4Imprint (LON:) is continuing its steady approach in a US market facing uncertainties from the imposition of tariffs and with vacillating business confidence. The impact has been limited so far, with first-half revenue holding up well and a small edge up in operating margin.

The second half, though, is more likely to be affected by suppliers starting to replenish the inventory bought at lower price points. We do not expect 4imprint to be passing on those price rises in full, resulting in a temporary modest squeeze on margin through H225 and FY26.

As in previous difficult trading periods, potential turbulence presents an opportunity for further market share gains, given the group’s inherent financial strength and strong cash generation. Net cash was US$102m at the half-year end.

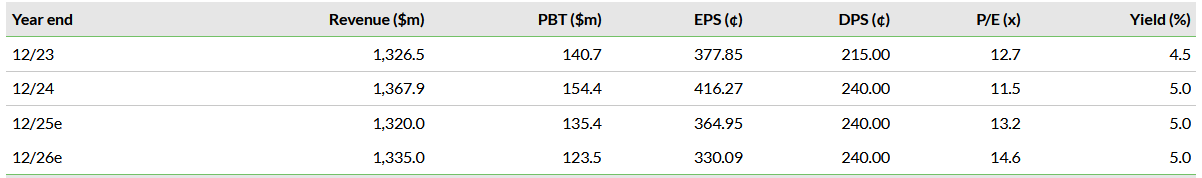

Note: PBT and EPS are normalised, excluding amortisation of acquired intangibles, exceptional items and share-based payments. DPS excludes special dividends.

Solid Performance in H1

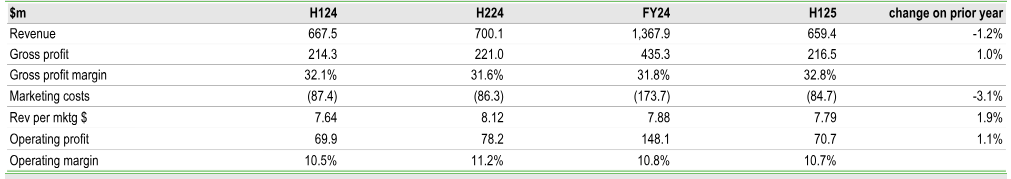

H1 revenue was 1% down on the previous year, with a similar pattern to the prior reporting period in resilient demand from existing customers and a slower pace of new customer recruitment, reflecting the backdrop of economic uncertainty. There was a small edge up in operating profit margin from 10.5% to 10.7%, reflecting advantageous timing on pricing versus broadly flat supplier prices and the group’s perennial flexibility in determining the mix of marketing spend.

Revenue per marketing dollar, a key group KPI, was $7.79 in the period, up from $7.64 in H124. Underlying cash conversion was 118%, with the group ending H1 with $102.3m in net cash (lease debt only) despite having paid out dividends totalling $119.9m in the period, a sum which includes the special dividend declared for FY24.

Less Certain Conditions for H225 and FY26

At the time of writing, negotiations continue between the US administration and China on tariffs, with a wide range of potential outcomes. However, what is certain is that the supplier base is restocking at higher input prices. 4imprint has the financial resilience to play the long game here, absorbing some of the margin pressure, adapting its marketing strategy and positioning itself to build market share.

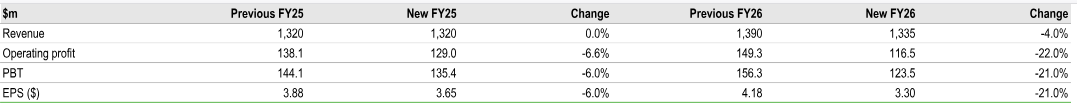

We have taken a more cautious stance on our modelled operating margin for both H225 and FY26, moving from 10.5% to 9.8% for FY25 and from 10.7% to 8.7% for FY26.

Valuation: Still Well Below DCF

4imprint’s share price is down 21% year to date, but the rating remains well ahead of the marketing services sector, reflecting its earnings quality, attractive cash conversion and distribution policies, in our view. We have recalculated the discounted cash flow on the basis of our revised estimates. On a WACC of 9% and terminal growth of 3%, as previously, the implied value is now £46.84/share, from £52.35 in May, 30% above the current share price.

H125 Results Show Resilience

Reported revenue down 1% over H124 has a slight timing benefit, with the value of orders received in the period down by 3% and a flat average order value. This nevertheless represents an outperformance of the market, which industry body the Advertising Specialty Institute reckons to have dipped 3.6% in Q125 and 3.2% in Q225, implying that 4imprint’s market share continues to build.

