Join Our Telegram channel to stay up to date on breaking news coverage

BlackRock’s (BLOK) Bitcoin ETP (exchange-traded product) has started trading on the London Stock Exchange today after the UK’s Financial Conduct Authority (FCA) lifted its ban on certain Bitcoin-based ETPs.

That is the first such product offered by the asset management giant in the UK. In its first hour of trading, the IB1T ETP saw trading volumes of 1,000 shares on the London Stock Exchange.

London Stock Exchange Launch Builds On European Presence

The iShares Bitcoin ETP started trading on the London Stock Exchange under the ticker “IB1T,” and allows investors in the UK to gain exposure to Bitcoin through a regulated market without needing to hold the crypto directly.

BlackRock’s product was already available to some European investors. This is after it listed on Xetra, Euronext Amsterdam and Euronext Paris towards the end of March this year, according to BlackRock’s website.

The London Stock Exchange listing comes after the FCA opened up access to crypto ETPs for retail investors. This rule change had come into effect on Oct. 8.

Prior to that rule change, the FCA had barred retail access to crypto ETPs in 2021 due to concerns around investor protections.

One of the requirements for retail investors in the UK to buy into crypto ETPs is that the products must be listed on recognized, FCA-approved UK-based exchanges. Products will also have to follow financial promotion rules to prevent misleading advertising and inappropriate incentives.

BlackRock Looks To Cement Its Dominance In The Bitcoin ETF Market

BlackRock manages over $13 trillion in assets globally, and has seen strong growth in its crypto-focused products.

Its flagship US spot Bitcoin ETF, IBIT, was launched in January last year and has recorded the most cumulative inflows of all of the US products since their inception.

Data from Farside Investors shows that IBIT has seen $64.981 billion in cumulative inflows thus far. This is substantially more than the second-biggest cumulative inflows of $12.554 billion that Fidelity’s FBTC has seen since it launched.

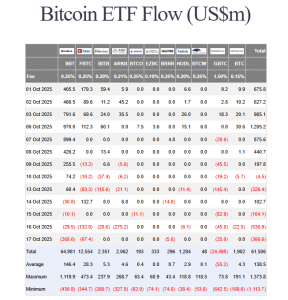

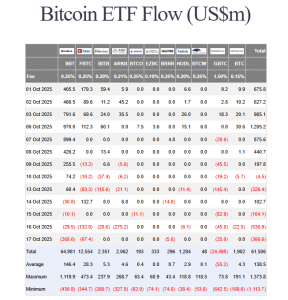

US spot BTC flows (Source: Farside Investors)

IBIT has, however, been in a multi-day outflows streak, which it extended in the latest trading session.

The product saw $268.6 million leave its reserves on Oct. 17, which was the highest negative flows seen on the day. Other funds, like Fidelity’s FBTC, Valkyrie’s BRRR, and Grayscale’s GBTC saw $67.4 million, $5.6 million, and $25 million outflows, respectively, on the same day.

IBIT’s latest outflows came after the product saw $29.5 million outflows the day before. On Oct. 15 and Oct. 14, the investment product saw respective outflows of $10.1 million and $30.8 million as well.

Despite the recent outflows, IBIT has been one of the top performers in both the US spot Bitcoin ETF market and among BlackRock’s other ETFs.

Just 374 days after launch, IBIT crossed $80 billion in assets under management, becoming the fastest ETF in history to achieve this milestone.

Its AUM then continued to grow at the start of October, and came within reach of $100 billion, according to Bloomberg ETF analyst Eric Balchunas. However, its AUM has since dropped to around $85.78 billion after a broader crypto market pullback, the fund’s page shows.

$IBIT a hair away from $100 billion, is now the most profitable ETF for BlackRock by a good amount now based on current aum. Check out the ages of the rest of the Top 10. Absurd. pic.twitter.com/E8ZMI2wynx

— Eric Balchunas (@EricBalchunas) October 6, 2025

IBIT has also outperformed BlackRock’s popular S&P 500 fund in terms of annual fees to become the asset manager’s most profitable ETF.

BlackRock’s CEO Has A Change In Stance Towards Crypto

Much of BlackRock’s expansion into the digital asset space has to do with its CEO, Larry Fink’s, change in stance.

In 2018, Fink described Bitcoin as a “speculative” asset and questioned why it “has so much fascination for the press.”

In 2021, he then said that BlackRock was studying cryptos like Bitcoin, but still argued that it was too early back then to say whether cryptos were more than speculative trading tools.

In October this year, however, Fink said that Bitcoin has a similar role to gold as a portfolio diversifier, and admitted that he was wrong about his earlier anti-Bitcoin comments.

CEO of world’s largest asset manager…

“We’re just at the beginning of the tokenization of all assets.”

Yes, includes ETFs.

Larry Fink on his positively evolving attitude towards crypto: “I grow & learn.”

Good lesson here.

And some of you *still* think crypto is a scam. pic.twitter.com/GJ8oxWF3vK

— Nate Geraci (@NateGeraci) October 15, 2025

While his stance may have shifted, Fink did still caution against investors making Bitcoin a large component of their portfolios.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage