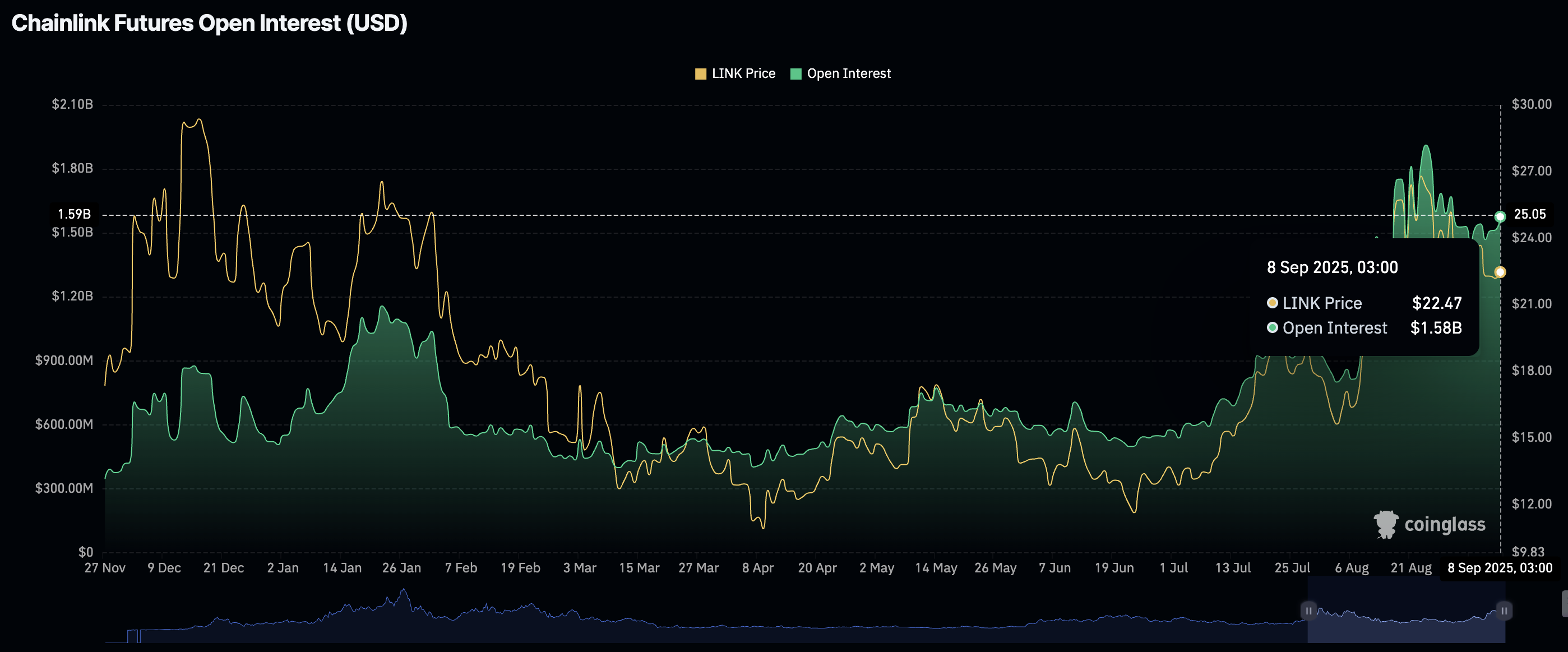

Chainlink (LINK) is trending higher, exchanging hands above $23.00 on Monday, buoyed by news that Grayscale has filed with the United States (US) Securities & Exchange Commission (SEC) to launch a LINK exchange-traded fund (ETF).

Grayscale has submitted an S-1 filing to the SEC, seeking permission to provide access to a Chainlink spot ETF. The application aligns with Grayscale’s broader initiative to expand access to digital assets beyond its current offerings, which include Bitcoin (BTC) and Ethereum (ETH).

Bitcoin (BTC) trades in green above $111,800 on Monday, supported by growing optimism over potential Federal Reserve (Fed) interest rate cuts and renewed institutional demand. Corporations such as Metaplanet and government entities in countries like El Salvador added BTC to their reserves, boosting market sentiment for the largest cryptocurrency by market capitalization.

Bitcoin price extends its gains, trading above $111,900 during the early European trading session on Monday, after recovering almost 3% last week. This recovery came as the US Nonfarm Payrolls report released on Friday showed that the economy added just 22,000 jobs in August, missing market expectations by a big margin.

Solana (SOL) price remains above $207 at the time of writing on Monday, having recovered nearly 3% last week. Robinhood-backed USDG stablecoin has seen its supply on Solana surge nearly 160% over the past month, overtaking Ethereum (ETH) and highlighting the growing adoption of the SOL network. Moreover, SOL Strategies Inc. is preparing to debut as the first Solana treasury company listed on Nasdaq, starting on Tuesday, underscoring the network’s expanding footprint.

SOL Strategies Inc., a publicly traded Canadian company dedicated to investing in and providing infrastructure for the Solana blockchain ecosystem, announced on Friday that it has received approval to list its common shares on the Nasdaq Global Select Market.