Existing customer retention has been good, with the bringing on board of new customers proving more difficult. This is consistent with a macroeconomic environment, coloured by uncertainty, in which businesses are hesitant to spend on promotion. 125,000 new customers were recruited in the period, down from 145,000 in H124, placing 217,000 orders, down from 250,000. Orders from existing customers were very slightly up on the previous year.

Gross margin was slightly up at 32.8% (32.1%), reflecting the timing difference between sale and input pricing changes.

Exhibit 1: H125 Key Performance Indicators

Source: Company accounts

Taking a More Cautious View on H225 and FY26

With so much uncertainty on the bigger picture for the North American corporate market, but with underlying trends that prices from suppliers are going up, it makes sense to take a more cautious stance over the likely out-turn for H225 and then with a whole year’s impact for FY26.

The conclusion of tariff negotiations might result in a significantly different outcome. Based on 4imprint management’s previous attitudes to suppliers and customers during difficult trading periods, these figures assume that the preference will be to take a degree of the pain on margins to protect and grow market share. This will improve the longer-term outlook for the business, with the significant cushioning afforded by the reserves of cash.

Exhibit 2: Changes to Forecasts

Source: Edison Investment Research

In light of these changes, we now model a maintained ordinary dividend for both FY25 and FY26, which remains comfortably covered and which provides the stock with a premium yield.

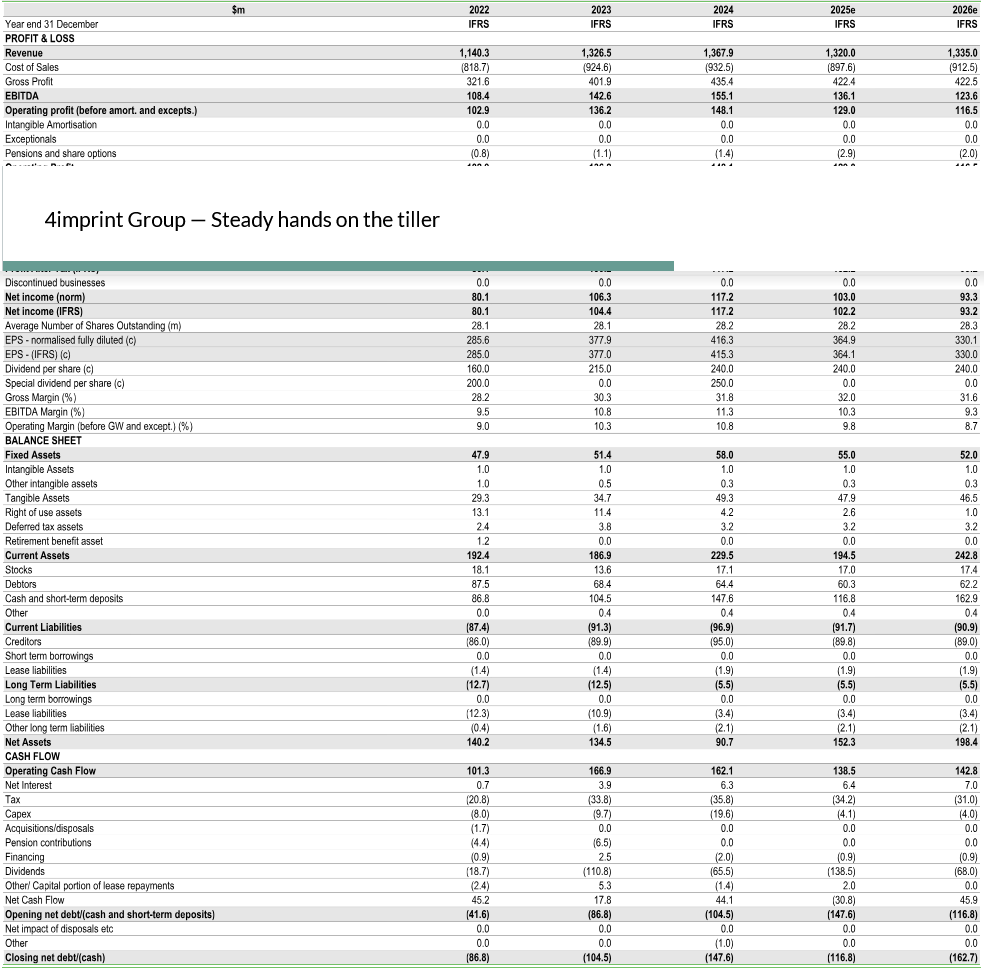

Exhibit 3: Financial Summary

Source: Company accounts, Edison Investment Research