SINGAPORE – Singapore property and hotel tycoon Kwek Leng Beng has reaffirmed his confidence in Shanghai, and sees opportunities to deepen Hong Leong Group’s presence in China.

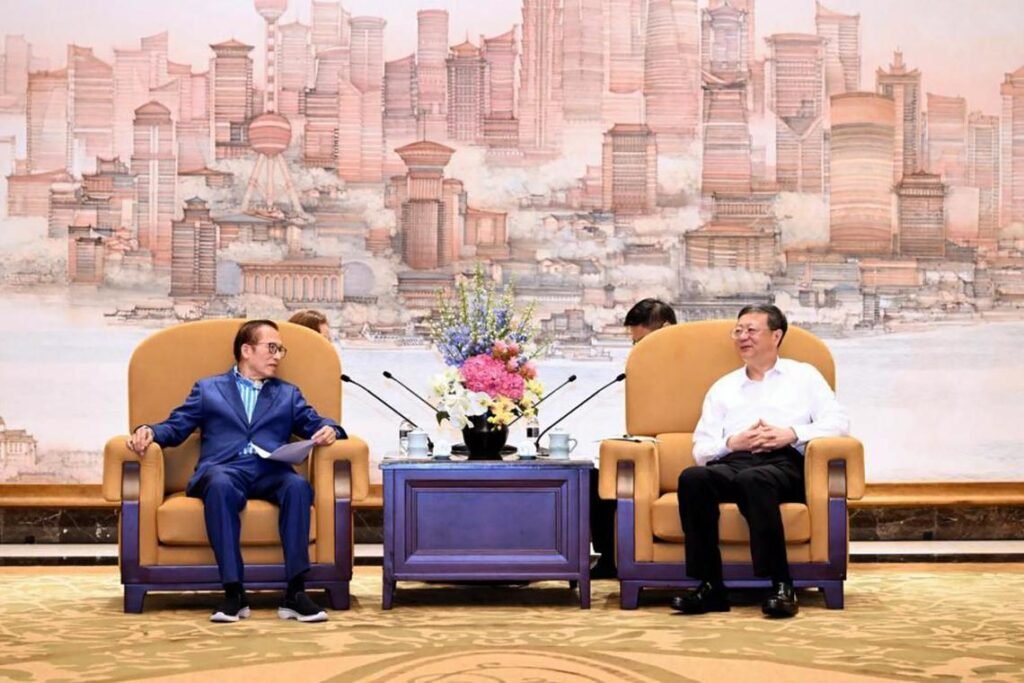

Speaking at a meeting in Shanghai with its party secretary Chen Jining on Sept 9, Mr Kwek said that as a long-term investor in China, he remained confident in the Chinese financial hub’s “resilience and strong fundamentals”.

“We see abundant opportunities to deepen our presence, advance sustainable development initiatives, and contribute meaningfully to Shanghai’s ongoing transformation,” said Mr Kwek, who is executive chairman of family-owned conglomerate Hong Leong Group and Singapore-listed developer City Developments Limited (CDL).

“These could include participating in Shanghai government funds, with proceeds disbursed to companies within the high-tech, innovation framework or with global consumer connections,” Mr Kwek said.

He noted that Shanghai’s fast-expanding technology and innovation hubs would complement sectors such as finance and urban management.

This was the first meeting between Mr Kwek and Mr Chen.

Mr Chen, the Secretary of the Shanghai Municipal Committee of the Chinese Communist Party, urged the Singapore tycoon to expand Hong Leong’s footprint in China, and seek new development opportunities.

“As urban renewal, industrial transformation, and technological innovation quicken pace, there are expanding opportunities for both foreign and domestic enterprises to develop the city,” he said.

Mr Chen said he hopes Hong Leong will extend investments in new growth sectors such as science and technology and high-tech parks, and build on Shanghai’s initiatives to grow and cultivate an innovative industrial ecosystem.

He said the diversified Hong Leong Group could leverage its resources and cast its net wider to new priority areas such as digitalisation and sustainable building initiatives in Shanghai.

Hong Leong’s business now spans real estate development, hotels, finance, trade, and industry.

The Chinese official emphasised Chinese President Xi Jinping’s plans to accelerate Shanghai’s development into a leading global hub for finance, trade, shipping, and the broader economy.

He also stressed that the priorities of China’s 15th Five-Year Plan was to modernise traditional and emerging industries, advance technological innovation, and develop future-ready cities.

Mr Chen said Shanghai would continue to offer long term, stable, transparent and predictable conditions to support stronger growth for domestic and foreign companies.

Hong Leong Group is no stranger to the Chinese market. The group’s roots there can be traced as far back as the 1980s, with the development of its first China hotel, the Holiday Inn Crowne Plaza in Xiamen, now Millennium Harbourview Xiamen.

Today, CDL’s hospitality arm, Millennium Hotels and Resorts, manages several of the group’s hotels throughout the country. These include Grand Millennium Beijing, Grand Millennium Shanghai Hongqiao, Millennium Chengdu, and M Social Suzhou.

The Singapore group also entered the building materials sector in the early 1990s. Its trade and manufacturing arm, Hong Leong Asia (HLA) grew to become one of China’s leading producers of diesel engines, supplying nearly half a million engines a year.

In recent years, HLA has been ramping up research and development investments in new energy solutions such as fuel cell powertrain systems for more efficient and lower carbon emissions.

Hong Leong also expanded into real estate, with a portfolio spanning major cities including Shanghai, Suzhou, Chongqing, and Shenzhen.

Hong Leong Holdings continues to be active in major urban hubs, building mixed-use developments across Chinese cities, including Chengdu and Chongqing.

Since 2013, China has been Singapore’s largest trading partner, and Singapore has been China’s largest foreign investor, according to Singapore’s Ministry of Foreign Affairs’s website.

Mr Kwek said CDL’s mixed-use development project at Shanghai’s Xintiandi area is progressing well.

CDL, together with its Chinese partner Lianfa Group, won the tender for the Xintiandi site in November 2024 for 8.94 billion yuan ($1.6 billion). CDL has a 51 per cent stake in the project.

At that time, analysts’ reaction to CDL’s re-entry into China was mixed given that in 2021, it made an impairment loss of $1.78 billion on its investment in Sincere Property, a Chinese developer. This effectively wrote off 93 per cent of its total investment in Sincere.

Mr Chen also met another Singapore delegation on Sept 9. They included a team from Temasek, Singapore’s state-owned investment company, led by its chairman Lim Boon Heng, deputy chairman Teo Chee Hean, and executive director and chief executive officer Dilhan Pillay Sandrasegara.