Bitcoin price is entering one of its most fragile moments of the cycle. The price action says it. The onchain data screams it. And the mood across crypto feels tense, almost brittle

Bitcoin price fell to a low of $80,524 on Friday, its lowest level since April and a level many didn’t expect to see again this year. The drop pushed the bitcoin price more than 35% below its all-time high, erasing all year-to-date gains and dragging risk sentiment across the entire market with it.

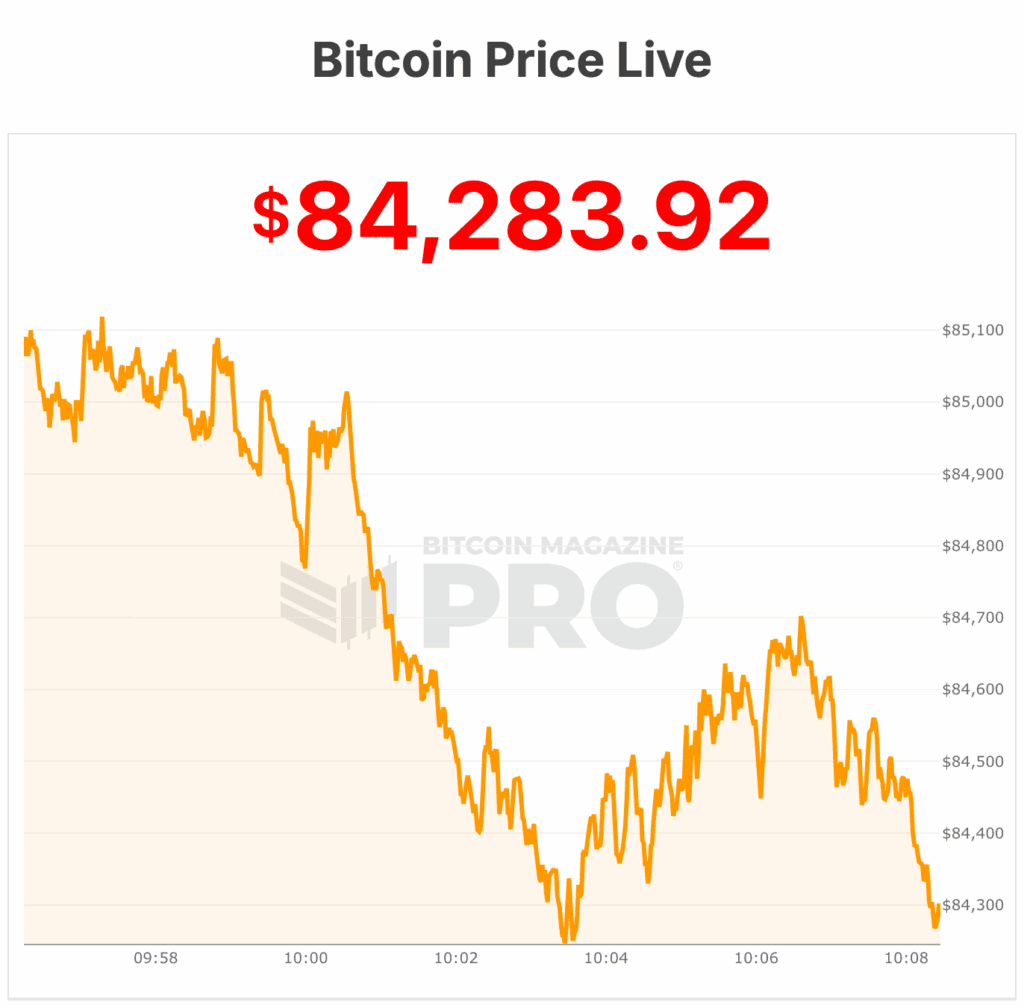

Since the dip, the Bitcoin price has rebounded to the $84,000 range, showing high volatility across crypto markets.

Glassnode data shows realized losses spiking to levels last seen during the November 2022 FTX capitulation. Short-term holders — those who bought within the last 90 days — are unwinding at scale. Their selling now dominates the tape. Realized-loss dominance has surged into a range usually reserved for panic.

Market structure is also breaking down. Independent analyst MEKhoko noted that Bitcoin is now trading more than 3.5 standard deviations below its 200-day moving average. That type of deviation has appeared only three times in the last decade: late 2018, the March 2020 crash, and the June 2022 Three Arrows/Luna meltdown. Each event marked a moment of extreme fear, forced selling, and exhaustion.

This week feels similar. Funding rates collapsed. Spot sellers stepped forward. Momentum traders vanished. The market’s marginal buyer— the one who chases strength—has simply stepped aside.

The result is a chart stretched to its limits and a community trying to make sense of it.

Some point to macro pressures. Rate-cut hopes have faded. AI stocks broke down. Volatility jumped across traditional markets. Crypto didn’t stand a chance.

Despite this, the bitcoin price pullback has nearly reached the $78,000 to $82,000 zone of Giovanni Santostasi’s Bitcoin power-law model, a region that has historically generated mid-cycle bounces rather than cycle lows, offering bulls a sliver of hope as price revisits levels last touched multiple times in 2024.

Others point to the Oct. 10 “mechanical glitch.” Tom Lee said a stablecoin price feed malfunction triggered cascading liquidations across exchanges. Nearly two million accounts were wiped before anyone realized what was happening. The market, he argued, has been “limping along” ever since.

On October 10, the crypto market experienced a massive “flash crash” and deleveraging event, triggered by an unexpected U.S. tariff announcement that sent shockwaves through global markets. This resulted in over $19 billion in leveraged positions being liquidated within hours, marking it as one of the largest single-day wipeouts in crypto history. The remnants of the crash are still being felt today.

Still others see deliberate pressure. Mike Alfred accused large players of pushing Bitcoin lower through derivatives. Lee said he agreed.

The probability of retesting new all-time highs in the coming weeks has dropped below 50% unless major levels are reclaimed.

Bitcoin price outlook

Bitcoin Magazine analysts believe that the core message of buying every dip is no longer a reliable strategy. In downtrending markets, multiple failed dips are common, and the Short-Term Holder Realized Price — historically a pivot for recoveries — now acts as resistance. Meanwhile, broader cost-basis metrics such as Realized Price and the 200-Week Moving Average sit in the mid-$50Ks and rise slowly, suggesting eventual value zones may develop anywhere from $55K to $65K or higher depending on how long weakness persists.

Supply-demand indicators reinforce caution. The VDD Multiple continues rising as price falls, showing experienced holders are distributing, not accumulating. Long-term holder supply is also declining, another sign that the market is still unwinding. Funding rates and derivatives positioning have not shown the typical capitulation extremes seen at major bottoms.

To invalidate the bear case, Bitcoin must reclaim $100K, the STH Realized Price, and the 350DMA with sustained closes. Until then, a defensive, data-driven approach is favored over aggressive dip-buying.

At the time of writing, the bitcoin price is $84,283.