Bitcoin (BTC-PKR) may still have significant upside ahead. A recent analysis by CryptoQuant contributor PelinayPA places a 55 percent probability that the current bull cycle top has not yet been reached, despite the token’s more than 13 percent drop from its October 6 peak near 126,000 dollars.

What Supports the Bull Case

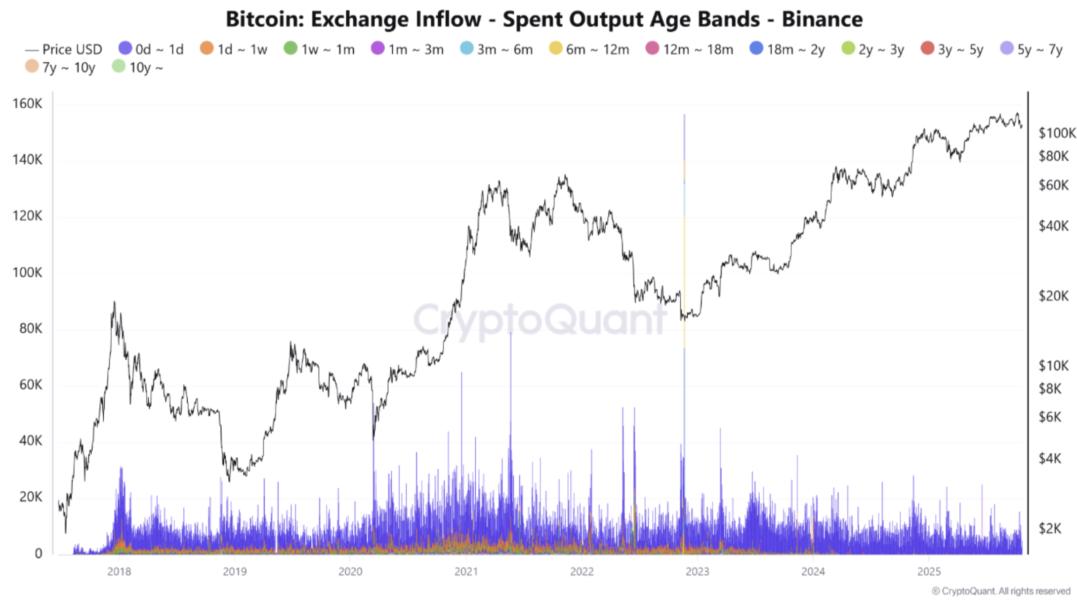

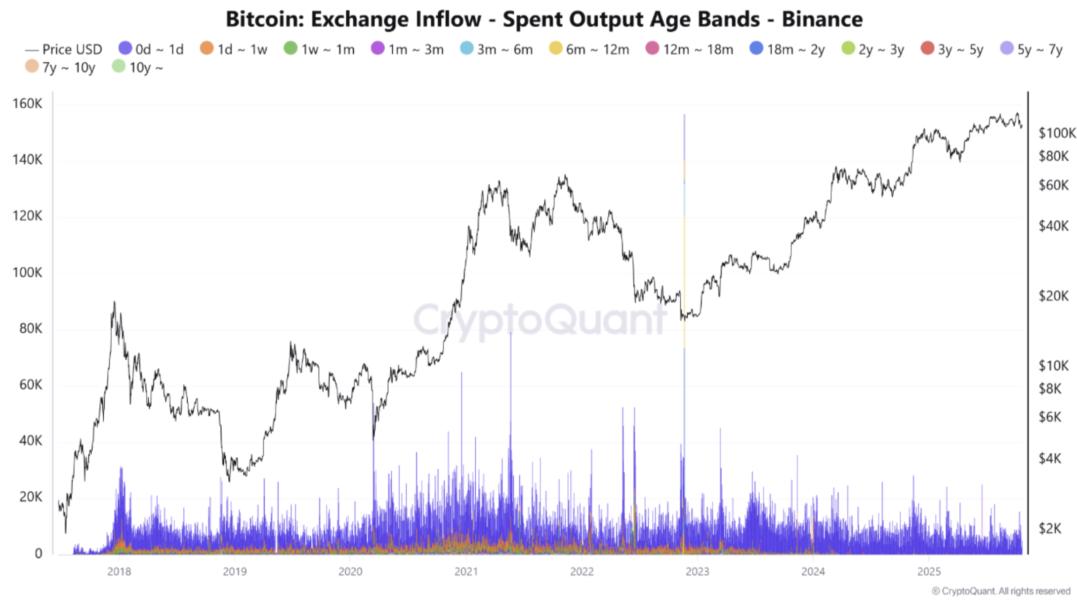

One of the strongest bullish signals is that coins held six months or longer remain largely unmoved. According to CryptoQuant data, this suggests long term holders are not capitulating. Mid cycle behaviour is often characterised by holding rather than selling.

The report also notes an uptick in 0 to 1 day coin inflows to exchanges, indicative of short term traders or new entrants reacting to volatility. However, long term holder behaviour remains stable. Analysts argue the current price behaviour around 108,000 dollars reflects consolidation rather than a top. A possible dip toward 102,000 dollars could be healthy within an ongoing uptrend.

Broader Trends Reinforcing the Outlook

Institutional Adoption Gains Momentum

Data from Reuters show that a significant portion of Bitcoin’s rally is now driven by institutional demand rather than speculative retail buying. ETF inflows reached record levels, open interest in futures rose to about 57 billion dollars, and the leverage ratio fell, indicating less risky, more capital backed positioning.

Global Crypto Adoption Continues Strong

The 2025 Global Crypto Adoption Index by Chainalysis confirms that countries like India and the US are leading in crypto uptake, supporting the narrative of structural demand.

Forecasts Remain Bullish

Multiple analysts foresee targets in the 150,000 to 250,000 dollar range for Bitcoin by the end of 2025, with long term potential even higher depending on institutional flows and supply dynamics.

Bitcoin Outpacing Traditional Assets

In mid 2025 Bitcoin surpassed gold in year to date performance, reinforcing its narrative as a hedge and an alternative store of value.

Key Risks for Investors to Watch

- Macro and Regulatory Headwinds: Shifts by central banks or hostile regulatory moves could derail momentum.

- Speculation vs Accumulation: While long term holders are holding, short term traders are still active. A cascade of retail profit taking could trigger sharp pullbacks.

- Overhangs from Dormant Wallets: Large wallets that have remained inactive for years have started to move in 2025, prompting fears these coins could eventually hit the market.

- Cycle Timing: Historical cycles suggest Bitcoin peaks roughly every four years, but institutionalisation may extend or modify this pattern.

What This Means for Investors

- Position for upside, but expect volatility: The bull case is intact, but investors should be prepared for dips and consolidation phases.

- Institutional signals matter more than headlines: ETF flows, futures positioning and long term holder data are more telling than media hype.

- Keep an eye on structural developments: Broader adoption and regulatory clarity can have outsized effects on price and sentiment.

- Avoid treating this like a direct trade: The current phase appears more suited to long term investing than short term speculation.

According to on chain and market data, Bitcoin has a roughly 55 percent chance of remaining in its bullish phase. The shift toward institutional accumulation, global adoption, and structural demand provides a strong foundation.

However, there’s no certainty: Investors should use this as a strategic signal, not a guarantee, and remain disciplined in managing risk and expectations.