will eventually have a larger market value than gold in the next ten years.