The two believe the current rally in base metals marks the early stages of a potential multi-year commodity supercycle, with copper leading the charge.

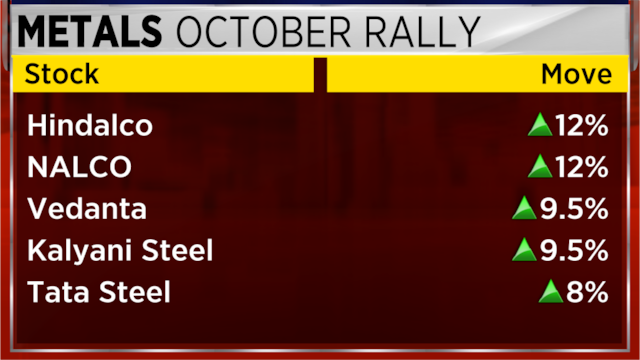

The recent surge has seen Indian metal companies such as Hindalco Industries, National Aluminium Company (NALCO), Vedanta, and Tata Steel gain between 6% and 12% in October. This rise has been fuelled by a sharp increase in prices on the London Metal Exchange (LME).

This week alone, copper prices have climbed 4%, aluminium 4.5%, and zinc 3%.

Narne said he believes the era of physical assets has begun—a trend that could last several years. He attributed this shift to global tariffs and supply chain realignments that have tightened the movement of goods.

According to Narne, years of under-investment and production stagnation have depleted inventories. Citing London Metal Exchange (LME) data, he stated that aluminium inventories are down almost 50% from their peaks, while zinc inventories have fallen by about 32%.

He compared the situation to silver, where inventories have been depleted and spare capacity is minimal—a dynamic he believes will be the primary driver of the commodity supercycle.

Also Read: Hindustan Copper CMD sees firm prices on AI-driven demand

Among base metals, copper stands out as the most bullish. Barratt highlighted that copper is currently in about a $300 backwardation, indicating stronger demand today than several years ahead—a clear sign of persistent supply constraints.

He added that any additional catalyst, such as US interest rate cuts, could push copper prices to record highs of $12,000–$13,000 per tonne. Narne was even more optimistic, forecasting prices could rise to $13,000 and beyond, potentially touching $15,000 within the next 18 months—representing a 30% to 50% upside from current levels.

The China factor remains central to this outlook. While China’s economy has been deflationary in recent quarters, Barratt sees “green shoots of recovery.” He expects China’s green energy transition to sustain strong demand for copper.

“China is at the forefront of cleaning up its act in terms of green energy, and that creates a big demand for copper,” Barratt said. He also pointed to China’s ability to inject stimulus as an important market support.

For other metals, the outlook is more moderate. Both analysts see a 10–15% upside for aluminium, though Narne expects a period of price consolidation. For zinc, Narne projects a potential 25–30% upside.

Also Read: Copper holds highs as market eyes freeport mine supply upset

The steel view was mixed. Barratt believes steel prices can continue to rise as long as macroeconomic conditions remain supportive. Narne, however, was more cautious about India, citing rising raw material costs, particularly coal, which could limit price gains. He expects only a 4-6% upside for Indian steel in 2025, despite strong demand growth of 8-9%.

However, experts warned of potential risks. Barratt cautioned that a political showdown in the United States could quickly derail the commodity rally. “If there’s a showdown in the US concerning Trump’s policies, things could change very quickly,” he said.

For the entire discussion, watch the accompanying video